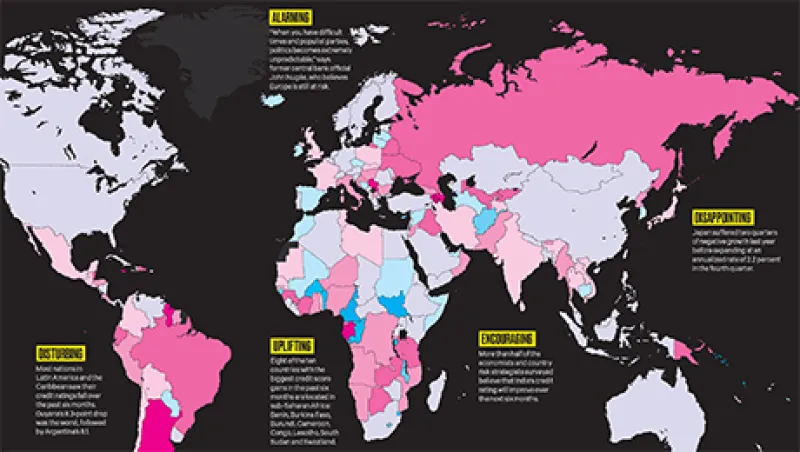

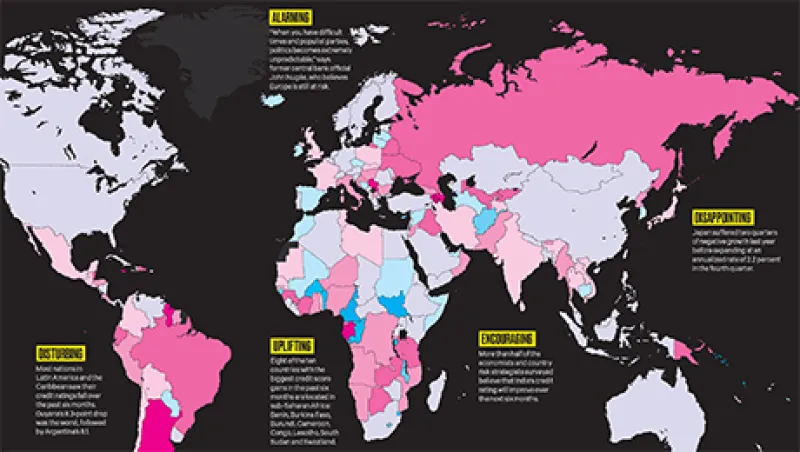

Credit Worries in Europe and EM Countries Offset U.S. Strength

Our Country Credit survey shows widespread weakness stemming from concerns about the euro area and the health of emerging-markets economies.

Harvey D Shapiro

March 3, 2015