< The 2014 Tech 50: Moving Out of the Lab and Into the Cloud

3

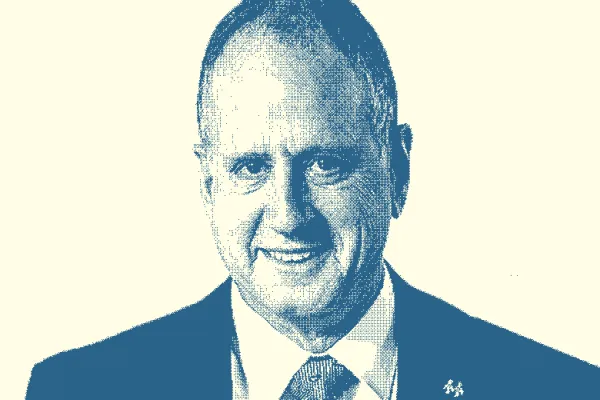

Catherine Bessant

Global Technology and Operations Executive

Bank of America Corp.

Last year: 4

Reflecting on one of the biggest jobs in financial technology — or anywhere in banking, for that matter — Catherine Bessant waxes philosophical: “Is technology a supporting element of banking, or is it what we sell?” Bank of America Corp., of which Bessant has been global technology and operations executive since 2010, had 238,560 full-time employees as of March 31. Today, with a $17 billion operating budget, Bessant’s group consists of some 124,000 staff and contractors, 40,000 of whom came on in April, indicating how the balance is tipping at $2.1 trillion-in-assets BofA. “We still have to deliver on all the traditional fronts, reducing the cost of providing services, [ensuring] stability and platform performance,” says Bessant, 54, who previously served as BofA’s president of global corporate banking and chief marketing officer. “But innovation is increasingly about technology capabilities,” which will be critical to growth and competitiveness. Emphasizing the importance of intellectual property, the Charlotte, North Carolina–based bank obtained 265 patents last year, 62 percent more than in 2012. “Think about the transformation of our business model against a backdrop of serving 30 million active online customers and 15 million mobile customers,” Bessant says, noting that delivery channels are changing and customer loyalties can swing in a world of handheld devices and social media. She regards regulatory change as “an opportunity to make our work better. You can’t motivate a large technology and operations organization if you classify a significant portion of the work as a burden.”

The 2014 Tech 50

1

Dave Cross

| 1

| 3

IAN CURCIO 2011

| 4

FayFoto/Boston

| 5

Teri Pengilley

|

| Thomas Secunda Bloomberg | Jeffrey Sprecher Intercontinental Exchange | Catherine Bessant Bank of America Corp. | Stephen Neff Fidelity Investments | Lance Uggla Markit |

6

| 7

| 8

Photographer:Charlie Simokaitis

| 9

| 10

Mark McQueen

|

| Robert Goldstein BlackRock | David Craig Thomson Reuters | Phupinder Gill CME Group | Anna Ewing NASDAQ OMX Group | R. Martin Chavez Goldman Sachs Group |

11

| 12

| 13

| 14

| 15

Christopher Elston

|

| Deborah Hopkins Citi Ventures | Dan Mathisson Credit Suisse | Daniel Coleman KCG Holdings | Michael Spencer ICAP | Michael Bodson Depository Trust & Clearing Corp. |

16

| 17

| 18

Todd Plitt

| 19

| 20

|

| Joe Ratterman BATS Global Markets | Dominique Cerutti Euronext | Ron Levi GFI Group | Gaurav Suri D.E. Shaw Group | Charles Li Hong Kong Exchanges and Clearing |

21

Larry Lettera/ Camera 1

| 22

| 23

| 24

XT

| 25

|

| Lou Eccleston S&P Capital IQ | Lee Olesky Tradeweb Markets | Richard McVey MarketAxess Holdings | Seth Merrin Liquidnet Holdings | Antoine Shagoury London Stock Exchange Group |

26

Production

| 27

Wayne R. Martin

| 28

| 29

Thorsten Jansen

| 30

Adam B. Auel

|

| Christopher Perretta State Street Corp. | Kevin Rhein Wells Fargo & Co. | Peter Carr Morgan Stanley | Hauke Stars Deutsche Börse | Robert Alexander Capital One Financial Corp. |

31

| 32

| 33

Paul Elledge

| 34

| 35

Stephen Brashear

|

| David Gershon SuperDerivatives | Chris Corrado MSCI | Joseph Squeri Citadel | Tanuja Randery BT Global Services | John Bates Software AG |

36

| 37

| 38

| 39

Photo Credit: Kevin Irby

| 40

|

| Gary Scholten Principal Financial Group | David Gledhill DBS Bank | Simon Garland Kx Systems | Cristóbal Conde FinTech Innovation Lab | Jeff Parker EidoSearch |

41

| 42

Jeff Smith Photo

| 43

| 44

| 45

|

| Kim Fournais & Lars Seier Christensen Saxo Bank | Kenneth Marlin Marlin & Associates | Tyler Kim MaplesFS | Jim McGuire Charles Schwab Corp. | Jim Minnick eVestment |

46

| 47

| 48

tomohisa ichiki

| 49

David Poultney

| 50

A.E. Fletcher Photography

|

| Steven O’Hanlon Numerix | Sebastián Ceria Axioma | Yasuki Okai Nomura Research Institute | Niki Beattie Market Structure Partners | Mas Nakachi OpenGamma |