By Berlinda Liu, Director, Global Research & Design, and Phillip Brzenk, Director, Global Research & Design, S&P Dow Jones Indices; Matthew Brown, President, COO, and Michael Rulle, Founder, CEO, MSR Indices

Since the launch of the first risk parity fund—Bridgewater’s All Weather Fund—in 1996, many asset managers have offered their version of risk parity to clients. The risk parity industry has especially gained traction in the aftermath of the 2008 global financial crisis, growing to an estimated USD 150 billion-175 billion at year-end 2017 according to the IMF.

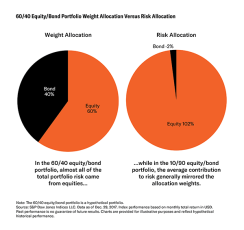

In the past, such strategies lacked an appropriate benchmark, leaving most investors to benchmark against a traditional 60/40 equity/bond portfolio. The issue with this approach is that a 60/40 portfolio reflects neither the construction nor the risk/return characteristics of risk parity strategies. Generally considered to be diversified in dollar terms, the reality is that nearly all of the portfolio risk arises from the 60% allocation to equities. When a portfolio is equal-risk weighted as opposed to equal weighted, it may lead to superior risk-adjusted return.

With the purpose of providing a transparent, rules-based benchmark for risk parity strategies, we introduced the S&P Risk Parity Index Series. These indices construct risk parity portfolios by using futures to represent multiple asset classes and attempt to reflect the risk/return characteristics of funds offered in the risk parity space. Cognizant of the fact that risk parity funds in the industry can have different volatility targets, the index series consists of three indices with different target volatility (TV) levels: 10%, 12%, and 15%.

Learn more about the economic rationale for implementing a risk parity approach in a multi-asset portfolio construction, and see the data that shows the S&P Risk Parity Indices – a transparent, rules-based passive implementation of risk parity strategies – track active risk parity funds much closer than a traditional 60/40 equity/bond portfolio.