Thirty-four-year-old James (Jimmy) Levin was next in line to become the chief executive officer of $32 billion hedge fund firm Och-Ziff Capital Management Group.

Until, suddenly, he wasn’t.

At some point between Valentine’s Day 2017, when Levin was promoted to co–chief investment officer and granted a 39 million-share incentive package, and the day before Christmas Eve, when a client letter announced Levin would not replace Dan Och as CEO after all, the succession plan changed.

The change did not go over well. One month after the client note was distributed, Och-Ziff board member William Barr resigned. In a regulatory filing on January 29, Och-Ziff said the resignation was related to “a disagreement over CEO succession, as well as business and governance plans for the company.”

The next day, Och-Ziff announced a new successor: Outsider Robert Shafir, chief executive of Credit Suisse Group’s Americas operations, would take over as CEO on February 5.

The announcement, in which Och lauded Shafir as a “world-class executive” with a “distinguished career,” included a brief statement from Levin regarding the man hired in his place: “Oz is a tremendous firm with a talented and creative team that works each day to identify and execute on the most compelling investment opportunities around the world,” he said. “I am excited about the future and look forward to welcoming Rob.”

A spokesperson for Och-Ziff declined to comment further on the firm’s succession planning.

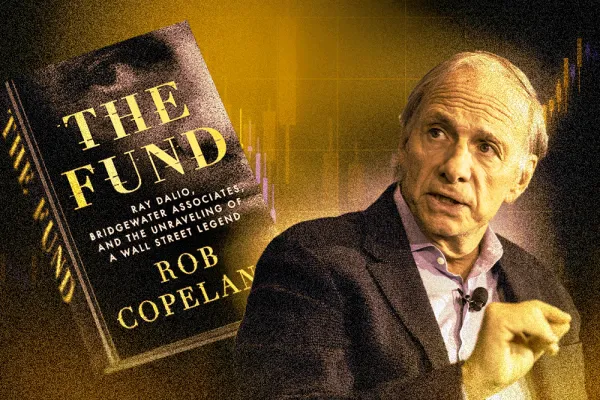

Och-Ziff is not the only hedge fund firm in recent years to backtrack on a widely understood succession plan. In 2016, Bridgewater Associates made headlines when heir apparent Greg Jensen was removed as co-CEO and replaced by ex–Apple executive Jon Rubinstein. Jensen remained as co-CIO, whereas Rubenstein would stay at the firm for just nine months before another new co-CEO, David McCormick, was welcomed in a March 2017 client letter.

The letter, shared on Bridgewater founder Ray Dalio’s LinkedIn page, noted that successful management transitions involve some “trial and error.” As for Jensen, Dalio wrote simply that “handling both a co-CEO job and a co-CIO job is tough.”

He added, “For that reason we decided that Greg would shift his full attention to the co-CIO role.”

A spokesperson for Bridgewater says that there have been no further updates to the succession plan since the changes announced last year. “The big takeaway is that Bridgewater is in the process of a ten-year transition plan,” she adds.

Such transition plans have increasingly come to the foreground in hedge fund discussions, as the founders who launched the industry look toward retirement. According to Casey Quirk, Deloitte’s asset management consulting practice, roughly a quarter of hedge fund founders are now older than 65. A further 42 percent are between the ages of 55 and 65.

“The industry was started over the past few decades, so you have a whole generation of founders that are quickly getting to the age where they either want or need to think about transitioning leadership to the next generation,” says Yariv Itah, Casey Quirk’s global practice leader.

As Dalio put it in his client letter, “Any organization run by a 60-plus-year-old that says it isn’t in transition is either naive or disingenuous.”

Although the concept of generational transition is certainly not unique to hedge funds, hedge funds face challenges that other firms may not encounter when planning for succession. Founders, for one, may be reluctant to relinquish control of the firms they built.

“Quite often, even when there’s a plan in place, the patriarch doesn’t want to exit when they are supposed to and the plan falls apart,” says Michael Goodman, managing partner at Long Ridge Partners, an executive search firm focused on alternative-investment firms. “The biggest challenge is ego. Ego can be a hard thing to get over.”

Any succession plan, he adds, is going to fail if the firm’s leaders are not fully committed to it.

Itah agrees. “You need to have a person who is now in control who wants to see the franchise continue and is willing to give up power and economics over a long period of time” for the sake of the up-and-coming leadership, he says.

Otherwise, Itah adds, it’s likely the firm will just end up getting sold — or, possibly, shut down entirely.

In the case of Och-Ziff, founder Och appeared willing to cede control at the agreed upon time — just not to Levin.

“After extensive discussion with the board of directors, including the company’s independent directors, who support transitioning to Jimmy in the near future, it was the conclusion of Dan Och . . . that now is not the right time to transition to Jimmy,” the December client letter stated, according to a Wall Street Journal report. A person familiar with the matter confirmed the succession planning changes announced in the letter.

With Levin out as the next CEO, a search ensued for a replacement option, with the firm ultimately landing on Shafir — who, in addition to serving as CEO of Credit Suisse Americas, was co-head of the firm’s private banking and wealth management business. The investment banking veteran is new to the hedge fund industry, having worked at Lehman Brothers Holdings and Morgan Stanley before joining Credit Suisse in 2007.

The decision to hire Shafir was an unusual one: According to Goodman, hedge fund successors are typically groomed internally. Although Och-Ziff is something of an outlier, both as a large publicly traded firm and one seeking to recuperate its image following a criminal bribery investigation, in general the recruiter says he’s “not a fan” of bringing in an outsider to take over.

“A place could fall apart if they brought in somebody from the outside,” he explains. “It would kill the culture. People have to feel they’re working for something and incentivized to work for something.”

Itah is more ambivalent. “It depends on the culture and the brand of the firm,” he says. “With some firms it is very important that the person will present continuity of the investment philosophy, and in that case it will be important for that person to come from the inside.”

Other companies, however, may want someone with a fresh perspective who can grow the business with new ideas, he notes. But regardless of strategy, Itah emphasizes the need to develop not just one successor, but a group of new leaders.

“You don’t want to be dependent on just one person to do it right,” he says.

Itah recommends devoting at least five years, and preferably seven to eight years, to the generational transition process.

“Having enough time and taking enough time to try out different approaches to having a new generation of leadership emerge — that is the secret to dealing with all these challenges,” he says.