Ultra-accommodative money policies are disappearing in the rear-view mirror of the investment landscape, and interest rates are steadily creeping upward in the US, with Europe likely to see rates begin a slow rise at some point in 2019 or 2020. In the fixed income markets, where a hike of a few basis points in interest rates could negate a year’s worth of income, “risk-free” assets are no longer the norm. The next credit cycle is evolving as you read this, and will require an innovative approach to seize opportunities as each stage of it unfolds. As a result, investors are looking for innovation – forward-looking solutions that are flexible and built specifically to address the goals of investors seeking attractive yields in the current environment.

Disrupting the traditional

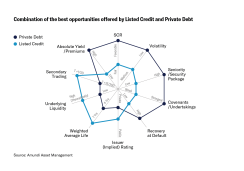

“The credit continuum approach disrupts traditional practices and transcends siloed organizations to deliver bespoke solutions with risk-adjusted yield targets,” says Amundi’s Global CIO Pascal Blanqué. Leveraging its expertise and global perspective in fixed income, Amundi is redefining the lens through which investors view credit, broadening its scope to the point that it creates a credit continuum. It’s important to concentrate on the meaning of continuum, i.e. a continuous sequence where adjacent elements don’t differ all that much, but the more extreme the gap between two spots on the continuum, the more distinct they are. In short, it’s the ideal view for spotting potential across the entire spectrum of credit opportunities, ranging from liquid corporates (both investment grade and high yield) to less liquid assets such as private debt, structured finance-related debt, and securitized assets. In particular, “private debt offers investors an excellent way to diversify their fixed income exposure, allowing them to mitigate both duration and credit risks, which is particularly relevant in the current financial market environment” states Thierry Vallière, Head of Private Debt, Amundi.

Investment teams’ governance is another key innovative feature of the credit continuum approach. For credit continuum to be successful in its implementation, it is fundamental to nurture the cross-fertilization of ideas across investment teams and to make sure that research and analysis capabilities are shared, along with investment tools, by all credit investment teams.

Applying tremendous rigor

Globally, the rising rate environment in the US and the low rate environment in Europe require a holistic strategy to find opportunities amid their lack of synchronization. Eurozone growth has begun to decelerate, but continues to remain strong and is broad-based. Across the Atlantic, hedging cost for US dollar denominated bonds is elevated in a rising rate environment.

In that context, portfolio construction is critical. “By investing through the whole credit spectrum, the credit continuum has access to floating rate instruments, which significantly reduces duration risk,” says Éric Brard, Head of Fixed Income, Amundi. “Picking the optimal instrument and best allocating it across the wide-ranging available submarkets requires permanent monitoring of the constantly evolving liquidity of each segment,” adds Jean-Marie Dumas, Head of Alpha Fixed Income Solutions, Amundi.

To fully seize the potential of the credit continuum requires rigorous work on the part of an asset management team, which must pay attention to each step of the process from the investor’s risk/return profile to portfolio construction and active investment. For example, “tracking the most sensitive bucket to a credit event within the portfolio must be part of the process an investment manager puts in place in such an investment framework,” says Dumas. “In particular, it is necessary to apply stress tests and operate a constant monitoring in order to decide whether to exit or not, and at what price.”

Market pricing is viewed as a key driver of realized performance in the credit continuum, and that performance is driven by credit selection capabilities and momentum execution. This is all underpinned by fundamental and quantitative research that assesses the strength of each credit instrument.

Thinking one’s way through the credit continuum is akin to exploring new territory, and leads to the natural development of new tools and methodologies to exploit new discoveries. These new tools and methodologies are the means by which theory is transformed into practice. In the context of the current financial markets, the credit continuum strategy is only at its beginning, but the pillars of its success – achieving the expected overall outcome – align with Amundi’s expertise across the entire tapestry of fixed income, from investment grade bonds to private debt.

Combination of credit opportunities