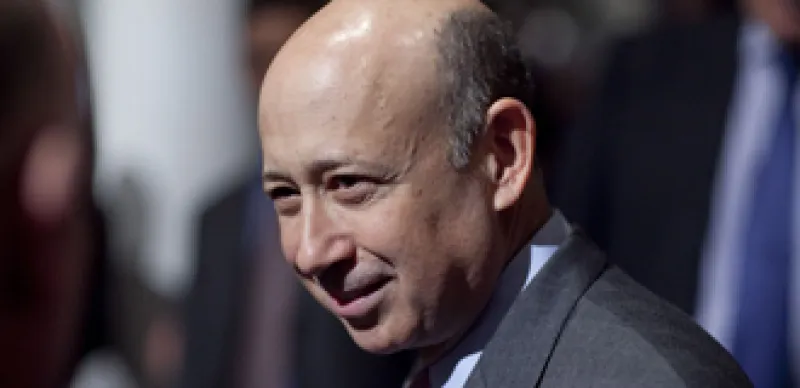

It may have been founded in 1869, but Goldman Sachs Group today is the house that Lloyd built. A man of modest roots (his father was a postal clerk) who began his career as a tax lawyer, of all things, 56-year-old Lloyd Blankfein has overseen the transformation of Goldman from a traditional investment bank focused on client-serving businesses to what many critics and even some fans have termed a hedge fund. During Blankfein’s tenure running day-to-day operations at Goldman (which effectively began when he was named COO in December 2003, three years before becoming chief executive), the firm has demonstrated an uncanny ability to generate huge profits trading its own capital in everything from stocks and bonds to commodities, currencies and derivatives. The success of Goldman has not been lost on its rivals, many of which significantly boosted their own proprietary trading and risk-taking activity during the past decade, though not always with similar results.

During this transformation gobs of money were made, and Wall Street gained a reputation as a giant casino where the traders were winning at the expense of the other poor suckers at the table — clients, shareholders and eventually taxpayers. To make matters worse, when the markets melted down in the fall of 2008 — and Goldman was just one of many banks that might have gone bankrupt without a capital infusion from the Federal Reserve — there was no getting back traders’ fat paychecks. And so journalist Matt Taibbi didn’t so much strike a nerve as ignite the collective synaptic system when in a July 2009 article for Rolling Stone he called Goldman “a great vampire squid wrapped around the face of humanity.” Something had to be done. When President Barack Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act into law last summer, he made it illegal for deposit-taking institutions to engage in proprietary trading. No way was Lloyd Blankfein going to get paid to gamble with mom and pop’s savings, the reasoning in Washington went.

“Congress has spoken,” says Michael Wiseman, managing partner of New York law firm Sullivan & Cromwell’s financial institutions group, which during the 2008–’09 crisis advised almost every major financial services firm, including insurance giant American International Group, Swiss bank UBS and Goldman Sachs. “There is going to be a change in the banking industry.”

Change is sweeping through the global financial services industry. At the same time that lawmakers in Washington were putting the kibosh on proprietary trading, on the other side of the Atlantic the Basel Committee on Banking Supervision agreed to impose stricter capital requirements, raising the minimum common equity that banks must hold to 7 percent under the Basel III accord, which also lifts capital requirements for banks’ trading books to bring them in line with charges for lending activity. The net effect, by most early estimates, is that banks will need to have three times as much capital to support their trading operations as they have today.

The combination of Dodd-Frank and Basel III limits the ability of banks to take risk, though it by no means completely eradicates it. Banks have been lobbying the regulators charged with enforcing Dodd-Frank, hoping for a lighter interpretation of the rules. At the same time, they have begun to prepare for the worst, reorganizing and repositioning toward less risky, more client-oriented businesses like asset management and investment banking. Analysts expect the changes to result in lower returns on equity, at least in the short term. Although the Blankfein model was great for traders and bank senior management — which increasingly came to be one and the same — it came with greater volatility, high compensation ratios and low stock valuations. By reversing those detrimental effects, the prohibition against proprietary trading could in the long run be better for banks, and for their shareholders.

There is now almost universal agreement that risk, if not exactly bad, is significantly more complicated and daunting than most realized before the crisis — something that bank management, as well as regulators and investors, might want to remember. The hope that lies at the heart of the new reforms is that if essential banking institutions are prevented from making the types of big bets that became prevalent in the past decade, the whole system will be safer. The danger, of course, is that by limiting the ability of banks to diversify their businesses, lawmakers and regulators are creating concentration risk. If a bank is engaged in fewer businesses, a big problem in any one of them could have a profound impact.

For sure, proprietary trading didn’t cause the banking collapse. The two banks that failed, Bear Stearns Cos. and Lehman Brothers Holdings, did so because they had weighed down their overleveraged balance sheets with bad mortgage debt. But many think the risk-taking culture that had taken over banking in the preceding decade was to blame. In the aftermath of the economic collapse, policymakers on Capitol Hill and in the White House increasingly came to view proprietary trading as a big part of that culture. And they sought the counsel of former Federal Reserve chairman Paul Volcker.

At 6-foot-7, the 83-year-old Volcker is an imposing Cassandra. For decades few people listened as he fought deregulation and worried about banks’ risky activities. But in November 2008, as the financial crisis was gaining velocity, his voice got a boost when then-president-elect Obama appointed him chairman of the newly created Economic Recovery Advisory Board. Volcker’s views found their way into the regulatory reform package through the backing of the White House and a bill co-sponsored by Democratic Senators Carl Levin of Michigan and Jeff Merkley of Oregon. Section 619 of the 2,300-page Dodd-Frank Act, better known as the Volcker rule, prohibits deposit-taking banks from engaging in short-term proprietary trading. It also sets strict limits on how much banks can invest in hedge funds and private equity: just 3 percent of a fund’s assets.

But the former Fed chairman’s triumph could be short-lived. The key will be how regulators interpret the Volcker rule. The Financial Stability Oversight Council, which was established by Dodd-Frank, was tasked with studying how regulators should implement the rule. Depending on what the FSOC finds, the Fed, the Commodity Futures Trading Commission, the Federal Deposit Insurance Corp., the Securities and Exchange Commission and other regulators charged with enforcing the new rules could decide that almost all of what banks were doing in proprietary trading can continue under the guise of market making or risk management — and this would be a blow to Volcker’s attempt to lessen risk in the banking system.

Regardless of what happens, no one thinks this is the end of risk-taking. “You will always have speculation,” says Joseph Schenk, CEO of First New York Securities and former CFO of boutique investment bank Jefferies & Co. “The question is, what is the most appropriate venue?” Should it be deposit-taking institutions or hedge funds and proprietary trading firms like First New York, which currently trades its partners’ own capital and is planning to open its doors to outside money next year?

The exodus has begun. In late September news broke that George (Beau) Taylor was leaving his position as global head of commodities trading at Credit Suisse to form his own hedge fund with seed money from New York–based alternative-investment firm Blackstone Group. A month later there was a good deal of excitement when Kohlberg Kravis Roberts & Co. hired a team of nine traders from Goldman’s principal strategies group to set up a new hedge fund unit for the private equity firm. People familiar with what happened say Goldman has been keen to make a bold statement to show its willingness to break up its proprietary trading business and get out of the regulatory crosshairs.

Behind the scenes, however, Goldman and other banks have been lobbying hard for a liberal interpretation of the Volcker rule. The stakes are huge. In recent years, Wall Street firms have gotten as much as 20 percent of their revenues from proprietary trading. No wonder that during the first six months of 2010 Goldman spent $3.5 million on lobbying, according to the Center for Responsive Politics in Washington.

In the past, banks generally have not broken out proprietary trading when reporting their financial results, and this has made it difficult to determine exactly how meaningful the business has been. Still, it’s clear that trading (including both market making and principal investing) has come to dominate revenue at the big banks. In 1999, the year Goldman went public, its revenues were split relatively evenly among its three main businesses: Investment banking accounted for $4.4 billion, trading and principal investing for $5.8 billion and asset management for $3.2 billion. In 2007, Goldman made $7.56 billion from investment banking, $31.23 billion from trading and principal investments and $7.22 billion from asset management and securitization services. This is why Blankfein and his traders ruled Wall Street.

Few if any analysts have a better understanding of Wall Street than Charles (Brad) Hintz, who was a former treasurer of Morgan Stanley and Lehman Brothers’ CFO before moving to Sanford C. Bernstein & Co. in 2001 to cover the securities and asset management industries. In November, Hintz, a perennially top-ranked analyst on Institutional Investor’s All-America Research Team, published a detailed report on the impact of Dodd-Frank and Basel III on trading. By his reckoning, the business will become meaningfully less profitable, but he says banks will regroup by moving balance-sheet assets and resources to other, more lucrative areas, such as emerging-markets debt and equity and sovereign bonds. To make up for some of the lost revenue, banks will start charging clients more to borrow. At the same time, they are lowering their compensation ratios from their recently high level of 50 percent. If banks take these steps, Hintz says, they can make up for the lost revenue from proprietary trading and other activities that have been restricted by Dodd-Frank, such as over-the-counter derivatives trading.

As merger and acquisition activity picks up, investment banking will once again be a meaningful contributor to the bottom line. Meanwhile, asset and wealth management are starting to look appealing. It is not a coincidence that JPMorgan Chase & Co. CEO Jamie Dimon appointed Jes Staley, previously the head of asset management, to run JPMorgan’s investment bank and that Morgan Stanley’s board selected James Gorman, former head of the global private client business at Merrill Lynch & Co., as its CEO a year ago, replacing John Mack (who stayed on as chairman).

Jane Gladstone, head of the financial services advisory practice at boutique investment bank Evercore Partners in New York, warns that asset management might not be as effective a solution as bank executives currently hope. She says they will find it difficult to compete against large independent asset managers like BlackRock and Fidelity Investments. “Asset managers are a wonderful business, but the banks just might not be the best sole owner of them,” she says.

There are those who think the Volcker rule and all the regulatory reform measures being taken in the U.S. and Europe have not gone far enough to curb banks’ risky behavior. “We just had one of the biggest credit bubbles known to mankind, and Washington is hesitant to regulate the industry,” says Richard Bernstein, founder and CEO of New York–based investment firm Richard Bernstein Advisors and a former chief investment strategist at Merrill Lynch. “How do you have to bail out an industry and Washington is hesitant to regulate it? I don’t understand that at all. You would think that they would regulate these people like there is no tomorrow.”

Many anticipate that banks will find a way around the proprietary trading restrictions. “The Volcker rule makes an effective statement about how the industry should behave, and it gives an additional key to the regulators in pursuing actions, but I think the end result will be much narrower in scope than originally devised,” says Michael Mayo, a New York–based analyst at CLSA, a unit of Crédit Agricole Securities.

One of the most outspoken critics of the banks and their recent behavior, Mayo is a big fan of Volcker. The former Fed chairman is a personal hero of Mayo’s for his willingness to say and do what is politically unpalatable but economically necessary. But Mayo is skeptical about how the Volcker rule, along with the whole regulatory reform package, will work in practice. “Merely because Dodd-Frank is 2,300 pages doesn’t necessarily mean the industry will be more appropriate in its behavior,” he says. “Dodd-Frank could have been 23,000 pages and it wouldn’t make any difference, because the industry will always be one step ahead in managing around regulations.”

In the current climate banks are downplaying the importance of speculation to their bottom lines. It took an incredible moment of amnesia for Citigroup CEO Vikram Pandit to tell Congress back in March that “my perspective is that proprietary trading is not a meaningful part of what we do as a bank. I don’t think banks should be using capital to speculate.”

While at Morgan Stanley in 2005, Pandit had been keen to take on more risk with that firm’s balance sheet. During the past decade Citi itself had some extremely significant proprietary trading units, including Westport, Connecticut–based commodities business Phibro. So important was Phibro to Citi’s bottom line that its head, Andrew Hall, received a 2009 pay package of $100 million. The reason Phibro is no longer a part of Citi is that the bank, after its U.S. government bailout, could no longer honor Hall’s contract and was forced to sell the unit.

DURING THE FEBRUARY SENATE Banking Committee hearings on the rule that bears his name, Volcker got a surprising ally in the form of an old foe: John Reed. The ex-CEO of Citi, now retired, was unstinting in his view that proprietary trading and the culture it fosters should have no place at a commercial bank. “It’s not that I feel these functions shouldn’t exist,” he told Congress. “I would simply separate them from institutions that are the deposit takers and basically the traditional lenders for much of the economy.”

Although during his tenure in the 1990s as CEO of Citicorp Reed was not actively involved in lobbying Washington, by virtue of his job he was associated with the movement that, at least to Volcker’s way of thinking, contributed to the whole problem in the first place. That decade a group of high-level Wall Street executives lobbied for the repeal of the Glass-Steagall Act, the 1932 law that separated commercial and investment banking. In 1998, Reed sold what was already the U.S.’s biggest bank to Sanford Weill’s Travelers Group to form behemoth Citigroup, correctly betting that Glass-Steagall would soon be repealed.

Travelers owned investment banking firm Salomon Brothers, which Weill had acquired in 1997 and merged with his Smith Barney business. Salomon had been known for its particularly aggressive proprietary traders, immortalized in the Wall Street classic Liar’s Poker. In that book, author Michael Lewis recounts his time at Salomon in the 1980s, when John Meriwether and his band of fixed-income arbitrageurs ruled. In 1993, following a Treasury bond pricing scandal, Meriwether and his team resigned from Salomon and founded hedge fund firm Long-Term Capital Management.

For four years, LTCM (which included Nobel Prize–winning economists Robert Merton and Myron Scholes) prospered. But in August 1998 its highly leveraged portfolio fell 44 percent after Russia defaulted on its sovereign debt, and it had to be bailed out by a consortium of 14 big banks and Wall Street firms brought together by the Federal Reserve Bank of New York to avoid a complete market meltdown.

Volcker, then chairman of the New York investment bank J. Rothschild, Wolfensohn & Co., had been vigorously opposed to the repeal of Glass-Steagall. The LTCM debacle was precisely the type of systemic crisis he had feared, and in its wake he continued to lobby hard for maintaining the separation between deposit-taking institutions and investment banks. But the forces for deregulation, including then–Treasury secretary Robert Rubin and his deputy and successor, Lawrence Summers, won the day: In November 1999, Glass-Steagall was repealed.

“The financial sector lost its way,” says investment adviser Bernstein, who has long opposed the repeal of Glass-Steagall, even when he was at Merrill Lynch. “It is no longer fulfilling its major role: to aid the capital formation process.”

During the past decade banks weren’t just using their balance sheets for proprietary trading; they were also using them to make private equity investments and hold inventories of syndicated loans. In a low-interest-rate environment, where spreads were narrow and commissions continued to fall, banks understood that they could make more money investing and trading their own capital than lending it out. At the time, everything seemed to make a lot of sense.

“Because of the confidence in them, banks and investment banks had extremely good access to low-cost funding, so they were able to run extremely high leverage ratios,” explains Michael Litt, chief investment officer of Darien, Connecticut–based hedge fund Arrowhawk Capital Partners.

According to Bernstein’s Hintz, in 2000, Goldman Sachs had a leverage ratio of 17.2 times, meaning that the firm’s assets were 17.2 times its capital base. That same year, Merrill Lynch had leverage of 22.7 times and Morgan Stanley, 21.9. By the first quarter of 2008, Goldman’s leverage ratio had jumped to 27.9 times, Merrill’s to 28.5 and Morgan Stanley’s to 32.8. Although much of the capital went toward placing securitized loans and making principal investments, an increasingly significant percentage went to proprietary trading, particularly in fixed income, currencies and commodities, better known as FICC.

“Because of banks’ market making, they had a potential advantage in the effectiveness of their proprietary trading,” says Litt, explaining the attraction of the business.

One of the unintended consequences of repealing Glass-Steagall was to put trading on steroids. “You asked me why trading exploded,” says former Citicorp CEO Reed, 71, in an interview with Institutional Investor. “Profit.” But, says Reed, the short-term bonus-driven mentality of a trading institution is very different from that of a banking institution. “An aggressive trading culture is very difficult to control within the context of a bank,” he says. “That is why culturally it’s important to keep proprietary trading separate from the commercial banks.”

In 1981, Goldman Sachs acquired commodities broker J. Aron & Co., where Blankfein had recently started working as a gold trader. The deal propelled Goldman into the commodities business. By the mid-2000s, FICC trading had become an important profit center, not just at Goldman but at all of the major banks. One indication of just how much Wall Street had come to rely on proprietary trading is the change in value at risk, or VaR, which measures how much a bank can lose in any given day. Between 1999 and 2009, Goldman’s VaR skyrocketed nearly 800 percent, from $25 million to $218 million. Citigroup’s trading VaR jumped from $52 million in 2000, the year Reed retired, to $319 million in 2008. The trading VaR of Deutsche Bank, which has long had a deep bench of proprietary traders, tripled between 2002 and 2008, from €42.4 million (then worth $43.2 million) to €122 million ($164.1 million). (Deutsche exited proprietary trading at the end of 2008.)

Proprietary trading comes in two forms. There are pure proprietary trading units, which have no client-facing responsibilities and operate completely separate from the rest of their institutions; teams like this include the quantitative-based QT group at Goldman Sachs and the Process Driven Trading unit at Morgan Stanley. Then there is the proprietary trading that takes place within client businesses as part of their market-making function; many asset-backed-trading desks on Wall Street fall into this category. Banks argue that this second type performs a valuable function and should be allowed to continue.

The proximity of client and principal businesses is one of the reasons proprietary trading has been vilified in some corners. The concern — and it is a legitimate one — is that proprietary traders will use the information about client orders to trade in front of them, benefiting themselves at a cost to clients. In March 2004, London-based Deutsche Bank broker-dealer subsidiary Morgan Grenfell & Co. was fined £190,000 ($343,900) by the U.K.’s Financial Services Authority for front-running clients by trading in seven stocks (including Euromoney Institutional Investor majority owner Daily Mail and General Trust). That decision spurred a debate over the question of how banks should balance the relationship between client and proprietary businesses and added to the growing sense that they might not always be acting in the best interest of clients.

Meanwhile, proprietary traders were deciding that they would like some clients of their own; they hoped to make more money by trading off a larger capital base. In 2004, Citigroup turned its successful proprietary trading unit, Tribeca, originally Travelers’ bond arbitrage desk, into a client-facing business, using $100 million of Citi’s own capital to fund it. The next year, UBS spun out a team from its fixed-income proprietary trading unit to form Dillon Reed Asset Management.

Not everyone on Wall Street believed that investment banks should operate like Goldman. But bucking the trend could be a career-altering decision, as Philip Purcell found out. Purcell, a onetime McKinsey & Co. consultant, became CEO of Morgan Stanley following its 1997 merger with his company, brokerage firm Dean Witter Reynolds. Although earnings increased under Purcell, by the middle of the next decade some senior management members, as well as some former Morgan Stanley executives, felt he lacked strategic vision; they also wanted the firm to make more-aggressive use of its balance sheet.

Matters came to a head in June 2005. Vikram Pandit, who then was running investment banking at the firm, refused to back Purcell when a powerful group of eight former Morgan Stanley executives began calling for the CEO’s dismissal. Pandit and his loyal cohort, John Havens, promptly left the firm and formed their own hedge fund, Old Lane Partners (later acquired by Citi for $800 million). Purcell resigned and was replaced by former CEO Mack — just in time to ramp up Morgan Stanley’s proprietary risk in its fixed-income trading division, which led in late 2007 to $9.6 billion in write-downs on large mortgage-related losses.

THE WHITE HOUSE chose to make its announcement proposing the Volcker rule on the morning of January 21, 2010, at the same time that Goldman Sachs was holding its fourth-quarter earnings call with analysts and investors. In the past, Goldman executives had declined to talk in specifics about proprietary trading because the firm didn’t break it out from its other businesses, but now that the practice was being banned, Goldman had more reason to address it. This was not lost on CLSA analyst Mayo, who had also been listening to the White House press conference.

What percentage of your business, he inquired of Goldman CFO David Viniar, is proprietary trading?

“If you take our pure, walled-off prop business that has nothing to do with clients, you are talking about a number that probably in most years is 10-ish type of percent, plus or minus a few percent,” Viniar responded.

“So 10 percent of the total revenues?” Mayo asked.

“In that range,” Viniar conceded.

Viniar very deliberately spoke only about walled-off trading. If proprietary trading desks with a client-related function were also included, that 10 percent figure would be much higher, probably 20 percent or more for Goldman, according to some estimates. Hintz believes that walled-off proprietary trading accounts, on average, for 10 to 15 percent of banks’ total sales and trading revenue. The loss of that revenue, combined with reduced profits from OTC derivatives trading — the bulk of which will now be cleared and settled by central clearinghouses as a result of Dodd-Frank — will lead to a roughly 280-basis-point drop in pretax profit margins for aggregate sales and trading, Hintz predicts.

But the real kicker is the change in leverage. Hintz estimates that regulatory reforms will limit banks’ gross leverage ratios to 15 times capital. Based on historical returns, he reckons those changes should reduce the return on equity of trading units by 45 to 50 percent, pushing the ROE of sales and trading below banks’ cost of capital. In other words, the broker-dealer part of the business will no longer be profitable.

“Fundamentally, our analysis certainly indicates that it is going to be very difficult for any major capital markets player to generate returns substantially above its cost of capital in its trading book,” says Hintz.

All this, of course, means less money. Kevin Conn, an investment officer and financial services sector portfolio manager with $204 billion, Boston-based MFS Investment Management, says banks will see their ROE drop from 15 to 16 percent to about 13 percent. Other investors are more negative, believing that ROE could fall to 9 percent or lower. But Conn anticipates some positives too: The move out of the volatile business of proprietary trading will likely improve stock valuations.

“Investors like certainty; they like consistent, stable growth models,” Conn says. “Reform is going to create lower return on equity and much less volatility. And investors will be willing to pay a higher price-to-earnings multiple.”

Conn is more concerned that U.S. banks might become less competitive globally if foreign-domiciled banks are not subject to the same regulatory restrictions. Unlike non-U.S. financial institutions, U.S. banks are subject to the Volcker rule wherever they operate. “U.S. banks will be regulated by U.S. regulators no matter what,” says Sullivan & Cromwell’s Wiseman.

U.S. banks have always had an uncanny ability to find ways to make money. Hintz anticipates that under Dodd-Frank and Basel III, banks will have to become more efficient in how they deploy their capital. In his November research report, he argued that after letting some of their more regulatory-sensitive businesses run off and “throttling back” on securitization — moves that will achieve a 10 percent permanent improvement in regulatory capital efficiency — “the balance sheet optimization will begin.”

To Hintz’s mind, the “new optimal” balance sheet of Wall Street will include a large sovereign debt book, bigger portions of emerging-markets equity and debt, and much smaller commitments to low-margin business like money markets, preferred stock, developed market equities and investment-grade corporate bonds. By optimizing their balance sheets, Hintz estimates, bank trading units can increase their revenue yield on net assets by 10 to 15 percent.

With banks unwilling to commit capital to low-margin businesses, spreads will widen. That will pose a problem for borrowers, but one of the issues that caused the credit crisis was banks’ willingness to park so much debt on their highly leveraged balance sheets. “Regulators don’t want the banks, through their ability to leverage their balance sheets, to determine the price of risk assets,” says Arrowhawk Capital’s Litt.

One thing is clear: Wall Street compensation will go down. “There will never be another $50 million guy at a bank,” says First New York CEO Schenk, referring to the legion of traders who took home eight-figure bonuses during the past decade. Many anticipate that Goldman will find a way to be the exception, but not institutions like Citi or Bank of America Corp., which acquired Merrill Lynch at the height of the crisis.

As the banks reorganize their broker-dealer operations and sell off inventory, their other business lines will begin to play a more prominent role. Investment banking is already coming back. Goldman Sachs made $1.2 billion from investment banking in the third quarter of 2010. Its broker-dealer business still makes more — $6.38 billion in the third quarter — but while sales and trading net revenues were down 36 percent from the third quarter of 2009, the investment bank’s net revenues improved by 24 percent. For the first nine months of 2010, Goldman ranked No. 1 in worldwide completed and announced mergers and acquisitions, according to Dealogic, as well as in common stock offerings, according to Thomson Reuters.

Many banks are turning to asset management to make up for some of the lost revenue from proprietary trading. The appeal is obvious: The business boasts a steady revenue stream and, in the case of alternative investments like hedge funds and private equity, high fees. Although Morgan Stanley recently sold hedge fund firm FrontPoint Partners, JPMorgan’s Dimon has made it clear he intends to keep his bank’s hedge fund business, Highbridge Capital Management. Goldman, meanwhile, is keen to build Goldman Sachs Asset Management, which manages $677 billion, to a size that will rival $1.3 trillion Pacific Investment Management Co. and $3.45 trillion BlackRock. In a sign of how much asset management’s standing at banks has already changed, GSAM’s net revenue for the third quarter of 2010 was $1.4 billion — more than the net revenue of Goldman’s investment bank.

There is no guarantee that banks’ love of asset management will be reciprocated. “It’s a tactical solution,” warns CLSA’s Mayo of the move to build asset management. “Don’t confuse a tactical solution with an effective strategy. As a general rule, the pure players are in a league of their own versus the bank-owned asset management businesses. And if you haven’t run your asset management business well up until this point, why are you going to start running it better now?”

In the aftermath of the Volcker rule, at least one bank, JPMorgan, has moved proprietary traders into asset management. The hope is that these traders will be able to raise outside funds; under the Volcker rule there is a limit to how much the banks can stake them. But Ilana Weinstein, CEO of New York–based executive recruitment firm IDW Group, who works with top hedge funds and bank trading desks, doubts the move will last. “It’s only a temporary fix,” she says.

Traders who successfully make the transition eventually will most likely branch out on their own or join outside hedge funds, where the economics are more attractive. Those who fail to raise funds will either move back into the friendly confines of the broker-dealer or drop out of the industry entirely.

For its part, Goldman began moving proprietary traders into asset management in 2007. Blankfein’s firm and Wall Street may be better for the changes under way, but only when the next financial crisis arrives will lawmakers and regulators know for sure if their new banking system is any safer.