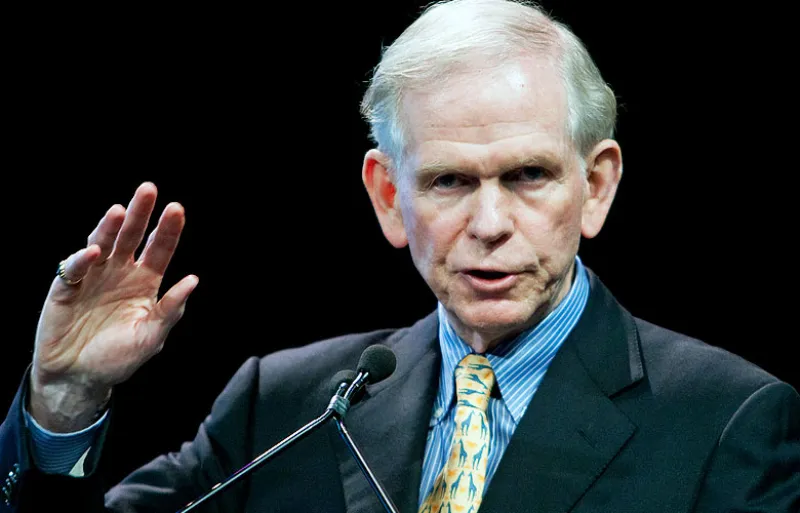

As U.S. stock prices continue to climb, a diversified portfolio is no longer going to cut it, according to Grantham Mayo Van Otterloo & Co.’s Jeremy Grantham.

Grantham, co-founder of the asset manager and a famed value investor, wrote in his latest client letter that a typical portfolio of diversified stocks and bonds will deliver real returns below 3 percent over the next decade — a “near disaster for pension funds.”

The forecast is based on the belief by Grantham and his colleagues at GMO that U.S. equity valuations, measured through price-to-earnings ratios, will remain high for as long as 20 years before reverting to pre-1998 levels. Grantham had made a similar prediction in his May client letter, writing that investors should “brace themselves for continued higher multiples than those of the old days.”

Now, Grantham says investors should try to avoid U.S. equities altogether in favor of emerging market equities, or what he describes as the “one asset that is reasonably priced in a generally very high-priced world.” In his letter, the GMO strategist called for an asset allocation that is “heavily overweight” emerging markets and includes some exposure to Europe, Australia, and Asia, leaving out U.S. equities.

“Be as brave as you can on the EM front,” Grantham said in the letter. “Bravery counts for so much more when there are very few good or even decent alternatives.”

GMO is well-known for making big bets, having developed a track record of successfully calling market bubbles. The firm, established in 1977, was bearish ahead of the 2008 financial crisis and before the technology stock bubble in 2000. The firm’s contrarian views, however, can take years to pay off, and performance has suffered in the meantime: GMO’s Benchmark-Free Allocation Fund Class III earned just 3.4 percent in 2016, according to Morningstar. This year, it’s up 11.6 percent through November.

“If you mean to offer a useful asset allocation service to institutions, one that is designed to beat benchmarks and add value as well as lower risk, then you must make bets,” Grantham wrote.

Grantham currently invests 55 percent of his family’s pension funds in emerging markets, according to the letter. GMO’s Benchmark-Free Allocation strategy, which Grantham said is constrained by “what a substantial majority of investment people think is normal behavior,” has a 27 percent allocation to emerging markets.

[II Deep Dive: GMO’S Mean-Reversion Strategy Is Tested in Today’s Market]

Meanwhile, the firm’s assets under management have dropped to $74 billion in September, from $124 billion in June 2014, according to GMO’s website. In his letter, Grantham acknowledged that big market bets can come with significant career risk, including losing clients.

“If you are not prepared to put considerable career or business risk units on the table,” he said, “you should not offer the service.”