We have all heard the mantra that fundamental investing is the best path to consistent, long-term equity returns. Whereas there have been extreme periods in which this has not held true, the market has historically always returned to bedrock principles, such as revenue growth, earnings and profit margins. But is this pattern true today? I believe it is not, and that being right on the fundamentals alone will not be enough to generate sufficient returns and manage risk.

Several factors have combined to forge deep structural changes across the entire investment industry, including trading, regulation, technology, macroeconomic factors and the competitive landscape.

Deep markets need active trading. A market with ample liquidity provides buyers and sellers with minimal friction in the form of bid-ask spreads and also acts as a strong ballast against volatility. Conversely, thinner volume creates wider spreads and greater volatility, as fewer buyers and sellers means stock prices display an up or down gap, triggering sharp moves. This dynamic forces investors to get in and out much more quickly.

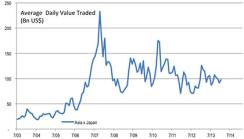

Many of our major markets have seen dramatic declines in overall trading volume over the past ten years (see charts 1 and 2).

Chart 1 (click to enlarge)

Chart 2 (click to enlarge)

Fortunately, other markets, particularly in Asia, have experienced dramatic increases in trading volume (see chart 3). More and more, investment is moving toward these rapidly developing markets. Many of these markets, however, are still highly correlated with one another, rising and falling because of global money flows and shifts in investor sentiment, rather than underlying company fundamentals.

Chart 3 (click to enlarge)

The use of analytical and trading technology has been a tremendous boon for average investors. Whether you’re buying 100 or 10,000 shares, analytical and trading platforms are equally accessible. These resources have significantly reduced the advantage of professional investors, however. With all investors having access to the same information at the same time, deeply undervalued stocks are rare. The rise of rapid trading systems has also weakened the value of fundamental investing. These systems use complex algorithms that measure changes in company fundamentals and trade on these new data, all before a human analyst can begin to react. There is software that automatically scans any news or company report, looking for key words or phrases, which it then interprets into a buy or sell signal, all within seconds. By the time a portfolio manager digests the same information, the news has long been reflected in stock prices (see also “Analysts Beware: A Machine Has Its Eye on Your Job”).

For many years, investment professionals have needed to balance the desire to gain superior investment knowledge about a company with the real and present danger of stepping into the wide gray area of insider trading. Still, there was no substitute for fundamentals, due diligence and, in particular, talking extensively to management to understand the cost inputs or how the changing energy or consumer environments might affect the bottom line next quarter or next year.

Regulation Fair Disclosure, or Reg FD, changed much of that. Under this Securities and Exchange Commission rule, first introduced in August 2000, companies are prohibited from communicating anything they haven’t already released, and if they do inadvertently disclose something, the recipients are required to keep that information confidential until the company communicates that information to the rest of the investing public. Reg FD’s objective was to ensure no one received preferential treatment. The rule may very well have accomplished this. But it also succeeded in eliminating the value of meeting with company management.

Since the introduction of Reg FD, companies have been loath to discuss any issue or answer any question that is not part of prearranged talking points. The discussions are now governed as much by the in-house attorney as by the CFO. Industry conferences have largely become a waste of time for investment professionals; the only value now comes from meeting with other investment teams to get their views. For their part, investment teams are likewise constrained by Reg FD: They cannot disclose anything of value that they haven’t already heard, and if they do inadvertently disclose something, investment teams are required to keep that information confidential until the company properly communicates it to the rest of the investing public.

Investment markets have always been affected to one degree or another by macroeconomic events. At times, regardless of a given company’s underlying fundamentals, its stock price will move based not on its own attributes but on events outside its control or influence. Whereas the impact of these events could be significant in the short term, markets eventually again reflect the underlying fundamentals of each company. The severity and frequency of macroeconomic shocks have only grown over the past few decades as globalization has reached an inflection point and governments influence far more of our economy — particularly since the terrorist attacks of September 11, 2001, and the 2008–’09 financial crisis.

During the past decade, the role of government has shaken up the role of a company’s fundamentals in its stock price. The near collapse of the global financial system brought to the forefront the critical role of central banks, which took unprecedented actions to avert a potential economic meltdown. Today economies and markets are driven more by the actions of governments than by companies and their underlying fundamentals. With much of this increased authority and influence now hardwired into the system, these dynamics are here to stay.

These developments have been a near disaster for fundamental investors. Since 2008, risk-on and risk-off environments have increasingly been the result of central bank policy or other governmental actions ultimately driving stock prices, rather than having a transitory effect. Although the effects of this policy will eventually pass, their impact has lasted much longer than previous instances, in some cases causing stock prices to be irrational for decades.

The effect has been a market increasingly sensitive to the swings of macro factors and events and less sensitive to fundamental valuation metrics. Chart 4 shows the sensitivity of the equity market to the Chicago Board Options Exchange Market volatility index (VIX), which indicates expectations of market volatility. Equities have always had a negative correlation to volatility, but that relationship has become much more pronounced over the past ten years.

Chart 4 (click to enlarge)

The relationship between equity markets and changes in the U.S. dollar has also dramatically shifted since the financial crisis, showing how much global currency flows and central bank decisions have affected stock prices.

Chart 5 (click to enlarge)

The financial crisis also brought about an entirely different relationship between global markets and commodity prices, which are often used as a key gauge of global growth and inflation. For decades, the two factors showed little correlation. But 2008–’09 brought a synchronized economic free fall, and the link has remained.

Chart 6 (click to enlarge)

The result of all these factors has been the demotion of fundamental valuation metrics as a major indicator of stock prices, as it has become much more difficult to add value strictly through fundamental analysis on the individual company level.

One way to measure if, and to what degree, the market is differentiating between fundamentally strong and weak companies is to look at spread factors. Charts 7 and 8 show the difference in spread between the strongest and weakest companies in the financials and industrials sectors, based upon ten standard fundamental metrics such as the earnings yield and price-to-book-value ratios. The strongest companies have high earnings yield, low price-to-book and strong profit margins, whereas the weakest have the opposite. In an environment in which investors reward fundamentally strong companies and punish the weak, the spread should be wide, as it was briefly in 2008 — although one could argue this behavior was a rush to safe, defensive stocks. But the spread has only narrowed over the past several years.

Chart 7 (click to enlarge)

Chart 8 (click to enlarge)

The factor spreads have uniformly declined across all sectors since 2008. In fact, with the exception of telecom stocks, all sectors have experienced overall declines, highlighting the fact that it is much more difficult to generate alpha using just the standard fundamentals.

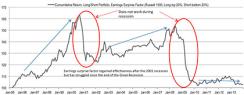

The decline in the importance of fundamentals is also evident when looking at how stock prices react to earnings announcements. Normally, one would expect that a company’s stock price would move correspondingly to its earnings. If earnings are higher, the stock price goes up, and vice versa. Chart 9 shows how since the 2008 financial crisis, investors have not reacted to earnings announcements as they did before. Investors are much more sensitive to other factors that drive overall stock prices, and much less sensitive to the underlying factors, in a particular company’s fundamentals.

Chart 9 (click to enlarge)

Despite all these issues, fundamentals do still matter. And although other factors have reduced the importance of fundamentals in recent years, there are several considerations that may help investment teams improve their process and their returns.

Think in terms of degrees of relationship. Increasingly, portfolio managers must contemplate second- and third-order fundamental impacts to find new investment ideas. For example, if there is a glut in natural gas that translates into cheaper crude oil prices, who is helped or hurt down the food chain? Everyone thinks about cars and airlines, but what about companies that make plastic bags, asphalt and even cosmetics? And which companies supply technology or machinery to those manufacturers? The point is, investors need to begin thinking earlier and deeper about investment themes.

Investors have to have an overall outlook, which consists of a thesis and a plan, and that plan must include a rationale for each trade, why a stock will move up or down. Analysis of fundamentals alone is insufficient. If a certain thesis does not play out, get out. If it does play out, you should already know the price level at which you no longer want to hold — or be short — the stock.

Incorporate macro factors into your analysis, and consider entry and exit on trades. Before buying or shorting any company, investment teams should do a careful analysis to understand what macro or individual market factors are closely tied to the stock price. There are the obvious relationships, such as oil and airlines, but by running a historical correlation, including such factors as interest rates, commodity prices, currency moves and industry volatility, you’ll find relationships you never thought existed. Once you identify these connections, pay close attention to them when considering entering or exiting a trade.

Understand who are the normal owners or traders of a stock. Who else closely follows this company, and are their motivations and objectives — holding period, investment versus hedge, big position or small trading position — the same or different from yours? Answering these questions is crucial if you don’t want to be left scratching your head at random price moves. A favorite of mine is when portfolio managers realize that two otherwise unrelated companies are connected because the stocks have similar shareholders. So when one stock sells off, holders look to cut their overall beta exposure by selling the other holding, which happens to include yours.

Understand the technicals. I know: Technicals? Fundamental investors are unwilling to factor technical indicators into their investment process. But not considering them is foolish. Whether or not you believe in technical trading, others do, and these indicators affect the stock price. Take time to look at key technical indicators, and determine if any correlate with your stock price. If they do, think long and hard about entry and exit around those indicators.

Watch the game film. The best sports teams watch game film, including their own and that of their competitors, trying to learn what they can do better. Within the investment industry, quantitative investment managers watch a lot of game film. They have a set of proprietary signals or factors they have developed over the years and have incorporated into their models. These managers regularly evaluate the effectiveness of these factors and adjust the models accordingly, reducing or eliminating those not working and constantly testing for new ones. The point here is not whether quantitative models outperform other styles— in fact, they have done quite poorly recently — but rather, that quant investment managers are always looking to improve.

Fundamental managers almost never do retrospective analysis. Despite the fact that the market can reward some factors in some years and punish them during others, fundamental investors rarely evaluate the effectiveness of their process over time and tweak it to reflect what the market is rewarding.

Barry Colvin is the head and founder of Colvin Capital, a firm based in Westchester County, New York, that works with investment firms to streamline and develop their business. Prior to establishing Colvin Capital, Colvin was the vice chairman and an executive committee member of Chicago-based hedge fund firm Balyasny Asset Management.

Data source: Bloomberg, J.P. Morgan Quantitative and Derivatives Strategy