Many of the worst-performing hedge funds in 2011 are leading the pack so far this year.

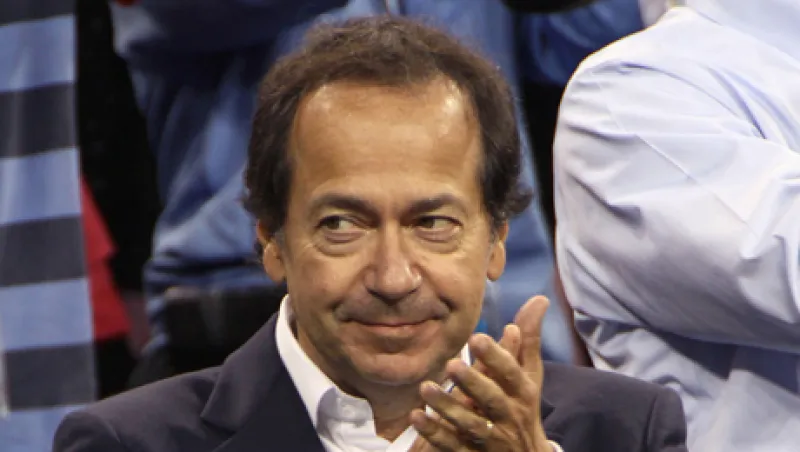

Of course the most high-profile — however incipient — turnaround is taking place at Paulson & Co., where its most aggressive fund is reportedly up about 5 percent through January after dropping 50 percent in 2011.

But a number of other long-short equity specialists have also dramatically reversed their fortunes. Maverick Fund, managed by Tiger Cub Lee Ainslie, for example, was up nearly 6 percent through January 27. The $3 billion fund dropped 14.93 percent last year, according to HSBC.

Mark Kingdon’s M. Kingdon Offshore was up 6.24 percent through January 27. His $1.5 billion fund lost 18 percent last year.

AJR International is performing even better this year. The aggressive $517 million fund headed by Alexander Roepers was up 10.86 percent through January 27. It lost 6 percent last year.

In Europe, RAB Global Mining & Resources, a small $82 million fund, was up 8.34 percent after losing 24.57 percent last year.

All of these funds made money in 2009 as well but declined by 35 percent to 40 percent in 2008.

Investors who remained in the funds for the entire ride are mostly above their high-water marks. But those who chase performance are very likely to still be in the red if they bought into any of these funds at or near the top of their recent roller-coaster ride.

In fact, many investors who piled into Paulson’s funds after his legendary triple-digit gains in 2007 are still under water.

Perhaps the most volatile fund is the Henderson European Absolute Return Fund. The $112 million long-short equity fund, which concentrates on European companies, is up 14 percent so far this year. Launched in June 2001, the fund lost 42.53 percent last year, wiping out the 40.53 percent gain in 2010. It seemed to have been on a roll at the time, having surged more than 110 percent in 2009. But that astounding performance came after losing more than 40 percent in 2008.

The upshot: If you invested in the fund at the end of 2007, just before it plummeted amid the 2008 global financial crisis, you would have been barely in the black at the end of 2011 despite the phenomenal back-to-back gains in 2009 and 2010.

Of course, if you got into the fund at the beginning of 2009 — right after the big loss — you would now be up about 75 percent despite the 42 percent loss last year.

Got to love volatility.