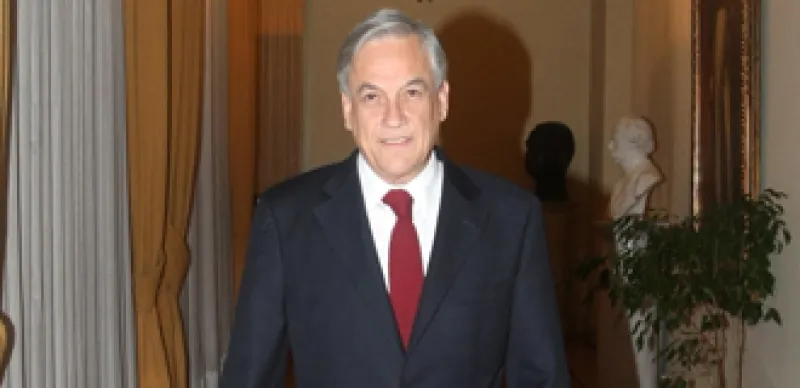

(18/07/2010) Entrevista a Presidente, Sebastián Piñera en La Moneda, para Reportajes de El Mercurio. (Newscom TagID: clelmercuriopic004625) [Photo via Newscom]

El Mercurio/Chile/GDA/Héctor Ara/El Mercurio de Chile/Newscom

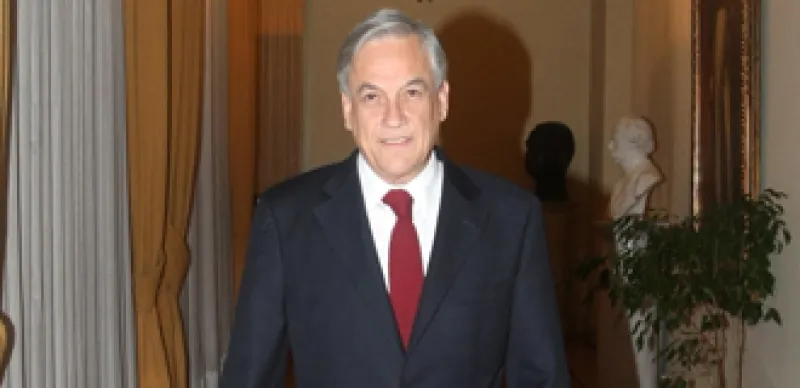

(18/07/2010) Entrevista a Presidente, Sebastián Piñera en La Moneda, para Reportajes de El Mercurio. (Newscom TagID: clelmercuriopic004625) [Photo via Newscom]

El Mercurio/Chile/GDA/Héctor Ara/El Mercurio de Chile/Newscom