Rating agencies that score companies based on their environmental, social, and governance performance may face conflicts of interest when they also license indexes based on those ratings, according to new research.

The study is admittedly limited, with only two agencies included in the analysis. But the researchers did find that the more the agency earned from licensing ESG indexes, the more likely it was to assign higher ESG ratings to companies whose stock has performed well, according to the collaborative research conducted by scholars from Emory University and Columbia University.

The conflict arises as asset managers and others may be more likely to license indices with a history of generating strong returns. "...while ESG raters face incentives to develop and maintain reputations for providing credible information, their alternative business lines — particularly those related to stock index construction and licensing — may potentially conflict with the reputational incentives in the production of ESG ratings. Index licensing revenues are increasing in the performance of the licensing funds," according to the study.

"We find that raters with strong index licensing incentives issue higher ESG ratings for firms with better stock return performance relative to raters with weaker licensing incentives, after controlling for the firm’s fundamental ESG performance," wrote the authors. "We also find that raters that construct ESG-based indices more often include and place greater weight on stocks with better stock return performance in the ESG-based indices."

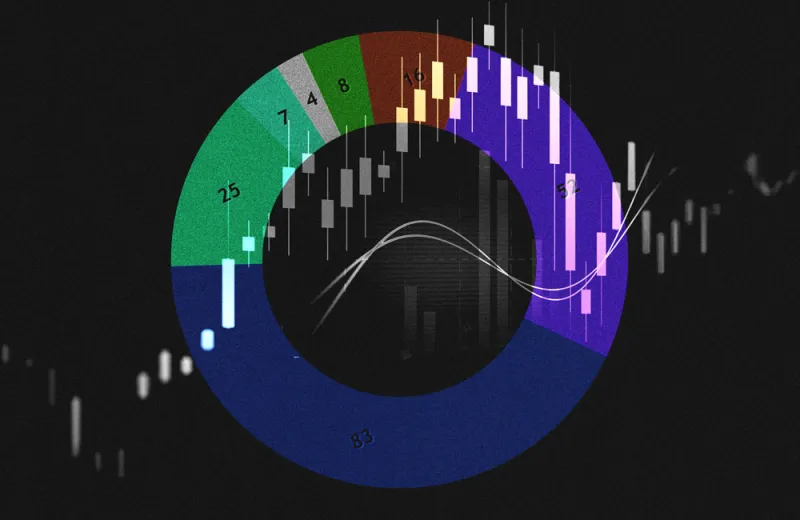

In the paper, the scholars studied the ESG scores generated by two leading rating agencies: MSCI and Refinitiv. MSCI generates more than 60 percent of its operating revenue from selling indices. The authors considered MSCI a high-index rater. In comparison, Refinitiv collects less than 15 percent of its total revenues from index license sales, making it a low-index rater.

The difference in ESG ratings is significant between these two agencies. For every standard deviation of increase in a company’s stock return, MSCI assigned an ESG score that is 31 percent higher, according to the paper. To be in the sample, companies must have received ESG ratings from both agencies. The result is derived from a sample of 1,691 U.S.-based companies from 2012 to 2019.

Lisa Yao Liu, an accounting professor at Columbia University and one of the paper’s authors, said the research team is in the process of analyzing data from more rating agencies, such as Sustainalytics. The preliminary results based on the analysis of MSCI and Refinitiv show that the ESG rating industry hasn’t effectively addressed conflicts of interest, especially given that “MSCI has a lion’s share of ESG ratings on the Street,” said Shivaram Rajgopal, another Columbia professor who also worked on the research.

MSCI did not respond to a request for comment. A spokesperson from London Stock Exchange Group, which owns Refinitiv, said it aims to help clients make decisions that are “independent from any potential interferences.”

“[ESG] is still a landscape where there’s not a lot of mandatory disclosure, and that has created an opportunity for third-party raters to step in and play an important role in providing information for the market.” said Suhas A. Sridharan, an accounting professor from Emory University and one of the paper’s authors. “We’ve seen this real proliferation of raters that seem to be doing different things, but there’s not a lot of clarity around where the differences in ratings come from.”

It’s not the first time that researchers have found significant differences in ESG scores assigned by different rating agencies. An MIT study in 2019 found that a company could receive an "A+" rating from one agency and be labeled an “ESG laggard" by another. It also found that the correlation of ESG scores among leading ratings providers was only 30 percent. This stands in stark contrast to the 99 percent correlation found among credit rating agencies, according to the MIT paper.

“The goal of ESG ratings is to measure ESG performance,” Sridharan said. “But if we don’t know what ESG really is and we are relying on these ratings, we need to at least recognize that the ratings are going to be measuring different things.”