Seemingly every rechargeable electronic device in existence. The drive toward electric vehicles across the globe. Renewable energy sources that depend on massive batteries to store power. If a Jeopardy! answer bundling all three ended with, “all have this silvery-white metal in common,” few viewers at home would fail to blurt out the easy $200 question: What is lithium?

The batteries made with this element have become essential to our lives at work, at leisure, and on the go over the last two decades. And every investor knows that several large companies, such as Tesla and Apple, are dependent on its reliable supply.

Additionally, most investors also know that lithium values soared last year, with spot prices for lithium carbonate (one of the two compounds used in lithium-ion batteries; the other is lithium hydroxide) rising from less than $10,000 per metric ton in 2021 to more than $75,000 by the end of 2022. This spike occurred as inventories dwindled amid supply shortages, but producers soon caught up. Lithium’s value plunged earlier in 2023, partly due to a lull in demand from China, and the stocks of companies in the lithium industry fell with it.

According a May Morningstar report, this hasty selloff has created attractive opportunities for investors looking to fortify their portfolio with a market that’s positioned to surge in the coming years – potentially making 2022’s illustrious peak look like a small bump in the rear-view mirror.

Demand expected to triple by 2030

In the report, entitled “Lithium: Charge Your Portfolio as Stock Selloff Creates Opportunity,” Morningstar Equity Strategist Seth Goldstein, CFA, forecasts that lithium demand is likely to triple from its 2022 levels by 2030:The projected growth of electric vehicles (EVs) is the main driver in Morningstar’s forecast for the rise of lithium demand during the 2020s, with China, Europe and U.S. (in that order) leading the globe in adoption rates. While worldwide sales of EVs were only 8 million units in 2022, Morningstar expects that number to hit 40 million by 2030. And as it’s highly unlikely that any alternative choice in battery technology will take a chunk out of lithium’s dominance of the market (more on that later), virtually all of these cars could be powered by lithium batteries; this underpins Morningstar’s prediction that EV’s will account for two-thirds of total lithium demand by this decade’s end.

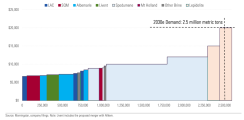

The following graphic from the company’s report (Chart 1) shows the expected climb in demand for lithium through 2030.

Chart 1: Morningstar projects lithium demand to more than triple from 2022 levels to over 2.5 million metric tons by 2030.

Lithium demand by end market in metric tons, 2016-30e

Chart 2, from the Morningstar report, shows the projected growth in power generation from wind and solar through 2030.

Chart 2: The growth in renewable energy usage will drive demand for batteries.

Net global solar and wind power generation capacity additions, 2023-30e

New mining source will raise costs

Meeting the growing global demand for lithium poses challenges, and Morningstar expects to see the metal remain undersupplied worldwide (as it has since 2020) through the decade as sourcing issues remain a pain point. With companies facing production delays as they struggle to obtain adequate supplies of lithium, the industry is turning to costlier methods of sourcing and processing lithium to generate the compounds needed to produce batteries. One prominent example, the Morningstar report notes, is extracting lithium from a specific low-grade hard rock (lepidolite) mined in China.

This additional source has reduced lithium shortages and helped feed hungry production lines since 2021, but Morningstar estimates that it will also raise the all-in marginal cost of producing lithium carbonate from about $12,000 per metric ton today to about $20,000 in 2030. This is another factor that should buoy lithium prices while – given lepidolite is almost exclusively mined in China – also adding to supply uncertainty. The combination should offer significant market rewards to companies that manage these challenges most effectively.

Chart 3, below, shows Morningstar’s estimates for the all-in cost of obtaining lithium carbonate (at forecasted 2030 demand levels) from lepidolite and other sources.

Chart 3: Obtaining lithium from China-based lepidolite will raise the marginal cost of production.

Lithium carbonate cost curve, 2030e, all-in sustaining cost basis

Morningstar’s analysts acknowledge in the report that many market analysts hold a differ view and expect lepidolite and other emerging sources of lithium to create oversupplies of lithium in the near-term – both driving down the element’s values and the profits (and soon, share prices) of companies in the lithium industry. “However, our differentiated view is that enough new supply will encounter delays to keep the market in a deficit, leading to higher prices and profits, driving producer stock valuations higher,” Morningstar writes.

Look for average price of $36,000

As for pricing going forward, Morningstar forecasts that lithium will average over $36,000 per metric ton through 2030 as demand increases and supply challenges persist. This is significantly higher than the market consensus – which sees an average price of $20,000 per metric ton from 2023 to 2030 – so Morningstar’s analysts are decidedly bullish on lithium’s future. For the very near term, they believe average lithium spot prices (per metric ton) will remain around $55,000 through 2024. The report summarizes:

Chart 4 from the May report shows Morningstar’s forecast for lithium spot prices, with volatility in response to swings in the supply and demand balance:

Chart 4: Morningstar forecasts lithium prices to average over $36,000 through 2023.

Lithium carbonate price per metric ton, 2015-30e

Two key stocks: Albemarle and Lithium Americas

As lithium prices fell earlier this year and analysts expressed pessimism, investors quickly jettisoned U.S.-listed lithium producer stocks – causing their vales to drop an average of about 35% from their 52-week highs, Morningstar notes. Their analysts believe “the selloff is an overreaction to a spot price decline that will correct itself throughout the rest of 2023,” and “even with our outlook for lower lithium prices in the coming years versus 2022, the companies under our coverage should still generate strong profits.”

Among the seven U.S. lithium producers it covers, Morningstar spotlighted two companies in particular – Albemarle and Lithium Americas – as especially promising for investors looking to add lithium-exposed stocks to their portfolio. Albemarle (ALB) is a Charlotte-based chemical manufacturing company operating globally, and Lithium Americas (LAC) is a lithium mining and production company headquartered in Vancouver and operating in the USA and Argentina.

While the report details the strengths and risk exposures of both companies, in sum, Morningstar’s analysts believe both stocks are well undervalued and offer different characteristics to fit investor preferences:

Sodium-ion batteries: long-term threat?

As their technologies progress in the coming years, alternatives to lithium batteries may gain a foothold in certain markets. Currently, the Morningstar report explains, the most prominent contender is sodium-ion, which can produce batteries that are cheaper to operate than lithium but also heavier (as they can store far less energy for their density). This makes sodium-ion technology more appealing for large stationary batteries, such as those used in the home and industrial ESS markets – and also a good candidate for some consumer electronic devices where cost is major selling point.

But it means sodium-ion is poorly suited to power EVs, as heaver batteries reduce driving range. This will likely provide lithium with a daunting moat in industry’s most important market, at least against the only competing tech that has progressed beyond the R&D stage. “EV producers will pay up for more energy density and less weight, as this allows them to offer EVs with a suitable range (for example, at least 300 miles),” Morningstar writes. “As a result, we see a low threat of sodium-ion batteries displacing lithium for EVs.”

Further, given lithium batteries currently “hold 90% of the market for ESS batteries and also hold a dominant share of consumer electronics batteries,” according to the report, sodium-ion manufacturers have a lot of work ahead to capture large shares of these segments – although Morningstar emphasizes that this is a clear possibility in looking several years out. And, of course, sudden innovations could bring unforeseen disruption.

But the absence of such shocks, lithium should remain the solid leader in these markets for years to come. And the stocks of lithium-producing companies that are ready to manage the volatile times ahead should be solid adds to institutional portfolios.