Nearly three-quarters of investment professionals believe the U.S. Federal Reserve’s corporate credit buying programs have stabilized markets since their lows in March. But this week’s II Fear Index reveals investors are also worried about new risk introduced by the initiatives — including a dangerous assumption of credit risk by the public.

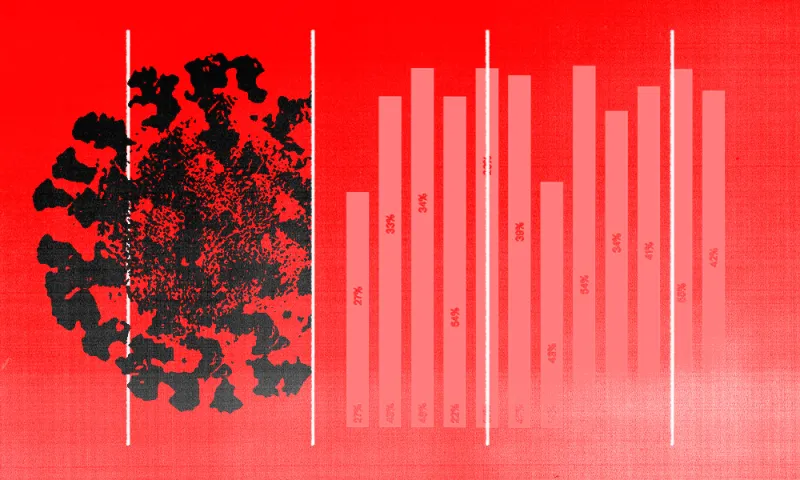

For six weeks, Institutional Investor has been polling investment professionals about everything from government initiatives to the rationality of equity investors for the weekly II Fear Index. This week’s survey had 168 respondents, the highest yet for the poll.

About 74 percent of the surveyed investment professionals said the move by the Fed to purchase corporate bond ETFs, a first for the central bank, provides necessary liquidity to credit markets. But 70 percent said the Fed’s ETF buying also “raises concern about careless risk taking.” Sixty-seven percent of respondents said the initiative “unreasonably encouraged shifting credit risks from the private sector to the public sector.”

When II asked about the Fed’s decision to buy corporate debt in the primary and secondary markets, 78 percent of investment professionals said they believed the programs provided necessary liquidity. However, just like with the ETF buying, the Fed’s direct debt purchases also raised investors’ alarm bells. Seventy-two percent of respondents said they were concerned about future risk taking; 70 percent were concerned about the shifting of credit risk from private hands to the public sector; and 69 percent said the Fed’s buying will “invite misuse, introduce moral hazard and adverse selection, and encourage unsound borrowing.”

Still, investors believe the Fed’s support is tied to economic healing. More than 60 percent of respondents to II’s poll said the Fed’s purchases of ETFs and corporate debt will help speed an economic recovery.

[II Deep Dive: The II Fear Index: GDP Is as Scary as the Virus]

Ensuring an economic recovery has become increasingly important for investors since the II Fear Index launched in mid-April. For the first time since II started the weekly survey, more than half of investors said they believed the government should prioritize the stability of the economy over public health. Forty-nine percent said public health should come first.

Last week, investors were essentially split down the middle on issue of the economy versus public health, but investor opinion has shifted quickly. During the week of May 12, only 42 percent prioritized the economy over public health.

A majority (53 percent) of investors anticipate a U-shaped recovery, or a sharp decline followed by an extended period of high unemployment and sluggish growth. Thirty-seven percent think the recovery will be W-shaped: a sharp decline followed by one or more recoveries before a sustained period of growth. Only 7 percent thought a recovery would be quick, or V-shaped.

The proportion of investors saying they are “less optimistic” about the economic prospects of their countries over the next several months has fallen by 13 percentage points compared to last week. Still, 31 percent of investors said this week that they feel less optimistic about the economy, while only 26 percent said they are more optimistic.

Investors are feeling a bit more bulllish on how their governments are taking leadership of the economy. When asked about “national governments’ current stewardship of the economy,” the proportion of respondents saying they are “more optimistic” rose by 5 percentage points. Still, only 20 percent said they are “more optimistic” about federal stewardship, with 42 percent saying they are less optimistic about the economic leadership of their governments.

Only 16 percent of investors said they are more optimistic about the near-term outlooks for their own careers and salaries. Twenty-five percent were less optimistic about their personal futures.

More results from the II Fear Index poll continue below. To contribute to the index, please register here.