As Bert Lance said, "If it ain’t broke, don’t fix it."

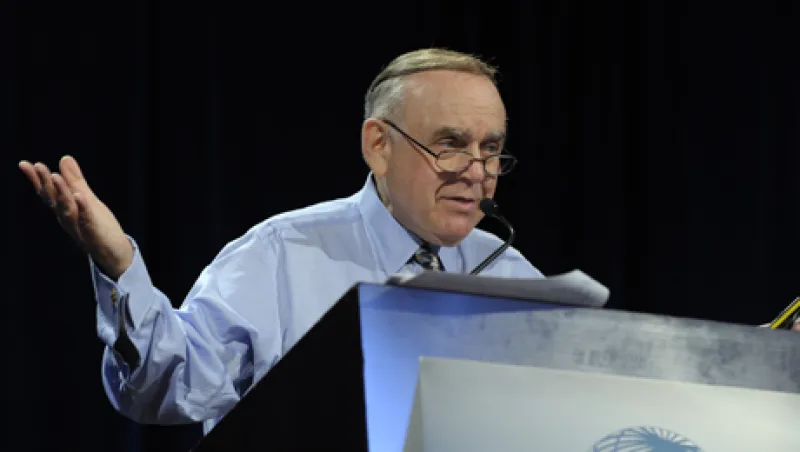

During the Best Ideas panel at last September’s Delivering Alpha conference, hedge fund titan Leon Cooperman shared with the audience his investing space of choice: equities.

Surprise, surprise.

It’s certainly no shock that Cooperman, CEO of New York–based equity hedge fund Omega Advisors, thought that “stocks are the best house in the financial asset neighborhood,” though he did admit the the quality of the neighborhood was suspect.

The equity market is so appealing, he said, in part because the alternatives are so unattractive. Cash, he claimed, would be at zero percent for the next few years. But it was U.S. government bonds that earned the brunt of Cooperman’s wrath.

"I wouldn’t own a U.S. government bond. I think it’s ridiculous,” he said. Cooperman noted that over a long period of time, 10-year bonds have tracked nominal GDP; and over the next three years, combining 2 percent to 3 percent inflation and 2 percent to 3 percent real growth, even with 5 percent to 6 percent yields, “Well, that’s a negative return in your holding period.”

“Pension funds to my amazement are more interested in — or as interested in fixed income as they are in equities, despite actuarial assumptions of 6 to 7 to 8 percent, and bond yields are 2 percent; the arithmetic doesn’t work.”

The current yield on the 10-year bond is around 1.51 as of Monday afternoon, down from 1.91 on September 9, 2011, the Friday before the Delivering Alpha conference.

Cooperman’s advocacy of equities was based on a number of assumptions:

• The U.S. will not go into a recession in 2011 or 2012.

• The ECB will step up to the plate and do for European financial institutions what the central bank did for U.S. institutions.

• President Obama will soften his antiwealth, antibusiness stance.

• The instability in the Middle East is genuinely about democracy rather than “something more sinister."

As for the positives, Cooperman singled out several companies he felt were primed for success.

Apple, he said, was at less than ten times next year’s earnings, with no debt and about $25 billion in earnings. The computer giant has continued to thrive since the passing of its founder and industry innovator Steve Jobs. It traded at $377.33 on September 9, 2011 and was at $613.11 Monday afternoon. That’s a 62 percent increase.

Boston Scientific, which Cooperman noted for its 16 percent cash flow yield, and which buys back about 8 percent to 10 percent of the company annually, has dropped about 9.5 percent from $6.20 to $5.61.

KKR Financial Holdings has risen just over 8 percent from $7.97 to $8.62; while Qualcomm has moved from $50.39 to $55.24, a 9.6 percent rise.

Lastly, Cooperman was impressed by Sallie Mae, which was buying back stock, had a dividend of 8 percent and had a liquidating value of between $19 to $20. Since September 9, the stock has jumped almost 28 percent from $12.71 to $16.25.

Stock picking is no easy task, but if anyone can make it look that way, it's Cooperman. Just one of the five equities he referenced has lost value, and Apple has shown impressive gains.

Over the last 50 years, he said, the S&P multiple had an average 15 times earnings; when the inflation rate was 1 percent to 3 percent, the S&P averaged 17 times earnings. When the S&P was averaging 15 times over those 50 years, 10-year government bonds averaged a 6.67 percent yield. The S&P is now somewhere between 11 to 12 times and 10-year bonds are 2 percent, he said.

The S&P 500 index, which was at 1154.23 on September 9, is now at 1351.42 as of Monday afternoon.

The U.S. economy has work to do, he said, as “we are all prisoners of 2008,” with a thin veneer of confidence. But to Cooperman, equities certainly posed the best investment opportunity, and judging by the results of the small sample he offered at Delivering Alpha, he just may have been right.

CNBC and Institutional Investor will be teaming up for Delivering Alpha again on July 18 in New York City. Leading up to the conference, we will be sifting through the best of last year’s Delivering Alpha and previewing this year’s content, which includes the return of Treasury Secretary Timothy Geithner as keynote speaker. We’ll also have two of his predecessors at Treasury in Hank Paulson and Robert Rubin, as well as Preet Bharara, U.S. Attorney for the Southern District of New York. And from the ranks of the country’s best investors we’ll have private equity giant Henry Kravis of KKR, Leon Cooperman of Omega Advisors, Pete Briger of Fortress Investment Group and William Ackman of Pershing Square. For the full agenda, visit the Delivering Alpha website.