By Marlene Hassine Konqui and Jean Baptiste Berthon

Despite suggestions that active managers would enjoy the new higher volatility regime this year, the signs are that alpha generation has already deteriorated. So, what’s next?

Since the February correction, stocks in all regions have started moving in sync as investors focused on trade and geopolitical concerns, a potential peak in the economic cycle and worries about the pace of reforms in Europe and Japan. As a result, company fundamentals and the information advantage became less central to returns.

As well as increasingly moving in the same direction at the same time, stock dispersion – a measure of the difference between individual stock and index returns – is also narrowing, again hampering active managers. The exceptions are the emerging markets, where elevated commodity prices, a healthier economic pulse and relatively easy financial conditions should still support alpha generators.

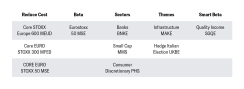

How to Blend Active and Passive Funds Over the Next Few Months

When it comes to choosing the right investment vehicle for a given market, we believe the optimal portfolio would currently look like this:

Relevant ETFs

The World of Alpha Today

Based on our research, here’s where we believe to be the alpha hits and misses in the coming months.

Europe: Q1 Outperformers = 58%

Europe is at an earlier stage in the cycle, so a wide range of stocks still offer upside potential given greater capex, operational leverage and other catalysts – especially if politics don’t prove as problematic as feared. Theoretically then, alpha conditions are favourable. For now, however, the political backdrop is deterring investors (as it impedes reform) as are euro appreciation and peaking economic growth. The latest earnings season was decent, but unimpressive.

Europe verdict: MISS! We’re not sure alpha potential will be realised as we move into the summer months

Relevant ETFs

US: Q1 Outperformers = 19%

As it did in the rest of the world, February’s correction spurred a recorrelation across US stocks and sectors. We believe it could last. Meanwhile, a transitory rise in dispersion will not create meaningfully higher alpha generation potential. However, there could be some opportunity among stocks sensitive to strong themes including tax reform, wage growth, or the energy revival. Earnings results have been robust, yet investors appear to be focusing more on warning signs of a possible peak in earnings – to the extent that positive surprises have been shrugged off and disappointments dealt with more severely. Returns following earnings announcements were primarily driven by sector and broader market moves rather than company idiosyncrasies.

US verdict: MISS! Alpha conditions are no better than they were in Q1.

Relevant ETFs

Japan: Q1 Outperformers = 31%

Conditions for alpha generators in Japan are similar to those in Europe. The potential appears significant with a number of themes at play including tax reform, the implementation of Abe’s “third arrow” (reforming corporate governance structures) and greater spending on defence. Yet, political risks are catching up with the leadership, which could make the implementation of reforms and constitutional changes more challenging. Broader market sentiment and yen gyrations will continue to dominate in our view.

Japan verdict: MISS! Potential also disguises reality in Japan. We expect little improvement as we move into summer.

Relevant ETFs

Emerging Markets: Q1 Outperformers = 33%

It’s true monetary normalisation and peaking economic growth in the developed world is weakening some of the external support for EM markets, but various local factors are beginning to prompt greater divergence between stocks and augment existing alpha potential. Equity correlations are also substantially lower. Right now, slowing in China, trade concerns, and tech are central to the prospects for Asian countries and their companies. Meanwhile, elections in Venezuela, Brazil and Mexico, and progress in NAFTA talks should drive Latin American markets. The situation in the Middle East, any renewal of the standoff between the US and Russia, and the pace of European growth will dominate in EMEA.

EM Verdict: HIT! The alpha environment is improving in emerging markets.

Relevant ETFs

Marlene Hassine Konqui is Head of ETF Research at Lyxor, and Jean Baptiste Berthon is a Senior Cross Asset Strategist at Lyxor.

THIS DOCUMENT IS DIRECTED AT PROFESSIONAL INVESTORS ONLY

This document is for the exclusive use of investors acting on their own account and categorised either as “Eligible Counterparties” or “Professional Clients” within the meaning of Markets In Financial Instruments Directive 2004/39/EC.

This document is of a commercial nature and not of a regulatory nature. This document does not constitute an offer, or an invitation to make an offer, from Société Générale, Lyxor International Asset Management or any of their respective affiliates or subsidiaries to purchase or sell the product referred to herein.

We recommend to investors who wish to obtain further information on their tax status that they seek assistance from their tax advisor. The attention of the investor is drawn to the fact that the net asset value stated in this document (as the case may be) cannot be used as a basis for subscriptions and/or redemptions. The market information displayed in this document is based on data at a given moment and may change from time to time. The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results. This also applies to historical market data. The potential return may be reduced by the effect of commissions, fees, taxes or other charges borne by the investor.

Lyxor International Asset Management (Lyxor ETF), société par actions simplifiée having its registered office at Tours Société Générale, 17 cours Valmy, 92800 Puteaux (France), 418 862 215 RCS Nanterre, is authorized and regulated by the Autorité des Marchés Financiers (AMF) under the UCITS Directive and the AIFM Directive (2011/31/EU). Lyxor ETF is represented in the UK by Lyxor Asset Management UK LLP, which is authorised and regulated by the Financial Conduct Authority in the UK under Registration Number 435658.

Lyxor International Asset Management (“LIAM”) or its employees may have or maintain business relationships with companies covered in its research reports. As a result, investors should be aware that LIAM and its employees may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.