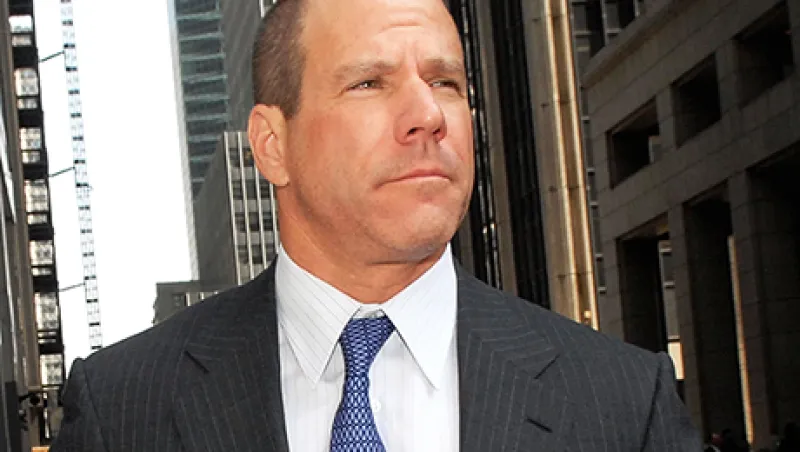

private gain TPG Capital is counting on new co-CEO Jon Winkelried to help it up its game. Private equity giant TPG has expanded well beyond buyouts, the strategy that made it a household name among institutional investors. But the Fort Worth, Texas– and San Francisco–based firm is far from well known for its broad range of products, which include growth, real estate and credit funds.

So $75 billion TPG has recruited Winkelried, who spent 27 years at Goldman Sachs Group — most recently as co-president and co-COO — to provide professional management and catch up with firms like Blackstone Group, whose high-profile co-founder Stephen Schwarzman brought in Hamilton (Tony) James from Credit Suisse Group in 2002 to run daily operations.

Winkelried’s mandate: Organize the firm so it can reap the benefits of a rich platform of strategies. In the past two years, TPG has raised about $18 billion, including $10 billion for leveraged buyouts, $3 billion for growth equity and $2.1 billion for real estate.

James Coulter, who shares CEO duties with the 56-year-old Goldman veteran, says Winkelried’s role has to be understood against the trend of private equity firms evolving into diversified asset managers. Players such as TPG, Blackstone and Apollo Global Management have moved into highly profitable, if riskier, areas such as lending to smaller companies that can no longer tap regulated banks for capital.

“People still think of us as a buyout firm, even though well less than 40 percent of our capital is in that area,” says Coulter, 55, who co-founded TPG with David Bonderman in 1992. “We have to manage ourselves well, and that person is different from someone running a fund. It doesn’t mean we’re reducing our focus on investing; management is an and, not an or.”

Although Coulter wouldn’t comment, Winkelried will assist the firm if it decides to go public, a move that TPG has always said is an option.

Coulter has served as sole CEO since Bonderman, 72, relinquished his co-CEO post to become chair last year, but he says dual leadership has always made sense for a firm that is based on deal making and personal relationships with investors. “So now you had a more complicated job and only one CEO,” he says. “There’s more of a tradition of co-CEOs in private equity than in any other business,” he adds. “Investment firms can’t be run as command-and-control organizations.”

Coulter explains that Winkelried is a good fit for TPG because he co-ran Goldman with Gary Cohn and has been involved in everything from credit to investment banking on a global scale: “There are few problems he’ll encounter in our organization that he hasn’t seen before.”

Winkelried is not a new face for TPG. Since leaving Goldman in 2009, he has advised the firm on the development of its credit business, which is now overseen by Goldman vet Alan Waxman. Winkelried, who became a Goldman partner in 1990 and co-president and co-COO in 2006, also long worked with TPG as a banker at his former firm.

Coulter says Winkelried’s experience at Goldman makes him well suited to help TPG better integrate its teams so they can leverage one another’s ideas and relationships as well as expand into areas like hedge funds. “We are an intellectual property business, with ideas and insights that we try to deliver across the world,” he explains. “Jon will help us organize more for that task.”