The developing world has never looked more appealing to custodian banks. Between 2011 and 2014 the 11 largest global custodians boosted their exposures to emerging and frontier markets by 20.9 percent on average, with the biggest jump in South America. Emerging economies help banks diversify revenue and capture growth opportunities. “Investors are looking to balance high risk and high return,” says Pascal Roland, senior manager of securities market infrastructure at SWIFT, an interbank messaging system based in La Hulpe, Belgium. “Emerging markets offer both.”

Some global custodians have been active in emerging markets for more than a century, but during the past decade those countries have leveled the playing field for the big banks by making regulatory changes that aim to meet international standards.

Meanwhile, investors are getting more comfortable with emerging markets’ financial infrastructures, explains Mark Kerns, London-based head of investor services at South Africa’s Standard Bank. Besides maturing capital markets, developing economies offer better legal frameworks and more advanced risk management approaches than they did ten years ago.

“Strategically, it’s important to be connected to the top 20 market capitalizations in the world as well as the very promising markets,” says Alain Pochet, Paris-based head of clearing, custody and corporate trust services at BNP Paribas Securities Services (BP2S). Between 2009 and 2010, BP2S began offering direct custody services in China, India and Brazil; these giants among developing nations are now the world’s second-, seventh- and tenth-largest economies, respectively.

The French bank’s emerging-markets focus is South America. Since 2010 it has established a presence in Chile, Colombia and Peru. Last November, BP2S, which has $8.7 trillion in assets under custody, won its first direct African mandate, in Morocco, serving as a local custody provider for the European Bank for Reconstruction and Development. This August it laid the groundwork for a major expansion in Asia, where it hopes to harness opportunities in mainland China, Hong Kong, Japan, Malaysia and Singapore, mostly by investing in its corporate trust services throughout the region.

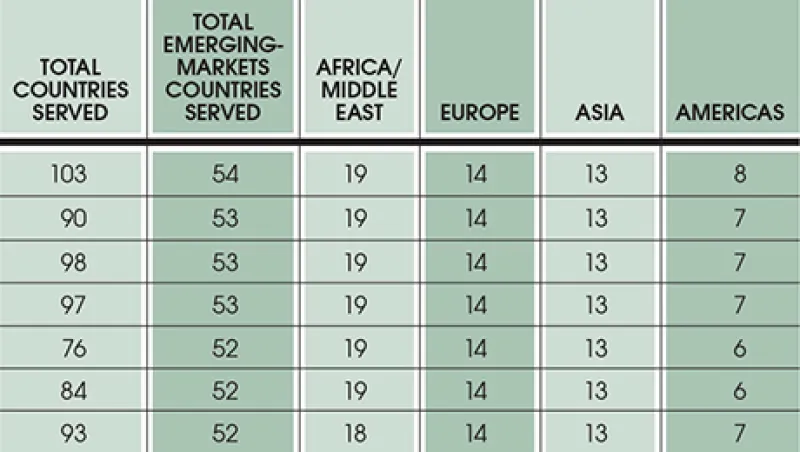

With $21.7 trillion under custody, Boston-based State Street Corp. serves the most emerging-markets countries, as defined by index and market analysis provider MSCI: a total of 54. Remarkably, New York’s Brown Brothers Harriman, whose custodial assets total just $4 trillion, is tied for No. 2 with $28.5 trillion BNY Mellon and $15 trillion Citi. Although nine of its 17 offices are in the U.S., BBH primarily serves emerging markets through local custodians, a growing trend.

BNY Mellon, the world’s biggest custodian, was a first mover in such alliances. In 1998 it joined forces with Standard Bank to offer international services to African investors, particularly in postapartheid South Africa. Standard Bank now has $330 billion in custodial assets and offices in 11 countries outside Africa; it emphasizes Asia thanks to a partnership with Industrial and Commercial Bank of China, which bought 20 percent of the firm in 2007.

Partly because Western regulatory directives hold banks liable for mistakes by local custody partners, some custodians prefer to avoid that risk. Citi has the largest proprietary network, acting as its own subcustodian in 62 of the 98 nations it services; those 62 countries account for 95 percent of global public market capitalization. “We are able to provide a singular, consistent service offering for our clients across all these markets,” says Sanjiv Sawhney, Citi’s London-based head of global custody and alternative investor services. “We have the right balance of local experts who know the local markets and overlay our global infrastructure on that.”

Building a custody platform that operates securely in emerging markets and adheres to regulations that are unique to each country can cost hundreds of millions of dollars. In Asia deep-pocketed global custodians have squeezed out their local peers, limiting selection for investors, SWIFT’s Roland notes: “Choice is disappearing because it’s a scale business, the sophistication of clients is growing and legislation is drifting away from protecting local banks to now trying to grasp international services.” • •