Equity investors across the world – focusing on North American, European, and Asian-Pacific markets – all have some big things in common. For one, most are bracing for a genuine recession (beyond the “technical” variety that some countries are already seeing) to settle into global economies by early 2024. Second, many are (understandably) giving wider berth to cyclical stock categories that tend to perform poorly as recessions near or are facing historic uncertainty (such as banking and commercial real estate). Third, many equity investors are high on two broad sectors that lots of analysts agree offer highly novel opportunities and strengthening tailwinds: tech and health care.

Within the latter sector, countless biotechs, pharmaceutical companies, firms that produce medical devices, nutraceutical enterprises, and other entities are vying for attention from markets and investors – with dozens of new and little-known players for every household name (such as Merck and Johnson & Johnson). One category unites several of these segments: Life sciences. And according to a recent Morningstar report, many companies in this area are once again priced attractively for stock investors with long time horizons.

Spotlight on toolmakers for drug manufacturing

Loosely defined as a multidisciplinary industry that seeks to promote the well-being of humans and other living things, you’ll find life sciences companies pushing the boundaries of nearly every realm of modern medicine, including diagnostic technology, genomic research and applications, telemedicine, and, of course, treatments for a multitude of illnesses and diseases.For investors, however, the aforementioned June Morningstar report makes it clear that life science companies that produce tools and devices vital to manufacturing new drugs may be the most compelling industry players at present – for several reasons.

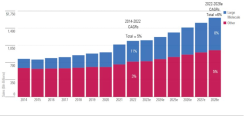

The Morningstar publication, entitled How an Idea Becomes a Drug: The Life Science Toolmakers Who Enable That Process While Also Reinforcing Their Moats, affirms one of the central attributes of these stocks for investors: “Life science firms often benefit from broad exposure to biopharmaceutical growth without taking on much product-specific risk.” This quality is highly appealing in and of itself, just considering the projected growth the global prescription drug market (see Chart 1).

Chart 1: Worldwide prescription drug sales set to continue growing in midsingle digits, with large molecules likely to grow faster in the high single digits.

The key feature: Stickiness

Both advantages relate to the “stickiness” factor, as these companies’ end users (often pharmaceutical makers) have many motivations to keep using their products rather them replace them with a competitor’s – even when there are cheaper or superior alternatives.One major motivation comes courtesy of the vigorous regulatory gauntlet that all medications must run to get to market. The drug manufacturing process is so highly regulated, the tools that pharmaceutical companies (and all the vendors and entities around them that play supporting roles in bringing new drugs into existence) use – a universe of devices including everything from precision scales to autoclaves, spectroscopes to countless forms of filtration systems – become virtually cemented into that process as soon as a drug begins its testing journey.

“Once a product’s application is on file, regulators require drugmakers to use the manufacturing process spec’d into that application to ensure safety and efficacy of that product, unless updated and approved by those regulators,” the Morningstar report explains. Making even one small change in that process can be extremely costly in terms of both time and dollars, potentially adding six months to the review period and an untold amount to the current $1.6 million fee the U.S. Food and Drug Administration charges to file a drug application without clinical data, according to Morningstar. Naturally, all parties involved want to avoid these consequences, as well as the extra scrutiny that even minor changes can invite. Accordingly, the report states:

Patents widen the moat

A second factor that enhances the “stickiness” of life science firms, making it harder for their end users to replace them, derives from their “intangible assets,” according to the Morningstar analysts. Simply, many firms specialize in a specific part of the drug manufacturing processes, and over years their platforms tend to develop a unique set of patent-protected features and qualities that not only offer a dominant solution, but also pose a legal barrier to competitors seeking to create an alternative offering that, again, will be sufficiently similar to the original to allow a drug company to even consider making the switch (given the regulatory hurdles they’ll face to make that change). The report says:Generics further sweeten the pot

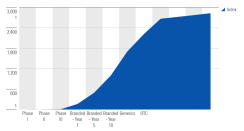

This stickiness even helps many life science companies maintain their market relevance (and stock values) when cash-cow drugs lose their patent protection, the report notes, as the toolmakers will often retain their role in producing the generic and biosimilar versions of the drug. In fact, having a top-selling drug go off-patent can be a boon to such companies, by greatly increasing its market (and production volume needs) even as its per-unit prices decline. The Morningstar report explains:Chart 2, below, “shows the estimated volume growth potential for life science toolmakers through various regulatory phases, including a potential increase of over 70% as a branded drug goes generic,” according to the report.

Chart 2: Annual drug volumes increase even as patents expire (below chart shows averages).

A return to reasonable values

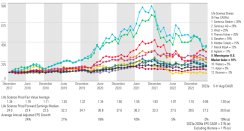

Stocks blessed with deep moats filled with regulatory headaches and patent litigation often maintain higher prices relative to their broader sector, naturally, and life science equities are typically no exception. “These positive attributes often do not come cheap from a stock valuation standpoint,” the Morningstar report notes. But the last several years have not been typical for these equities, as shown in Chart 3.During the pandemic, share prices of many life science companies that produce tools for drug manufacturing “rose above fair value, in our opinion, and above historic valuation norms, especially in 2020-21,” the report notes, adding:

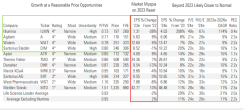

Chart 4: Some life science leaders are trading at moderate discounts to fair value.Sorted by price/fair value estimate (smallest to largest)

Look for double-digit growth ahead

As the historic performance details shown in the above two charts demonstrate, stocks of life sciences companies covered by Morningstar are now “collectively trading at an average discount to fair value for the first time in five years,” according to the June report, with the future for these equities looking strong:Life science firms that help scientists and pharmaceutical companies create new drugs and bring them through the approval process are still getting a cold shoulder from many investors – undeservedly, Morningstar argues – after their inflated values from 2020 and 2021 dropped sharply within the last year. While values could fall further, the analysts that authored this June report believe that the stocks have now descended to attractive price points for buy-and-hold investors. More importantly, they also believe these stocks have clear market tailwinds that should soon lift their share values to appealing heights again – with more resiliency than the short-lived pandemic expansion offered.

Given the formidable moats that defend these companies from competitors, their stocks can provide a strong opportunity to equity investors with long-term outlooks to capture double-digit upside at moderate risk. Seizing that opportunity may be especially important to fortify portfolios as recessionary winds swirl in the distance, threatening to flatten several other sectors and stock segments upon its arrival – both the usual suspects, and as often happens, some that present unwelcome surprises.

Learn more about investment opportunities in life science stocks.

Read more sector analysis on the II Communities on Equity Research & Market Insights.