Measuring and reducing the risk of loss is always a concern of equity investors, but it has become virtually an obsession for many since the 2008–09 market drop. The key to reducing risk is appropriate diversification (investing in a basket of stocks rather than a mere handful) and getting position sizes right.

For the purpose of this article, we’ll look at the impact of various security-weighting schemes on the return of one well-known and well-diversified basket of stocks, the S&P 500, over the past 16 years. The relationships, we find, have positive implications for actively managed as well as indexed portfolios.

Like many capitalization-weighted indices, the S&P 500 tends to be dominated by the largest-cap stocks. Sometimes, though, these stocks become the largest-cap because of excessive increases in their valuations. As a result, investing in these indices may lead to buying high and selling low: the opposite of every investor’s goal.

To avoid this risk of cap-weighted schemes, some investors have turned to equal-weighting their portfolios, but there are risks associated with that strategy, too. Because smaller-cap stocks tend to be hit harder in down markets and fare better in rising markets, equal-weighted portfolios and indices tend to be more volatile than their cap-weighted counterparts.

We looked for a portfolio-weighting approach that could offer the best of both worlds, while mitigating downside risk — which most investors fear more than volatility.

Volatility (the standard deviation of returns) is symmetrical: It captures upward and downward moves equally. But most investors typically hate losing money more than they love winning. That is, they care more about market drawdowns than market rallies. In other words, investors want upside, but not downside, volatility.

A variety of risk metrics focus on downside risk; for example, the Sortino ratio measures the return achieved per unit of downside price movement.

We used the Sortino ratio and other drawdown-sensitive risk metrics as guides to create a capital-allocation scheme based on expected tail loss, or ETL. A stock’s ETL measures the potential losses in the worst scenarios we’re likely to see — the rare and infamous black swans — as well as in down markets generally. In the ETL-weighted portfolio, we size positions so that each stock’s ETL contribution to the overall portfolio losses would be exactly the same.

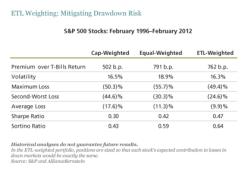

Our research results are encouraging; drawdowns for the ETL-weighted portfolios were generally smaller than for the other weighting schemes. In the display below we highlight the two worst drawdowns during the 1996–2012 period that we studied, as well as the average drawdown.

In the worst drawdown, which occurred during the Great Recession, the ETL-weighted S&P 500 portfolio lost substantially less than the equal-weighted alternative, and did modestly better than the cap-weighted portfolio — even though investors who stayed the course in equities clung to large-cap companies. In the second-worst drawdown, when tech imploded, damaging large-cap names more, ETL beat the cap-weighted alternative by a full 20 percent, and outperformed the equal-weighted construction as well.

Fueled by results like these, the average loss for the ETL-weighted portfolio was smaller than the average drawdown in both a cap-weighted and an equal-weighted portfolio over the 16-year time horizon.

The ETL-weighted portfolio also provided almost all of the additional returns of the equal-weighted index, with substantially lower volatility. Further, volatility was marginally lower than that of the cap-weighted index as well.

Given this array of results, the ETL-weighted index had a higher Sharpe ratio (which measures return against both positive and negative volatility) than either its cap- or equal-weighted counterpart, as well as a higher Sortino ratio. This last result gives us reason to be optimistic that ETL-weighted portfolios can soften the blow during market turmoil.

No risk strategy can reliably obliterate losses in down markets, but in our view, capital allocation using ETL has the potential to make such losses more tolerable.

In my next post, I will look at the use of expected tail loss in mitigating risk in multi-asset portfolios. We’ve found that the benefit there is even larger than what we see for stock-only portfolios.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Andrew Y. Chin is Global Head of Quantitative Research and Investment Risk at AllianceBernstein.