This communication is intended for investors categorised either as “Eligible Counterparties” or “Professional Clients” within the meaning of Markets In Financial Instruments Directive 2004/39/EC.

After an exuberant 2017 for the markets, can they rise further? Growth momentum seems strong – and synchronised – yet everything is feeling a bit “toppish”, especially with central banks heading for the QE exit doors.

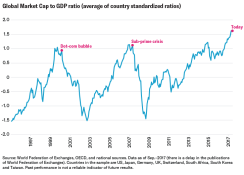

On the valuation front, most metrics are higher than during the dot-com boom and the lead up to the sub-prime crisis. At Lyxor, we’re not calling a crash – not yet, anyway – but with liquidity infusions set to grind to a halt there’s no room for complacency. While we expect a positive start to the year, regional and asset class returns could diverge during 2018.

Let’s take a look at the five main themes we expect to move the markets during the year.

1. Finally, a fiscal push

One of the main themes will be US tax reform and a rise in capex – wherever you look, companies are more willing (or more incentivised) to invest the cash they’ve been hoarding.

In the US, tax reform means equities should hit the ground running early in 2018. Winners could include domestically oriented names, small caps, retail, the tech giants, and possibly banks. Oil refiners, auto companies, and airlines could also benefit. However, highly indebted companies will struggle with the limits imposed on interest deductions, so we’re wary of US high-yield bonds.

In Europe, we expect more of a cyclical pick-up in investment. Structures have aged, and with brighter demand prospects corporations should want to take advantage of cheap financing to refresh their production capacity. The Japanese government is rumoured to be preparing a package that will incentivise companies to invest their cash. In China, reforms focusing on the environment, electric vehicles, and profitability should also fuel capex.

All this could bode well for commodities (excluding agriculture) and infrastructure, as well as sectors such as materials, technology, and financials.

Relevant funds from Lyxor ETF:

Lyxor S&P500 ETF

Lyxor Commodities Thomson Reuters/CoreCommodity CRB ex-agriculture ETF

Lyxor MSCI World Information Technology ETF

Lyxor MSCI World Financials ETF

Lyxor FTSE USA Core Infrastructure Capped ETF

2. QE exits and valuations

Central banks look set to move further away from their super-accommodative policies. So far, policy normalisation has proceeded with little upset, and risk-on strategies remain appealing for now. But it could be time to consider preparing your portfolio to dampen the effects of rising inflation and rates, market volatility, and currency movements.

Any preparations for a risk-off scenario fuelled by QE exit fears would, almost counterintuitively, steer us towards 10-year US Treasuries – a relative safe haven that is still in great demand – and German Bunds. Japan also appeals because of its loose monetary policy, while in equities, minimum variance strategies could be an option for investors looking for somewhere to hide.

Are you preparing for one last run with the bull, or the awakening of the bear?

While the major central banks currently look set to tighten, a slowdown in global growth is still possible, and would halt monetary policy normalisation immediately. It has taken a decade to heal the global economy, and the banks are not about to jeopardise their hard work by tightening unduly.

Relevant funds from Lyxor ETF:

Lyxor iBoxx $ Treasuries 7-10Y ETF

Lyxor FTSE USA Minimum Variance ETF

Lyxor SG Japan Quality Income ETF

3. Bond yields to rise...eventually

The good days for bonds could be over. Some factors keeping rates low remain in place, but the global economy is in its best shape in a decade, and the threat of deflation has disappeared. Our core scenario is that bond yields rise – although we’re not calling a market implosion.

In such an environment, we recommend reducing duration. We favour equities over fixed income, but if you have to hold sovereign bonds, countries where inflation (or growth) is less likely to be better than expected, such as Japan and the UK, look the best option.

We also like inflation break even stories, starting with the US early in the year, and eurozone exposures later in 2018.

Floating-rate contracts are another possibility to help deal with the threat of rising rates, as are short-duration bonds. Credit – notably high yield – looks expensive. We prefer European to American bonds as the ECB will remain active in the markets at least until September.

Relevant funds from Lyxor ETF:

Lyxor EuroMTS 1-3Y Investment Grade ETF

Lyxor US$ 10Y Inflation Expectations ETF

Lyxor EUR 2-10Y Inflation Expectations ETF

Lyxor $ Floating Rate Note ETF

4. Asia advances

Asia ex-Japan outperformed global markets last year and the three major indicators we follow – earnings, valuations, and liquidity – are still sending positive signals. Robust trade and commodity price stability should also be favourable.

What’s more, an improving structural story keeps us positive on Japan – especially given the likelihood of another four years of Prime Minister Abe’s loose policy mix.

Is running with the bull too risky when central banks are heading for the QE exit?

In China, there’s value to be found in the reform of state-owned enterprises and the focus on the environment, while the country’s economic concentration in IT is a long-term trump card. Shorter-term, Chinese equities look unlikely to repeat their stellar 2017: monetary tightening is underway and excesses are being tempered.

Emerging Asian markets should benefit once the US dollar resumes its downward trend. We favour Korea on valuation grounds, surging earnings growth, and signs of improving governance. We also like ASEAN markets, especially Malaysia.

Relevant funds from Lyxor ETF:

Lyxor MSCI AC Asia Ex Japan ETF

5. Exploit a two-speed Europe

The days of doubting the eurozone economy seem to be over, but with European equity valuations well above their long-term averages, a selective approach will be key in 2018.

We like French stocks given the general recovery and the progress of “Macronomic” reforms. German stocks have some appeal, especially if a Grand Coalition leads to increased government spending. That said, we prefer to take our exposure to Germany via bunds.

Conversely, the ECB’s gradual withdrawal of QE and a number of political hurdles cloud the outlook for Italy and Spain. The Catalan crisis is far from over, while Italian general elections loom large. Greece could also hit the headlines in 2018, albeit more positively. With its third bailout package coming to an end in August, it will need renewed access to the bond markets. Debt forgiveness appears to be on the Eurogroup’s agenda.

Meanwhile, UK equities continue to face Brexit battles. The agreed-upon divorce deal should bring some hope, but trade treaty deliberations complicate the outlook.

Relevant funds from Lyxor ETF:

Lyxor IBEX 35 Inverso Diario ETF

DISCLAIMERS:

Disclaimers:

All opinions/data sourced from Lyxor & SG Cross Asset Research teams. Opinions expressed are as at 05 January 2018.

THIS DOCUMENT IS DIRECTED AT PROFESSIONAL INVESTORS ONLY

This document is for the exclusive use of investors acting on their own account and categorised either as “Eligible Counterparties” or “Professional Clients” within the meaning of Markets In Financial Instruments Directive 2004/39/EC.

This document is of a commercial nature and not of a regulatory nature. This document does not constitute an offer, or an invitation to make an offer, from Société Générale, Lyxor International Asset Management or any of their respective affiliates or subsidiaries to purchase or sell the product referred to herein.

We recommend to investors who wish to obtain further information on their tax status that they seek assistance from their tax advisor. The attention of the investor is drawn to the fact that the net asset value stated in this document (as the case may be) cannot be used as a basis for subscriptions and/or redemptions. The market information displayed in this document is based on data at a given moment and may change from time to time. The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results. This also applies to historical market data. The potential return may be reduced by the effect of commissions, fees, taxes or other charges borne by the investor.

Lyxor International Asset Management (Lyxor ETF), société par actions simplifiée having its registered office at Tours Société Générale, 17 cours Valmy, 92800 Puteaux (France), 418 862 215 RCS Nanterre, is authorized and regulated by the Autorité des Marchés Financiers (AMF) under the UCITS Directive and the AIFM Directive (2011/31/EU). Lyxor ETF is represented in the UK by Lyxor Asset Management UK LLP, which is authorised and regulated by the Financial Conduct Authority in the UK under Registration Number 435658.

Lyxor International Asset Management (“LIAM”) or its employees may have or maintain business relationships with companies covered in its research reports. As a result, investors should be aware that LIAM and its employees may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

CONFLICTS OF INTEREST

This communication contains the views, opinions and recommendations of Lyxor International Asset Management (“LIAM”) Cross Asset and ETF research analysts and/or strategists. To the extent that this research contains trade ideas based on macro views of economic market conditions or relative value, it may differ from the fundamental Cross Asset and ETF Research opinions and recommendations contained in Cross Asset and ETF Research sector or company research reports and from the views and opinions of other departments of LIAM and its affiliates. Lyxor Cross Asset and ETF research analysts and/or strategists routinely consult with LIAM sales and portfolio management personnel regarding market information including, but not limited to, pricing, spread levels and trading activity of ETFs tracking equity, fixed income and commodity indices. Trading desks may trade, or have traded, as principal on the basis of the research analyst(s) views and reports. Lyxor has mandatory research policies and procedures that are reasonably designed to (i) ensure that purported facts in research reports are based on reliable information and (ii) to prevent improper selective or tiered dissemination of research reports. In addition, research analysts receive compensation based, in part, on the quality and accuracy of their analysis, client feedback, competitive factors and LIAM’s total revenues including revenues from management fees and investment advisory fees and distribution fees. Please see our investment recommendations disclosure website www.lyxoretf.com/compliance.