The Saudi Stock Exchange (Tadawul) underwent changes over the weekend that are intended to help bring in investors from other countries.

The exchange announced Wednesday that it had completed its transition to a T+2 settlement cycle, or transaction date plus two days, for all listed securities. At the same time, Tadawul introduced securities borrowing and lending, as well as covered short selling.

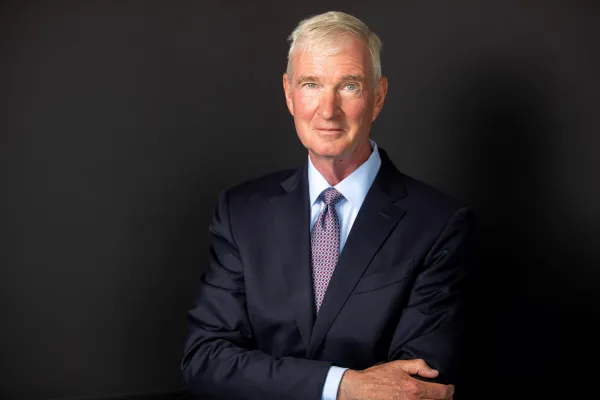

“We have been working very closely in the last 12 months with international institutional investors to understand how the Saudi capital market reforms would help attract more institutions,” said Khalid Abdullah Al Hussan, Tadawul’s CEO. “That resulted in several changes, which is what we activated last Sunday.”

These developments are based on discussions with international investors as well as index providers like MSCI about what it would take for Saudi’s exchange to attract foreign participation, he added.

European stock exchanges have been on the T+2 cycle since 2014, and the U.S. Securities Exchange Commission ordered an industry-wide switch to T+2 last month. Previously, the standard for settling payments was three days after the transaction.

Al Hussan said the shortened transaction cycle and addition of securities lending and short-selling will “enhance access, liquidity, efficiency, and transparency in the Saudi market,” and, hopefully make Tadawul “an important new factor in global equity markets, both as a source of capital and as an investment destination.”

“One of [our] main objectives is to act as the base of infrastructure to introduce more sophisticated financial products in the region,” he said, noting planned initiatives around debt, fixed income, and credit.

Recently, Tadawul also launched an REIT market and equity parallel market to “support the growth and contribution of these types of companies to the Saudi economy,” Al Hussan said.

Tadawul is the 23rd largest stock market among the 64 members of the World Federation of Exchange and the tenth largest among emerging market peers. It is the sole securities exchange for Saudi Arabia.