We believe there are some important new macroeconomic influences investors should consider when thinking about 2014. In particular, any drag from government austerity is expected to decline in 2014, which will have important implications for earnings, interest rates, currencies and, ultimately, global asset allocation.

As such, we retain a favorable outlook for the global economy in 2014, including rising but still relatively low inflation and, in many instances, accelerating growth. In particular, we expect economic expansion in Europe and the U.S. to rebound further as both economic zones enjoy less of a drag from government austerity.

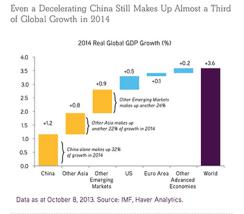

By comparison, we anticipate that many of the large emerging-markets economies, Brazil in particular, will remain sluggish relative to potential on the growth front again in 2014. We are using a 2.1 percent gross domestic product forecast for Brazil, versus the 2.3 percent consensus forecast. Although we believe export volumes will recover as global growth improves, the government’s ability to execute large-scale investment programs will likely be constrained by its need to maintain a 2 percent primary surplus.

Implicit in our global forecasts are two important considerations. First, we expect more positive legislation in what we think are the four key reform markets: Mexico (energy), Japan (push to increase base wages), Europe (bank stress test credibility) and China (state-owned enterprise reform). Second, we are not anticipating any major derailments amid U.S. midterm elections, nor do we expect any major political discord following elections in Brazil, Turkey, India and Indonesia.

Against our favorable forecast, however, we do want to caution that our research leads us to believe that we are now ahead of schedule on multiple expansion in public equities at this point in the macroeconomic cycle. Thus we think that certain stock markets, including the U.S., could bounce around a lot in the first half of the year before rallying.

On a separate matter, we also think that corporate creditworthiness in emerging markets will surface as an issue in 2014. We believe that nonperforming bank loans in China are already beginning to fray, whereas India must now deal more forcefully with deteriorating loans that have previously been listed as restructured. Finally, we think that countries with sizable or growing twin deficits will continue to see pressure on their currencies and credit default swaps in 2014 as the Federal Reserve’s tapering continues.

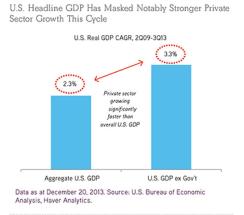

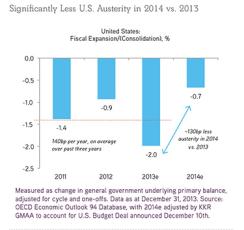

Overall, KKR still believes that the U.S. is in a period of deleveraging. After corporate and financial deleveraging, the third and final phase focuses on the volatility caused by government deleveraging and austerity. The U.S. has been forced to shrink deficits at almost every level of government, which has weighed on overall GDP growth in recent years. In 2013, for example, we estimate that government drag on GDP growth was a sizable 125 basis points.

Looking ahead, however, the good news is twofold. First, the structural deficit in the U.S. has closed by an average of 140 basis points per year during the past three years, culminating with 2013’s sizable 200 basis-point belt-tightening escapade. As a result, we think that the U.S. government deficit may be less than 3.5 percent in 2014, versus more than 9 percent in 2010. From almost any vantage point, this substantial reduction is constructive for investor confidence in the U.S., its government and its economy. Second, the absolute level of government austerity — and hence its corresponding fiscal drag — is expected to be much smaller in 2014 and beyond, which is clearly bullish for long-term growth expectations.

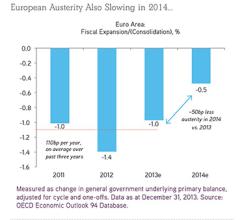

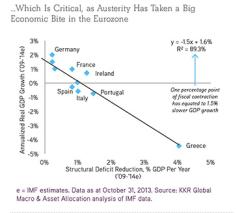

Austerity has also generated many headlines in Europe. So it might surprise some to learn that the euro zone has actually implemented less fiscal consolidation than the U.S. Indeed, Europe’s structural budget deficit closed by just 100 basis points in 2013, compared with 200 basis points in the U.S. But those headline numbers mask the fact that European austerity has taken a much greater economic bite, having occurred against the backdrop of a strong currency and without much offsetting monetary stimulus for the hardest-hit countries. All told, we estimate that every percentage point of fiscal consolidation is equivalent to a drag on GDP of 1.5 percent in Europe, which is far above the 0.5 percent to 0.7 percent GDP drag we would expect from a similar austerity program in the U.S.

Unlike the prior two bank stress tests in Europe since the unfolding of the 2008–’09 financial crisis, the 2014 round gives us confidence. We also have more confidence in the central bank head, Mario Draghi, who will be overseeing this stress test, than in the consortium of European officials who did the prior two. And, notably, as details on the stress test are still being worked out, sentiment remains somewhat skeptical about the prospect for its success. We thus think this key transition toward credible oversight is potentially underappreciated by the market.

Also, we think a successful stress test will help unlock trapped liquidity pools across the European lending market. In particular, cross-border lending and a lack of available credit for small- to medium-size enterprises remain major issues across Europe. If there is some improvement in unlocking available credit in these areas, we think that would bolster confidence and growth.

We believe we may now be entering the global synchronous phase of a long but bumpy recovery that started in 2009 and, as such, a broad-based allocation toward risk.

We must also consider, however, that unlike the case with past global recoveries, central banks are, in aggregate, likely to remain accommodative. Europe and Japan are showing the effects of this dovish policy. Even the U.S. version of tapering is more along the lines of slowing the positive rate of change, as opposed to outright contraction in monetary policy.

Given this viewpoint, we think our key overweight positions in global equities, private credit, special situations and real assets are likely to continue to serve us well in 2014. We also remain supportive of private equity, flexible credit mandates and growth equity.

Henry H. McVey is head of KKR’s global macro and asset allocation team.