By Aye Soe, CFA, Managing Director, Global Research & Design, S&P Dow Jones Indices

Modern portfolio theory (MPT) states that expectations of returns must be accompanied by risk or variation around the expected return. It assumes that higher risk should be compensated, on average, by higher returns.

Beyond relative performance of funds, market participants are also interested in the risks taken to achieve those returns. This motivated the authors of this paper to examine the performance of actively managed funds on a risk-adjusted basis.

Are indices risk managed?

Critiques of passive investing often argue that indices are not risk managed, unlike active management. Therefore, this study aims to understand whether actively managed funds are able to generate higher risk-adjusted returns than their corresponding benchmarks.

Our analysis showed that on a risk-adjusted basis, the majority of actively managed domestic and international equity funds underperformed the benchmarks when using net of fees returns. However, when gross of fees returns were used, managers in certain categories outperformed the benchmarks.

In fixed income, we found that actively managed bond funds outperformed their benchmarks when gross of fees returns were used. The results highlighted that fees negatively affected active bond funds’ performance.

Data

For our study, the underlying data source was the University of Chicago’s Center for Research in Security Prices (CRSP) Survivorship-Bias-Free US Mutual Fund Database, which is the same source used by the headline SPIVA U.S. Scorecard. The universe used for the study only included actively managed domestic U.S. equity, international equity, and fixed income funds. Index funds, sector funds, and index-based dynamic (leveraged or inverse) funds were excluded from the sample. To avoid double counting multiple share classes, only the share class with the highest previous period return of each fund was used.

Analysis

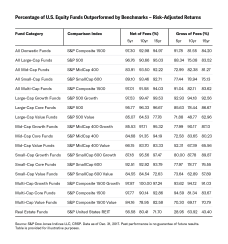

The report below shows the percentage of actively managed US equity funds that were outperformed by their respective benchmarks, using both net of fees and gross of fees performance figures, on a risk-adjusted basis over 5-, 10-, and 15-year investment horizons.

The results show that across all categories, actively managed US equity funds, on average, underperformed their respective benchmarks over intermediate- and long-term investment horizons. Large-cap value funds (over 10 years) and real estate funds (over 5 and 15 years) outperformed their respective benchmarks when using gross of fees risk-adjusted returns, indicating that fees played a major role in those categories.

Similar results were found in fixed income. When using net of fees returns, the majority of actively managed fixed income funds underperformed across all three investment horizons on a risk-adjusted basis, with the exception of investment-grade long funds and leveraged loan funds. However, when gross of fees returns were used, most fixed income funds outperformed the benchmarks. The role of fees in the underperformance of fixed income funds is a phenomenon highlighted in numerous research studies (Poirier et al. 2017; Dobrescu and Motola 2018).

The evaluation of active managers’ performance through a risk lens is an integral part of the investment decision-making process. Beyond the relative performance of funds, market participants are economically interested in whether funds are able to generate sufficient returns to compensate for the risk taken. However, as the study highlights, actively managed domestic and international equity funds across almost all categories did not outperform the benchmarks on a risk-adjusted basis. The figures improved for some categories when gross of fees returns were used. Similarly, in fixed income, fees were the biggest detractor from performance, not risk. The study reveals there is no evidence that actively managed funds were better risk managed than passive indices.

To see results from this study for international equity funds and fixed income, go here.