In an uncertain world, Asian local currency bonds can anchor portfolios

“Confused about the 2023 economic outlook for the US? You are far from the only one.” Those are the words of renowned fixed-income investor, Mohamed El-Erian who recently advised policymakers and businesses to focus on being as adaptable and flexible as possible in these uncertain times. Arguably, the outlook for the global economy has rarely seemed less sure. The myriad variables that could impact growth and inflation this year include the potential for further geopolitical events that could disrupt global supply chains, possible contagion from the banking crisis in the US, as well as the threat of recession in the US and Europe, to name just a few.

It certainly remains to be seen whether the Federal Reserve and the European Central Bank can reduce inflation without disrupting labour markets, consumer spending and the economy. Financial markets are likely to endure a volatile ride during the remainder of 2023 and possibly beyond as investors seek to navigate conflicting data on inflation and growth.

Parallel worlds: Asia thriving with dynamic growth

Against this background, it’s worth considering the factors that investors can rely on. Growth dynamics in Asia are one of the key considerations. While sticky inflation and recessionary risks are likely to characterise the developed Western economies, Asian economies are decoupling and are expected to enjoy a much more robust economic backdrop. The IMF anticipates that the advanced economies will grow by just 1.3% in 2023 and 1.4% in 2024, yet it sees Asia expanding by 4.6% and 4.4%, respectively, in those same years, powered in part by China’s reopening.1

Many Asian economies also enjoy robust domestic demand, while neighbouring countries are helping to feed this appetite. Domestic demand is a key driver of the Indian, Chinese, and Indonesian economies, for example, while Malaysia, Thailand, South Korea and Singapore benefit from close trade and services ties to the three engines of Asia’s growth. The region’s growing dynamism makes it less susceptible to recession risk from the US.

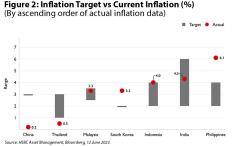

Inflation does not present the same challenge as in the US and Europe. Asian central banks have worked hard to contain inflation, and, in most cases, it is staying within their forecasts. That’s in sharp contrast to the West, where inflation has overshot expectations. In contrast, inflation is expected to remain low and on a falling trajectory in Asia.

Why Asian local-currency bonds?

Asia’s strong economic outlook, both in absolute terms and relative to the rest of the world, should provide support to Asian currencies and local-currency bonds.There are further reasons to diversify into local-currency bonds. These include the tendency of the US dollar to weaken when the rate-hiking cycle in the US is close to completion as risk capital starts to move out of the greenback. A US economic recession also traditionally results in capital moving into non-US dollar currencies, due to fears that the greenback will weaken.

More generally, a trend is also developing where central banks are switching reserves into non-US dollar currencies, while foreign trade is increasingly being accounted for in currencies other than the dollar. This trend may accelerate in the medium term, boosting the appeal of many emerging currencies. In addition, increasing flows of growth-seeking capital are being directed into the dynamic Asian economies, further supporting currency appreciation.

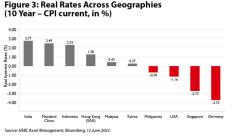

Meanwhile, Asian bond markets provide reasonably high yields. It makes sense to invest in medium- to long-duration bonds in local currencies to exploit the potential for Asian currencies to appreciate, as well as positive carry-trade trends. The real rate of return in Asian local-currency bonds is also much better than in USD bonds (refer to Figure 3 below).

How do Hong Kong dollar bonds fit into the picture

Amongst local currencies apart from the afore-mentioned Asian markets, we also see Hong Kong dollar as an interesting market especially for Hong Kong-based investors. The inclusion of Hong Kong dollar bonds in investment portfolios helps contribute a potential steady income stream in the local currency, which is useful for investors with asset–liability matching (ALM) needs in their balance sheets. For local investors, there is minimal exchange-rate risk as the Hong Kong dollar is pegged to the US dollar. Moreover, the Hong Kong dollar’s outlook is linked to the US Treasury market, which has performed well this year. Hong Kong dollar bonds also incur relatively little credit risk – there is little concern with the Hong Kong government and other bond issuers with high credit ratings in terms of default risk, repayment capability or liquidity.

Finally, apart from single bonds format, local investors can also invest in Hong Kong dollar bonds indirectly through the form of exchange-traded funds (ETFs) on the Hong Kong Stock Exchange in a transparent, convenient, and low-cost manner. To conclude, Asian bonds and currencies offer advantages for investors with broader risk appetites, while for investors who want to focus on opportunities closer home, HK dollar bonds are a high-quality option.

Find out more about HK dollar bonds

1 https://www.imf.org/en/Publications/REO/APAC/Issues/2023/04/11/regional-economic-outlook-for-asia-and-pacific-april-2023 and https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023

Important information

For professional investors and intermediaries only. This document should not be distributed to or relied upon by retail clients/investors.

This document is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management (Hong Kong) Limited (“AMHK”) accepts no liability for any failure to meet such forecast, projection or target. AMHK has based this document on information obtained from sources it reasonably believes to be reliable. However, AMHK does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document and the website have not been reviewed by the Securities and Futures Commission. Copyright © HSBC Global Asset Management (Hong Kong) Limited 2023. All rights reserved. This document is issued by HSBC Global Asset Management (Hong Kong) Limited.