Vijay Sumon, CME Group

At a Glance:

- Alphabet and Meta initiated paying dividends for the first time this year.

- With dividend uncertainty comes the need for investors to reconsider their dividend risk and manage their exposure.

The Federal Reserve began easing monetary policy for the first time in about four years with a 50-basis-point cut in interest rates on September 18, with investors expecting further easing through 2024 into 2025 to bring down rates from nearly two-decade highs. The Fed's move comes in the wake of inflation declining from over nine percent in 2022 to around 2.4% as of the October Consumer Price Index release.

Reducing borrowing costs amid steady economic growth can help to improve corporate earnings, allowing companies to maintain or increase dividends. Small-cap companies, in particular, could benefit from lower rates as they tend to depend on bank borrowings to fund operations unlike corporations that can tap bond markets. However, if the rate cuts are a reflection of a weakening economy, companies could potentially face declining revenues, thereby leading to the potential for cutting dividends to preserve cash holdings.

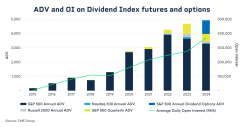

Amid this scenario, Dividend Index options can be a useful tool to hedge dividend uncertainty, transfer risk and isolate dividend exposure. Options on S&P 500 Annual Dividend Index futures (SDA) debuted in the U.S. for the first time as of January 29, 2024, reaching a single-day trading record of over 12K on April 18, 2024.

Dividend Announcements

Earlier this year, Meta took the market by surprise by confirming that it would pay its first-ever quarterly dividend of USD 0.50 to investors since Facebook floated on the stock market in 2012. This was announced on its earnings as of February 1, 2024, after the market closed. As Meta is an index component of both the S&P 500 and Nasdaq-100, the inclusion of the dividend would impact the pricing of their respective Dividend Index futures associated with them. Alphabet followed suit, announcing on April 25, 2024 that it would also pay a dividend for the first time.

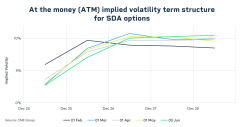

Market participants were forced to reconsider their risk and manage exposure when both Meta and Alphabet initiated paying dividends for the first time. This was expressed in both futures and options on S&P 500 Annual Dividend Index in the movements of the term implied volatility of the at-the-money options on the S&P 500 Annual Dividend Index futures at various dates.

Post announcements, the term structure of the volatility moved higher then subsequently normalized, reflecting the market’s risk view.

Longer-Term Trends

Dividend trends are influenced by a variety of factors. The broader narrative surrounding equity payouts is starting to shift, with companies more inclined to engage in stock buybacks rather than distributing capital directly to shareholders. Overall economic health, tax policies and corporate earnings will also remain areas to monitor as market participants consider their dividend risk.