With concerns around global trade wars piling up in an atmosphere of general geopolitical upheaval, and fears of an inevitable end of a historic bull run, uncertainty and volatility are the watchwords these days. As a result, investors are eyeing up alternative investments as a way to diversify their portfolios, seize opportunities, and hedge against unknown eventualities.

In this context, infrastructure is looking more and more like the most versatile player in an investors potential lineup: it can add a defensive element to a portfolio, provide predictable cash flows and capital appreciation, along with diversification, and comes with a sense of ownership that can be reassuring during turbulence, says Erika Gucfa, Investment Director, Private Markets, Aberdeen Standard Investments.

“People sometimes think about infrastructure as a defensive play within their portfolio because it tends to be less volatile than equities over time and it tends to have a stable yield,” she says. “There are predictable cash flows with infrastructure, which can be inflation linked for the duration of long-term contracts.”

Long live infrastructure

Infrastructure assets are often long-lived, which adds capital appreciation to the list of why it is worthy of consideration as an alternative investment. “There’s a high barrier to entry. For example, there are a very limited number of bridges that can be built – the average asset lifecycle for that asset is 50-100 years and competition for ownership is fierce. That drives up the value of those assets,” says Gucfa.

Based on the limited number of assets and the amount of capital that’s pursuing them, there is currently a whet appetite for infrastructure among institutional investors. The low correlation with traditional asset classes and low volatility provide stability and diversification in a portfolio, as well as a tactile sense of ownership.

“Investors like things that they can see, touch, and feel,” Gucfa says. “They like being able to say, ‘We’re invested in a dam,’ or ‘We are behind a water purification system.’ Those are things that investors like to be a part of – something tangible.”

PwC estimates that between $27 trillion and $29 trillion will be spent on infrastructure globally between 2016 and 2020. Some of that amount will be directed to sectors that are typically associated with infrastructure – transportation, utilities, energy, communication and the like – in greenfield (new) and brownfield (existing) projects. Other investments will focus on social infrastructure, which generally speaking includes the above, but also incorporates facilities that support social services, including hospitals, schools, and community housing.

In most cases, the public sector is responsible for social infrastructure, which can make financing a challenge. This has led to the rise in public private partnerships (often referred to as P3s), a win-win strategy for the public and investors.

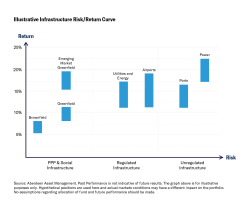

“At Aberdeen Standard Investments we actually cover various types of infrastructure in one way or another, be it through public private partnerships in concessions infrastructure, through core and core plus investments in regulated assets, through debt, through real estate, or through numerous approaches within energy and resources,” says Gucfa. “If an investor is looking for a yield play, core/core+ brownfield assets are a good option. Others seek capital appreciation by investing in midstream energy or social infrastructure in developing economies; infrastructure can act as a diversifier within a total portfolio context or within its own right on a sector by sector basis. We are able to tap into each of the ranges or sectors within infrastructure or hard assets in a variety of ways.”

Evolution and innovation

Infrastructure is a broad term that covers a lot of ground, literally. During April, for example, the Swedish government opened up a section of road on the outskirts of Stockholm that charges electric vehicles as they motor along. The system was originally conceived to charge heavy trucking, but it will be adapted for cars and buses in the future.

Innovation is also behind a widening definition of what constitutes an infrastructure investment, and the nature of infrastructure projects themselves. “There are exciting industrial advances that many wouldn’t expect to find in the asset class when considering basic building blocks of society,” says Gucfa. “But the applications of evolving technology are having a real effect on infrastructure. For example, in considering the design of a road system, it is possible to create a road in a virtual world and determine how varying volumes of traffic would better flow if the design is tweaked.”

Other ways that innovation is making the design and construction of infrastructure more efficient include 3D printing on construction sites to create replacement parts for equipment, limiting down time caused by mechanical failure; the use of drones to gain a more cost efficient bird’s eye view of a project while it’s underway, or scouting for locations in potentially hazardous areas; and smart grids, which use intelligent processing to control devices remotely and create greater capacity in power storage.

Location, location, location

Infrastructure investment deals are much sought after and highly competitive in developed markets, and that has the expected effect on pricing. “There’s a lot of capital chasing deals in developed markets, driving up the pricing and compressing the return profiles on many infrastructure assets,” says Gucfa. “As you look at deal flow, there’s heavy competition for brownfield assets also resulting in pushed out bid-to-win ratios.” It is important to target the right segment within any market opportunity in order to be sure that you are still seeing the right competitive dynamics and attractive deal flow.

“Currently, we see less competition in emerging markets, where there’s a mismatch between the amount of capital in infrastructure as an asset class generally and the amount of capital that’s needed in emerging markets,” says Gucfa. In addition, several countries in emerging markets have recognized the power behind public-private partnerships and have adopted the best parts of contracts utilized in developed nations essentially cherry picking them to solidify their own government initiatives around social infrastructure.

Among the themes within infrastructure that Gucfa and her colleagues are intrigued by are transportation (in particular rolling stock, or rail, airports, and roads), utilities (water and waste treatment, electric/gas distribution), energy (operational renewables, storage, and pipelines), and social (education, health care, housing).

“We have very strong platforms,” says Gucfa. “Our structuring and execution skills are second to none, and we have teams on the ground in every region in which we’re investing. The depth of experience, reputation and the market knowledge are unrivaled, which is why we are a trusted partner not only to our LPs, but also to global and regional developers as well as our industry peers.”

Aberdeen Standard Investments is a brand of the investment businesses of Aberdeen Asset Management and Standard Life Investments.

The document is intended for institutional investors and investment professionals only and should not be distributed to, or relied upon by retail clients.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any strategy.

All information, opinions and estimates in this document are those of Aberdeen Standard Investments (ASI), and constitute our best judgement as of the date indicated and may be superseded by subsequent market events or other reasons. ASI reserves the right to make changes and corrections to its opinions expressed in this document at any time, without notice.

This material is for informational purposes only and does not constitute an offer to sell, or solicitation of an offer to purchase any security, nor does it constitute investment advice or an endorsement with respect to any investment vehicle. This material serves to provide general information and is not meant to be legal or tax advice for any particular investor, which can only be provided by qualified tax and legal counsel. Information provided should not be relied on by the reader as financial or investment advice and does not take into account the particular financial circumstances of an investor. Prior to any investment decision you should obtain independent professional advice regarding your specific circumstances.

Some of the information in this document may contain projections or other forward looking statements regarding future events or future financial performance of countries, markets or companies. These statements are only predictions and actual events or results may differ materially. The reader must make his/her own assessment of the relevance, accuracy and adequacy of the information contained in this document, and make such independent investigations, as he/she may consider necessary or appropriate for the purpose of such assessment.

This material is not to be reproduced in whole or in part without the prior written consent of Aberdeen Standard Investments. Any data contained herein which is attributed to a third party (“Third Party Data”) is the property of (a) third party supplier(s) (the “Owner”) and is licensed for use by Standard Life Aberdeen*. Third Party Data may not be copied or distributed. Third Party Data is provided “as is” and is not warranted to be accurate, complete or timely. To the extent permitted by applicable law, none of the Owner, Standard Life Aberdeen* or any other third party (including any third party involved in providing and/or compiling Third Party Data) shall have any liability for Third Party Data or for any use made of Third Party Data. Neither the Owner nor any other third party sponsors, endorses or promotes the fund or product to which Third Party Data relates.

*Standard Life Aberdeen means the relevant member of the Standard Life Aberdeen group, being Standard Life Aberdeen plc together with its subsidiaries, subsidiary undertakings and associated companies (whether direct or indirect) from time to time.

In the United States, Aberdeen Standard Investments is the marketing name for the following affiliated, registered investment advisers: Aberdeen Asset Management Inc., Aberdeen Asset Managers Ltd., Aberdeen Asset Management Ltd., Aberdeen Asset Management Asia Ltd., Aberdeen Asset Capital Management, LLC, Standard Life Investments (Corporate Funds) Ltd., and Standard Life Investments (USA) Ltd.

© 2018 This material is owned by Standard Life Aberdeen or one of its affiliates.

![]()