In Anna Karenina, Author Leo Tolstoy famously observed, “Happy families are all alike; every unhappy family is unhappy in its own way.” The same might be said for hedge funds in 2017.

With stock markets soaring, many of the happy funds that managed to make double-digit returns last year had one thing in common: They invested in U.S. technology stocks — including Facebook, Amazon, Netflix, and Google — that were among the top holdings of hedge funds last year and led the Standard & Poor’s 500 stock index to a 22 percent gain in 2017.

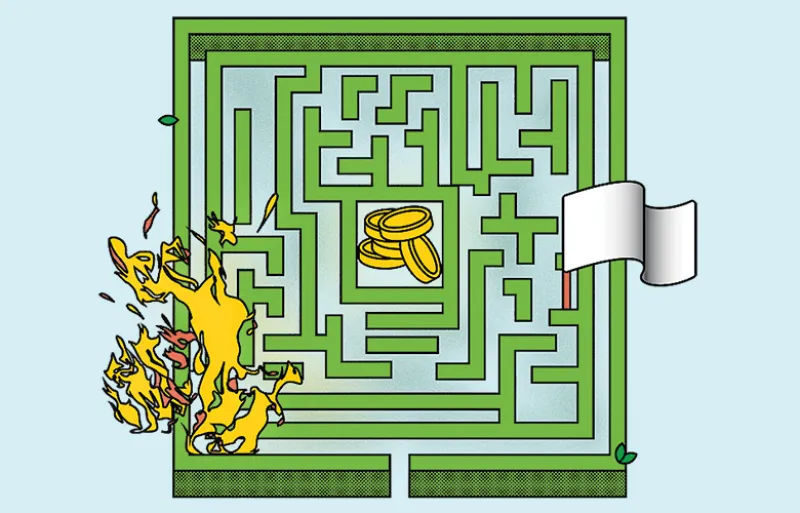

But there were plenty of unhappy hedge funds. A surprising 21 percent of hedge funds covered by data provider Hedge Fund Research lost money in 2017, according to HFR. These funds all managed to lose money in distinctly different fashions, from shorting the yen (and a lot of other stuff) to engaging in merger arbitrage to even owning defaulted Puerto Rican debt.

Take Hugh Hendry, who shut down his 15-year-old Eclectia macro fund after it fell 9 percent through August. Hendry is a former market bear, but he says it wasn’t an overall pessimistic stance that felled the fund.

“I was positive on the outlook for risk last year, but I found it immensely difficult to both construct a positive risk book and convince investors that this was appropriate,” he says, as they view macro funds as “essentially long volatility vehicles.”

Hendry says he had “big positions” that were “short the yen, long Chinese cash rates in the offshore market and short two-year German [government bonds],” all of which moved against him. The yen, in particular, tends to go up in times of crisis, he says, which is exactly what happened during the North Korean standoff. “Trump rhetoric over North Korea worked against me over the summer,” Hendry explains.

If other macro funds were long volatility, that might explain their big losses in 2017, a year when volatility was practically nonexistent. The hardest hit of the macro players appears to be Caxton Associates’ flagship Caxton Global Fund, which lost 13.4 percent. Caxton did not respond to a request for comment.

A macro overlay also took one of Clint Carlson’s funds down 22 percent. That fund, Carlson Black Diamond Thematic Long-Short Equity, was betting on stocks with a macro analysis. “It had three themes: China was going to have a slow year, it was shorting semiconductors — a horrible idea — and interest rates were going to rise, and they didn’t,” says an investor. That fund also fed into Carlson’s Double Black Diamond flagship, pushing it down 3.93 percent. (It was up 1.31 percent through January.) “I came to the conclusion over past year they were being stubborn,” the investor says. Carlson declined to comment.

In the realm of stubborn short bets, Mark Spiegel’s big Tesla short pushed his Stanphyl Capital Management fund down 12.4 percent for the year, according to an investor letter. Shares in Elon Musk’s electric-car company rose 46 percent last year, despite negative cash flow and tons of debt.

Short-selling in general was a disaster. Whitney Tilson, who shut his Kase Capital Management fund in September when it had fallen 8.9 percent for the year, attributes most of his pain last year to shorts. “Shorting, in particular, killed me,” he says. One of those shorts was diet-shake seller Herbalife, the multilevel marketing company that rose 45 percent after it bought back more of its shares last year. Herbalife was the worst performer in Bill Ackman’s Pershing Square Capital Management portfolio, accounting for 4 percentage points of its losses in 2017. Pershing Square ended the year down 1.6 percent to 4 percent, depending on the fund.

Bearishness also appears to have hurt Neil Chriss, who decided to shut down his Hutchin Hill Capital in November. It ended 2017 down 7.6 percent, after posting poor performance for several years, according to an investor report. Chriss, a quant trader who previously worked at Steve Cohen’s SAC Capital Management, told investors in September that he had lost money in credit, so he refocused the fund on equities, macro, and quant trading. At that time, he says, he was expecting a market correction. But it didn’t happen in time to save him.

Shorting, however painful, wasn’t the only culprit. Hedge fund mogul John Paulson even managed to lose money in his merger arbitrage fund. The Paulson Partners Enhanced fund, which uses borrowed money to double down on its trades, sank 35 percent last year, and Paulson Partners, his older merger arb fund, lost 17 percent in 2017, according to an individual familiar with the numbers. Then there were the one-off events — like Hurricane Maria, which blew a hole in hedge funds with big Puerto Rican debt portfolios. Mark Brodsky’s Aurelius Capital Management, for example, had more than 10 percent of its $3.5 billion fund in Puerto Rican general obligation bonds. Last November it held $447.4 million of the debt.

Aurelius ended 2017 up a little more than 1 percent. It did not respond to a request for comment.