The yield curve has predictive power that goes beyond the chances of a recession, according to new research from AQR.

In a new paper released Thursday, the factor investing firm examined how yield curve inversions could otherwise be useful by evaluating “the ability of the yield curve slope to forecast future economic conditions, as well as returns on stocks and bonds, using over 50 years of data across six countries.”

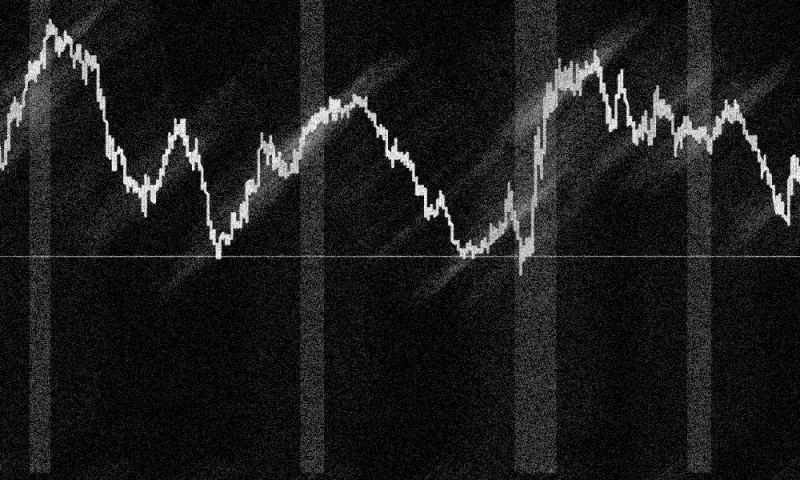

The yield curve charts the difference between the rate of a bond with a long life compared to one that matures in a short period of time. It generally slopes up as investors are paid higher rates to hold bonds that mature far into the future and lower rates for short duration paper. An inverted curve occurs when short-term rates are higher than long-term ones.

AQR argues that there is plenty of research to support the yield curve’s predictive value when it comes to macroeconomic factors, such as inflation and interest rates. Nonetheless, it has come to be defined as a signal for a coming recession, according to the paper, called “Inversion Anxiety: Yield Curves, Economic Growth, and Asset Prices.” AQR suggested that the media loves a good sound bite — and the curve inverting is a good one.

[II Deep Dive: AQR’s Problem With Machine Learning: Cats Morph Into Dogs]

After its analysis, AQR found that the yield curve works better in forecasting economic growth than stock and bond returns, especially outside the U.S.

“The yield curve has some efficacy for market timing, but it still has a high degree of forecast uncertainty,” the paper’s authors wrote. “Our results show the yield curve slope may be more useful for country allocation decisions than for market timing, and we remind readers that in both settings it is best combined with other predictors.”

After finding a relationship between the yield curve and next year’s GDP growth, AQR dug into the reasons why, finding some evidence that expectations for short-term interest rates and bond risk premia are equal drivers.

It’s logical, according to AQR, that if the yield curve can predict economic growth, it should also be able to tell investors something about future returns on stocks and bonds. AQR, however, found differences in the predictions. For example, the paper’s authors concluded that “while an inverted yield curve has been bad news for future equity and Treasury returns, the charts reveal meaningful variation in future outcomes…” In other words, investors shouldn’t be “overconfident” in relying on the yield curve to time the market, according to AQR.

The alternatives investment manager concluded that the slope of the curve can be used to predict future economic growth in many countries and stock and bond returns, but there’s a lot of uncertainty. AQR itself said it uses signals from the yield curve, but only combined with other factors.

“Even in a multi-factor composite timing model we tend to only ‘sin a little,’ taking relatively small purely directional timing views,” the authors wrote.