The Australian government took its financial sector to task in a recent Royal Commission report, but that shouldn’t dissuade foreign firms, according to a research and consulting firm.

The country’s workers, by law, must contribute portions of each paycheck to their retirement — or superannuation — account, which is a defined contribution plan invested similar to a traditional pooled pension fund. This has created an enormous growing pool of assets which lure foreign managers and service providers.

[II Deep Dive: Flexstone, Hostplus Start Private Equity Program]

The Royal Commission’s report shouldn’t change Australia’s appeal, Cerulli Associates argued in a statement Wednesday.

“Super funds will still need to make exactly the same decisions about asset allocation, currency hedging, and liquidity as they always did, and nothing in the Royal Commission is likely to make them choose any different underlying managers than they have done in the past,” said Ken Yap, a Cerulli managing director for Asia, in a statement.

“Australia remains an attractive market for investment managers and asset consultants, both local and global,” he added. “The damage has been on the distribution and retail advice side.”

The report took aim at inappropriate and undisclosed advisory fees and recommended a raft of regulatory changes to discipline the sales-driven industry.

Its criticism on the superannuation side focused on trustees, governance, and culture. “It should be concerning to regulators that professional trustees apparently struggle to understand their most fundamental obligation,” the report stated, before recommending that superannuation trustees be barred from holding other roles or offices.

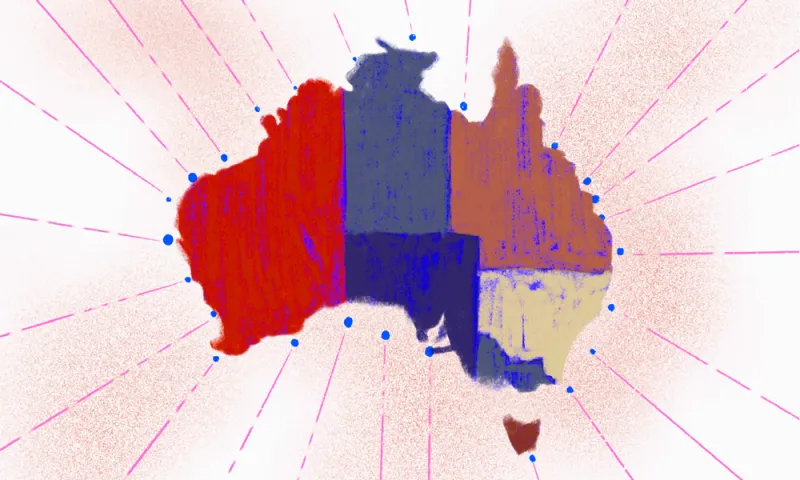

Australian super fund assets totaled A$2.6 trillion ($1.8 trillion) as of last March, according to the Royal Commission. Its findings led to major shakeups in the local investment landscape. Cerulli cited fund flows from bank-backed and retail funds to non-profit industry super systems as evidence of “just how badly this side of the industry had been hit” reputationally.

“In 2018, the fund with the biggest outflows in the entire industry was AMP’s superannuation product, while the biggest inflows were to industry fund AustralianSuper,” the research firm said.

Non-profit industry funds — of which AustralianSuper is the largest — generally run some assets in-house, but also provide substantial business to external managers.