The battle over funds that use environmental, social, or governance factors to analyze public companies has been playing out in board rooms and state legislatures for years. In early 2023, Republican Attorneys General from 25 U.S. states even sued the Department of Labor over a Biden administration regulation allowing retirement plan sponsors to consider ESG factors in investment decisions. The AGs say the new rule contradicts current requirements that sponsors simply focus on maximizing returns.

Critics argue that considering the environmental or social impact of companies leads to lower returns. Investors appear to buy some of these arguments, pulling money out of sustainable funds for the first time in 2023, even as conventional funds experienced inflows, according to Morningstar data.

But there’s a whole category of investments that have yet to be targeted by the skeptics. We wanted to research venture capital funds that are the private company cousin of ESG strategies — so called impact funds — and see how they performed compared with the overall VC market.

We found claims that impact funds must be concessionary — meaning investors give up some returns when they also pursue social goals — to be wrong. In fact, funds designed to solve some of society’s problems can produce returns comparable to non-impact funds and they can lower risks. Impact-aligned industries also can outperform others.

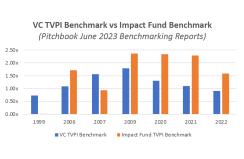

For our analysis, we evaluated Total Value to Paid in Capital, the standard performance metric used in venture capital, to compare impact and traditional funds. We found that there was no statistically significant difference in the performance of the two categories when looked at by vintage year — the year in which the fund made its first investment. On average, impact funds actually outperformed their peers, with more than 50 percent of the funds we analyzed beating their fund vintages’ benchmark.

Using data from PitchBook, a research firm on alternative investments, we analyzed venture funds overseen by managers that were members of either the Global Impact Investing Network or Impact Capital Managers, two of the largest impact investor groups. We also collected and included data from ICM members that did not report their returns to PitchBook.

While we weren’t able to definitively prove that impact funds outperformed traditional VCs because there simply isn’t enough data, the results still notably contradicted what critics of impact venture investing allege — that impact funds underperform peers.

Using PitchBook benchmarking tools, we were also able to show that our constructed benchmark of ICM and GIIN member funds outperformed VC benchmarks in five of the seven vintage years for which we have enough data. These results are consistent with a December 2023 report from PitchBook (see chart below).

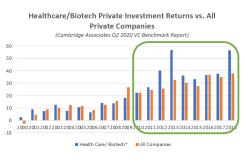

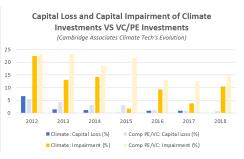

While a paucity of data on impact funds has made it difficult to analyze and compare performance with VC overall, there is more available information at the industry level. Our analysis showed that healthcare-life sciences and climate-clean technology — two impact-aligned industries —are predicted to outperform other sectors over the next decade.

Returns on VC investments in healthcare and biotech have matched or outpaced VC investments broadly and consistently since 2010, according to Cambridge Associates. See the chart below. While not all healthcare investments are focused on impact, the strong performance of the industry overall is notable.

Ethan Finkelstein is a current MBA student and Social Business Fellow at Georgetown University McDonough School of Business. He works as a Venture Fellow with Halcyon Fund and Recast Capital, a venture fund of funds, where he analyzes VC fund performances to inform investment decisions.

Dahna Goldstein is co-founder and Managing Partner of Halcyon Venture Partners.