Although a growing number of hedge fund managers are buying up professional sports team, they are not shunning their traditionally favorite collectible—art.

Nine of the top 200 art collectors in the world are hedge fund managers, according to the annual ranking by ARTNews. For the tenth year in a row, SAC Capital Advisors’s Steve Cohen is ranked among the top 10 art collectors, the only hedge fund manager in the upper ranks this year, according to the annual survey by ArtNews. He and his wife Alexandra are known for collecting impressionist, modern and contemporary art.

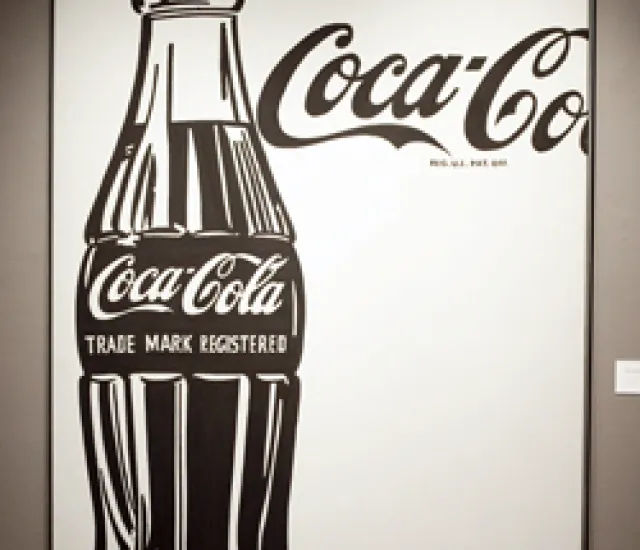

Last year Cohen paid about $110 million for one of Jasper Johns’ 'Flag' paintings. He also reportedly bought Andy Warhol's Coca-Cola painting for $35.4 million. He also shelled out about $300,000 for a world map made of tin cans and more than $180,000 for Tim Hawkinson’s 'Bike,' a work of collaged inkjet prints, according to The Wall Street Journal. Cohen also reportedly sold one of his first and rarest pieces of art — an Édouard Manet self-portrait. It wound up going for $33.2 million, toward the bottom of the anticipated range of $30.1 million to $45.2 million. And earlier this year, Cohen reportedly sold his Andy Warhol portrait of Elizabeth Taylor for slightly less than $27 million.

The other hedge fund managers among the top 200 art collectors this year include:

Centaurus Energy’s John Arnold and his wife, Laura, who is said to favor impressionism and postwar and contemporary art. The Houston-based former Enron energy trader and natural gas expert in 2010 lost money for the first time since he launched his $5 billion hedge fund eight years ago, finishing the year down 3.27 percent. His previous worst year was in 2009, when he was up 'only' 29.2 percent. He surged 50 percent in each of the two prior years, however.

Highbridge Capital Management’s Glenn Dubin favors modern and contemporary art, according to ARTNews. Dubin co-founded Highbridge with boyhood pal Henry Swieca in 1992. The hedge fund firm was sold a few years ago to JPMorgan Chase and Swieca subsequently retired. However, Dubin is still very active running Highbridge, which had $26 billion under management at year-end, up about 40 percent from the prior year. JPMorgan altogether managed $54.2 billion in hedge funds at year-end, making it the second largest hedge fund firm in the world behind Bridgewater Associates.

Level Global’s David Ganek and his wife, Danielle, were cited for their collection of contemporary art and photography. The former SAC trader’s hedge fund firm earlier this year agreed to pay more than $3.2 million in disgorgement, prejudgment interest and a civil penalty to settle civil charges for violating a Securities and Exchange Commission rule prohibiting short selling of stock during a restricted period prior to a public offering and then purchasing the same securities in the offering. In February Level Global announced plans to wind down its operations and fully liquidate its funds’ portfolios. It had been raided by Federal investigators last November as part of a widespread probe into insider trading. Level Global was co-founded in 2003 by Ganek and another former SAC employee, Anthony Chiasson. At year-end 2010, Level Global had $3.7 billion of assets under management in its Level Global Overseas Master Fund and Level Radar Master Fund.

GLG Partners’ Noam Gottesman was singled out for his collection of postwar and contemporary art. Several years ago, Gottesman reportedly owned works by artists Francis Bacon and Lucian Freud. He also helped bankroll the Tate Gallery’s purchase of two works by sculpture artist Rachel Whiteread. Gottesman, Pierre LaGrange and Jonathan Green founded GLG in 1995 as a division of Lehman International. Israeli-born Gottesman and his two co-founders spun off the company in 2000. In 2007 London-based GLG went public through a reverse acquisition transaction with Freedom Acquisition Holdings, a shell company that was trading on the American Stock Exchange. The combined company was renamed GLG Partners. Last year, London-based Man Group acquired GLG.

GLG co-founder Pierre Lagrange and his wife, Catherine, prefer postwar and contemporary art. The Belgian, who in the past has been photographed wearing long hair, reportedly is opening his European equities hedge fund to retail investors.

Citadel’s Kenneth Griffin and his hedge fund wife Anne Dias are partial to impressionism and Post-Impressionism art, according to the report. Several years ago, the Griffins — who were formerly regulars on ARTNews’ top-10 list--bought 'False Start,' a 1959 work by Jasper Johns, for $80 million. The Chicago-based couple also gave $19 million to The Art Institute of Chicago, which in turn named its Modern Wing, the “Kenneth and Anne Griffin Court.” It houses the museum’s modern, contemporary, and architecture and design collections. The Griffins also gave $500,000 to support the May 2007 exhibition, Jasper Johns: Gray.

ThirdPoint's Daniel Loeb and wife Margaret Munzer Loeb prefer postwar and contemporary art as well as feminist art. Loeb is best known for his scathing, vitriolic attacks on managements he deems to be doing lousy jobs. However, his activism is generally reserved for a small portion of his portfolio. Loeb is more of an eclectic opportunist, sometimes called a special situations investor. Whatever you call him, he had one of the better years in 2010 among hedge fund managers, racking up returns of 33.7 percent in the Third Point Offshore Fund, 38 percent in his Ultra fund and 41.5 percent in the Partners fund. This year Third Point Offshore Fund was up 6.8 percent through June.

GoldenTree Asset Management’s Steve Tananbaum and his wife Lisa are partial to postwar and contemporary art. Tananbaum, managing partner and chief investment officer, founded the firm in 2000. Today it has $13.7 billion under management, including $7.4 billion in hedge fund assets.