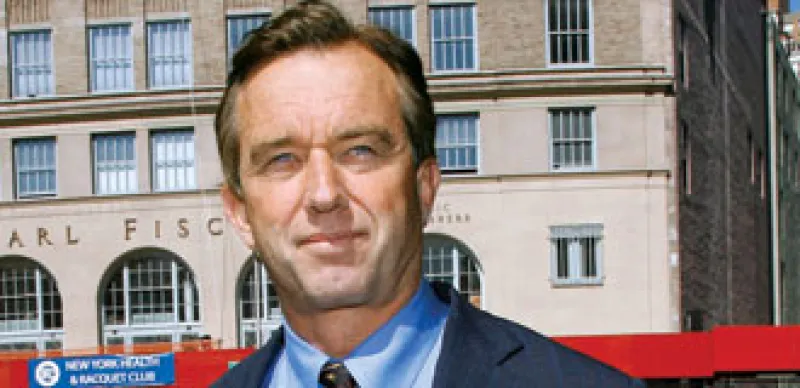

As senior attorney with the National Resources Defense Council, chief prosecuting attorney for the Hudson Riverkeeper and president of the Waterkeeper Alliance, Robert F. Kennedy Jr. has filed more than 400 lawsuits against alleged polluters and even gone to jail for the environmental cause.

So when the Kennedy scion became a partner of VantagePoint Venture Partners, a venture capital firm that invests in “clean technology,” earlier this year, it was another sign that “green” is coming of age commercially. The Silicon Valley–based firm, which also targets information technology, health care and Asia, has invested about 22 percent of its $4.5 billion in committed capital in such clean-tech enterprises as generators of solar and wind power.

“We are shifting a multitrillion-dollar energy industry away from entrenched, inefficient incumbents while advancing America’s environmental, economic and national security interests,” an enthusiastic Kennedy, 55, tells II Senior Writer Frances Denmark. “Private capital markets are already demonstrating a deep appreciation of the transformative value of green tech.”

1. When will we see viable green investment opportunities?

They already exist. Government investments in green tech are far more akin to seed capital than subsidies. This is in stark contrast to the coal, oil and nuclear industries, which falsely claim to be cheap while externalizing their costs and annually collecting billions in direct and indirect government subsidies. Government investment in green tech will eventually be unnecessary — the private capital markets are already demonstrating a deep appreciation of the transformative value of green tech. Meanwhile, President Obama has already promised to get rid of the $35 billion in direct oil subsidies. Within five to ten years, a green revolution is going to overthrow the incumbents.

2. What will it take to get this revolution started?

It has started. Last year, for the first time, wind industry employment surpassed that of the coal industry. Wind also accounted for 42 percent of all new electricity generation last year.

3. Won’t building new infrastructure to support renewable energy be expensive?

The status quo is far more costly. The U.S. could build a fully renewable energy system for what we spend every two or three years importing foreign oil. After we build that system, the energy is essentially free forever. In turn that will constitute one of the greatest permanent tax breaks that American businesses and households will ever have known. Even now, VantagePoint’s portfolio company, BrightSource, is constructing the world’s largest solar thermal plant in California. It will be built faster per gigawatt than you can build a coal plant and at less than half the cost of building a nuclear plant.

4. What’s the biggest threat to U.S. dominance in the new world of clean technology?

Annually, China is going to spend as much on green tech as it spends on its military, committing hundreds of billions of dollars to new energy technology. China already produces more wind turbines and solar panels than any other country. If we let them, they are going to steal this entire industry away from America. It is estimated that by 2013, 15 percent of the Chinese economy will be green tech. If we had a fraction of what the Chinese are putting into the space, we’d see an explosion in this industry.

5. What is holding the U.S. back?

The dearth of capital is handcuffing the industry. Right now there is a starvation of funds to scale up the technology. In private equity parlance it’s called the “dead zone” — when there is a proven technology, power purchase agreements and orders, and companies ready to be taken public, but not enough cash. We need a flood of money from private investors and the government.