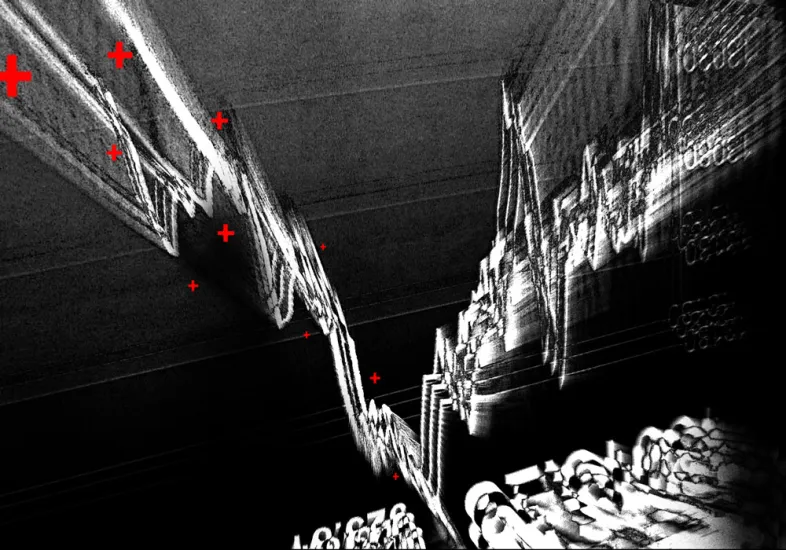

Equity markets have been rallying since March 23, but performance patterns suggest that this upturn is not the real recovery.

Value and small cap – normally standouts during recoveries — are the two of the worst performers in the current run-up, according to StyleAnalytics, a research and factor analytics firm. “This raises questions about whether the recovery has begun or whether this rally is just a momentary rise in the middle of a larger overall market crash,” wrote Damian Handzy, StyleAnalytics’ chief commercial officer, and James Monroe, a client consultant. “One possibility is that this recovery truly is unique as it is fueled not by market demand and consumer spending but rather by governments and central banks flooding companies with cash.”

Once the market bottoms and starts to bounce back, historical data suggest that value stocks should do well.

“But this crash has not been like any other crash we’ve seen. Who would have predicted, just two months ago, that volatile growth stocks would be defensive?” the authors noted in a study published Thursday.

In an interview with Institutional Investor, Handzy explained that the firm undertook the study to determine how different sub-factors behaved in past crashes and recoveries and what that would mean for investors positioning their portfolios for a recovery.

In U.S and European markets, the crash in March most resembled the 2008-9 global financial crisis from a factor perspective, rather than, say, the dot-com bust or 1987 correction. During the GFC, markets took 16 months to crash and 36 months to recover.

“Crashes were not all straight down; there are some temporary rallies,” said Handzy.

What distinguishes an uptick on the way down from a true turnaround?

“High volatility does well in recovery. Low volatility does not. The remarkable thing here is recoveries kind of all look the same. The crashes look different. They are idiosyncratic with unique factor signatures,” said Handzy. He compared it to Leo Tolstoy’s adage that happy families are all happy in the same way, but unhappy families are all unhappy in different ways. “That sums it up.”

[II Deep Dive: Hedge Funds’ Favorite Stocks Were Hit Hardest in the Coronavirus Crash]

In a recovery, value and dividend yield are winners followed closely by small cap securities. High volatility stocks are almost as good as value. In addition, the performance of momentum is lackluster or even negative. Growth and low volatility are losers, according to StyleAnalytics.

Performance differential tends to be substantial among factors in a recovery. High vol stocks, for example, delivered 60 to 70 basis points of excess returns each month, amounting to about 8 to 9 percent annually.

“And what have factors done since March 23? The only factor that has completely outperformed is momentum,” said Handzy. “Momentum has been on a tear over the last couple of years, and it’s still doing that today in the recent rally. That is very different from recoveries we’ve studied,” he concluded.