Illustrations by Tyler Comrie.

Shorting companies can get uncomfortably personal. Carson Block, the founder of Muddy Waters Capital, has faced death threats and menacing messages referring to his wife and his father by name. “Security is certainly something that I’ve invested in,” he says. “Certainly more than long-only investors.”

No doubt betting on a company’s decline can be an awful affair on both sides of the wager. Short-sellers call out unethical behavior, make allegations of corporate fraud, and point out fundamental flaws that may have escaped the notice of investors who they believe are overvaluing a business. “In what we do there’s a lot of antipathy,” notes Block, an outspoken 42-year-old who made a name for himself warning about the activities of Chinese companies. “We get called morons,” he says. “Oftentimes we’ll be accused of being criminally manipulative.”

It’s easy to imagine why a company targeted by short-sellers would reject a suggestion that its business is set to deteriorate, or that its shareholders have been snowed. Chief executives want to see their companies’ stock go up, as do investors seeking gains from long-term growth. The thinking of short-sellers can also run contrary to research on Wall Street — which, true to form, they view skeptically, partly because banks may do business with companies covered by their analysts.

Now the nine-year bull market is punishing these defiant minority investors to the point where it’s become hard to stay relevant as a group. A stretch of disappointing performances has made attracting assets more difficult, even as recent bouts of volatility raise questions over whether bearish bets may soon pay off.

Hedge Fund Research stopped publishing data on its short-bias index at the end of last year because there were no longer enough funds focused on the strategy, according to an HFR spokesman. For those that remained in the index, 2017 was, on average, a disaster: They were down 9.75 percent, the worst annual performance since plunging 18.6 percent in 2013. The sole gain over the past five years came in 2016, when the short-bias index returned 1.22 percent.

“It used to be a lot easier to make money as a short-seller,” says Block. “There’s so much inflation of assets since the financial crisis.”

Bull markets may help mask problems at companies with questionable business plans, or no earnings, as investors piling into equity markets push their valuations ever higher. Along the way speculative companies get the benefit of the doubt.

Takeovers, which tend to rise when investors are upbeat, can also hurt short positions, as shares of companies targeted by a buyer tend to jump on the news. The peril is prevalent. Short-sellers have been navigating record levels of mergers and acquisitions, with little sign of a slowdown this year. The $1.7 trillion of deals announced globally through April was up 67 percent from the same period in 2017, according to Thomson Reuters data.

“It’s been a hell of a current to try and swim against,” says Block, who declines to disclose Muddy Waters’ performance.

Although a bullish environment may provide short-biased fund managers with glaring opportunities for profit, they’re battling animal spirits and the prevailing optimistic views of the companies they’re betting against. True short-sellers — those who focus on picking companies to bet against as opposed to creating a short book to hedge long positions — tend to be outsiders their entire lives, according to Block.

“They’re seeing things differently,” he explains. “As a group these people tend to be somewhat socially awkward.”

Carson Block, founder of Muddy Waters Research. (Anthony Kwan/Bloomberg)

Not fitting in with the crowd has its price. It’s one thing to break an explicit rule, where an infraction can be pinned down, and quite another to go against the zeitgeist, according to Robert Sternberg, a professor of human development at Cornell University and an eminent psychologist. Breaking from the tribe makes people even more uncomfortable, he says.

“People get pissed by the crowd defiers,” explains Sternberg. “They are actually afraid they may know something they don’t know.”

Yale University finance professor William Goetzmann estimates that far fewer than 10 percent of professionals in the $3.2 trillion hedge fund industry are pure short-sellers. These financial detectives have long been treated like “pariahs,” he says, as people view them as profiting off the misery and failure of others.

Take legendary short-seller Jim Chanos, who founded Kynikos Associates in 1985. He famously made waves — and money — by pointing out red flags in Enron Corp.’s accounting before it plunged into bankruptcy in December 2001.

Though not all short bets involve allegations of fraud, they can — and almost always do — get under the skin of chief executive officers. Chanos’s high-profile short bet against Tesla, the electric-car maker based in Palo Alto, California, set the stage for a battle with its CEO and oft-hailed visionary, Elon Musk. Lately the winds are turning in favor of Chanos’s wager, as both equity and debt analysts have raised concerns about the company’s liquidity.

Moody’s Investors Service lowered Tesla’s credit rating to B3, six levels below investment-grade, in late March, citing a “significant shortfall in the production rate” of its latest vehicle, the Model 3. The carmaker is facing “liquidity pressures,” Moody’s said, because it’s burning cash ahead of looming bond maturities. Delivery delays have bedeviled Musk, who recently took to sleeping on the factory floor as Tesla has struggled to meet its production goals.

“I don’t have time to go home and shower,” he told CBS This Morning in April.

Concerns about the Model 3’s production rate prompted Goldman Sachs Group analysts to lower their six-month target for Tesla’s shares to $195 from $205, according to an April 10 research report. The revised price then represented a potential 33 percent drop in Tesla’s shares.

“Place your bets . . .,” Musk tweeted the day of the report, presenting a possible challenge to short-sellers. The trades are in.

In an interview with Rolling Stone last year, Musk called short-sellers “jerks who want us to die,” accusing them of making up false rumors and amplifying negativity. “It’s a really big incentive to lie and attack my integrity,” he said. “It’s really awful.”

Yet there’s a less confrontational way to think about the role of investors like Chanos and Block. Charles Jones, a finance professor at Columbia Business School in New York, sees short-sellers as a positive force in the world.

“They’re really important to financial markets,” he says. “We need to have optimists and pessimists helping to determine stock prices.” Otherwise, there is a risk of asset prices rising too high for certain companies and sectors. “We’re going to have bubbles; we’re going to have too much capital flowing into that industry,” Jones warns.

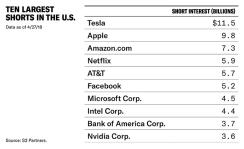

Short interest in U.S. equity totaled about $747 billion as of April 27, little changed from the start of the year but up 14 percent from the beginning of 2017, according to S3 Partners. The most heavily shorted industries were biotechnology, internet software and services, and semiconductors.

“Our whole system is predicated on having stocks that are right and helping people understand where capital should be deployed,” notes Jones. Although he sees short-sellers playing a needed role in this dynamic, he agrees that they tend to be vilified — particularly, he says, by CEOs who want their stock prices to be as high as possible.

“CEOs don’t care about the stock price being correct,” says Jones. “They want them to be high, and short-sellers get in the way of that.”

Agitated companies will sometimes push back through lawsuits.

Fairfax Financial Holdings — whose CEO, Prem Watsa, is known as the Warren Buffett of Canada — sued Steve Cohen; his former hedge fund firm, SAC Capital Management; and other fund managers almost 12 years ago for allegedly engaging in a short-selling conspiracy to drive down its stock price. The fund managers reaped “immense ill-gotten profits,” the Toronto-based company said in a 2006 complaint filed with the Superior Court of New Jersey in Morris County.

Fairfax, an insurance and financial services firm, alleged the fund managers accumulated short positions in Fairfax before “unleashing” a massive disinformation campaign, according to the complaint. The insurer said in the document that the “attack” against it had been “aimed at damaging, if not destroying, Fairfax” so short-sellers could profit from a drastic drop in the stock price. (The suit, which included Kynikos among the defendants, was dismissed.)

Investors have been cool to short-selling strategies — but recent data shows that might be changing.

Deutsche Bank’s annual alternative-investments survey, released mid-February, showed the bank was optimistic about hedge funds, with long-short equity back in demand. Deutsche probed 436 investors overseeing $2.1 trillion in hedge fund assets, finding that fundamental long-short equity was second only to event-driven strategies in popularity. “Going into 2017 a lot of investors said that long-short equity was at the bottom of the list,” says Marlin Naidoo, global head of capital introduction and hedge fund consulting at Deutsche Bank. “It completely flipped this year.”

Investors plan to direct an average 20 percent of their hedge fund allocations to long-short equity strategies, according to the survey. Private bank and wealth managers are most enthusiastic, expecting to allocate 47 percent to the category, whereas endowments and foundations were the least interested, with a planned exposure of 15 percent.

According to Naidoo, investors are evaluating long-short managers with “proven” track records on the short side. “They are more confident that people will very soon have an ability on the short side to make money,” he says, adding that private bank and wealth managers plan to more than double their exposure to long-short equity in 2018.

For fund managers focused on short-selling, though, attracting assets remains challenging, Naidoo notes. “We’re not seeing them allocate to pure short-sellers.”

Investors stung by the strategy may be slowly wading back into the territory by first increasing exposure to hedge funds with long and short strategies. Although the bull market has been tough for long-short managers with “fairly sizable short books,” says Naidoo, their long bets may mitigate the risk of short bets gone bad.

There’s another factor driving demand for long-short equity funds: Many asset allocators have spent the past few years consolidating their holdings in the strategy after finding a “high degree” of overlap in technology stocks, says Naidoo. As a result, they now want to add fund managers focused on sectors such as financial services, industrials, and consumer. They’re also spending time looking at long-short managers with international bets in countries like China, Naidoo notes.

Muddy Waters’ Block has seen investor interest changing with the ups and downs of the market this year. “Every time there’s a bit of turbulence, that’s when the phone calls come in,” says Block, who oversees $150 million of assets. “When it snaps back to normal, some of that interest tails off.”

Block discloses his short bets on the website of Muddy Waters Research, which he founded to help investors assess the value of companies. The firm says on the site that it “peels back the layers, often built up by seemingly respected but sycophantic law firms, auditors, and venal managements.”

Block remains concerned that Chinese companies can defraud investors on a massive scale through U.S. listings. China Internet Financial Services, a Beijing-based company that last year went public on the NASDAQ under the ticker CIFS, has caught his attention. Block disclosed his short position on Muddy Waters’ website in December, calling CIFS “just another worthless China fraud.”

Shares of CIFS, which provides financial advice to small to medium-size businesses, have since plunged, prompting the company to announce on April 10 that it’s monitoring its stock price and is fully cooperating with an independent investigation conducted by KPMG Advisory (China). Tony Tian of Weitian Group, an investor relations contact for CIFS, didn’t respond to a phone call and emails seeking comment.

“It’s amazing to me that we completely forget the lessons of 2011 and 2012,” Block says of his concern that Chinese companies may be duping U.S. investors.

It was in 2011 that Block gained fame for accusing Canadian-listed Chinese company Sino-Forest Corp. of being a Ponzi scheme. Sino-Forest, which had a market value of about $6 billion before he made his allegations, filed for bankruptcy the following year. In 2017, after a long regulatory investigation, the Ontario Securities Commission ruled that the company had knowingly defrauded investors by engaging in “deceitful or dishonest conduct” tied to its standing timber assets and revenue.

“I’m rooting for a world in which we’re asking tough questions,” says Block.

A willingness to endure the pressure, hostility, and ridicule that can go along with rejecting the status quo may well be part of someone’s personality long before that defiance crystallizes into a career, according to Sternberg. There’s a “frig-you attitude” that guides such people to take a different direction than the crowd, he says. For most people that’s hard to do.

“Who wants to spend their lives dealing with enemies all the time, especially when you haven’t done anything wrong?” asks Sternberg. “You’re not a law breaker. You are a zeitgeist breaker.”

Though investors reacted swiftly to Muddy Waters’ claims about Sino-Forest, the real-time warnings delivered by short-sellers can go on for years before they’re heeded — if they’re ever believed at all.

But the consequences of ignoring short-sellers — if they’re actually proven right — can be devastating.

Valeant Pharmaceuticals International was a popular long bet among hedge funds before its shares plunged in 2016. Chanos had been short the company, pointing to concerns about the accounting practices the company used for drug acquisitions fueling its growth. Valeant’s market value tumbled to about $10 billion in 2016, down from as high as $90 billion the year before.

For those who were long Valeant, it was a painful fall. “Clearly, our investment in Valeant was a huge mistake,” Bill Ackman, the founder of Pershing Square Holdings, said in the firm’s 2016 annual report.

For Ackman more pain would soon follow, from a years-long short wager on Herbalife. This year he gave up on the bet he’d made against the nutrition products company in 2012 on the belief that it was a pyramid scheme. Pershing said in its 2017 annual report, released in March, that Herbalife was a losing position unwound for technical reasons that had squeezed the billionaire hedge fund manager.

“While we continue to believe our analysis of Herbalife’s business remains correct, the shares have become a highly risky short sale in light of the extremely limited free float, and as a result, we have exited this investment,” Ackman said in the report.

Other high-profile hedge fund managers have wagers against the top-ten shorted U.S. companies that aren’t paying off.

For example, David Einhorn, founder of Greenlight Capital, has short bets against e-commerce giant Amazon.com, whose shares were up 34 percent this year through April, and Netflix, the video streaming company whose stock has soared 63 percent in the same period.

The hedge fund firm, which manages a mix of long and short positions, lost 13.6 percent in the first quarter, net of fees and expenses, according to Greenlight’s April 3 letter to investors.

For the small group making a living betting against companies they believe are doomed to fall, the constant stream of positivity emanating from Wall Street — the CEOs talking up their businesses, the sound of optimism ringing from investors clamoring for the next best-selling deal — may amount to little more than background noise. They hear it. They just don’t buy it.

They resolutely hold their positions because their own homework has led them to different conclusions. They know the best ideas may well turn out to be those bets where most people were on the other side.

Surviving those positions is another matter.

Short-sellers may make losing bets in any part of the economic cycle, but for now, even with the return of volatility in the stock market, the wind isn’t at their backs. As Block points out, being right about a company doesn’t guarantee making money on it — particularly in bullish markets when it’s cheap and easy for companies to access capital. Even this year, with investors showing signs of nervousness, money isn’t flooding through their doors.

In the meantime, Block is well aware that short-sellers aren’t celebrated for being outspoken about their positions — which only cements their status as outsiders, he says. But then again, he’s not the old-school gentleman short-seller quietly taking positions that go against the grain. And he’s mentally prepared for any blowback.

“It is street fighting,” Block says. “You have to have thick enough skin so it doesn’t bother you.”