Investors in Russian stocks may be finding it difficult to dump their holdings, but forward-looking short sellers are sitting on around a billion dollars in gains, given the collapse of Russian shares over the past two weeks.

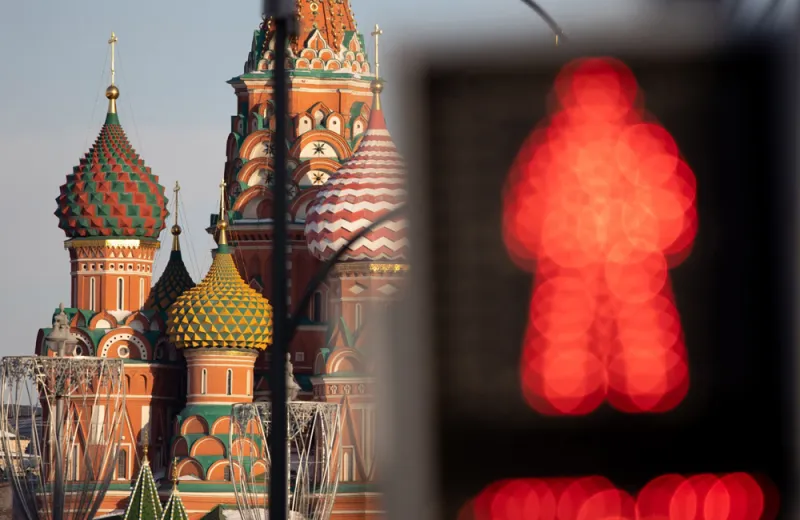

Putin’s invasion of Ukraine, which has been met with brutal financial sanctions from the West, led Moscow to shut down its stock market this week and to forbid foreigners to sell shares there. In addition, the MSCI has removed Russian stocks from its indices, the New York Stock Exchange and Nasdaq have halted trading in some Russian securities, and the London Stock Exchange has halted trading in 27 Russian securities.

Even with the local market shut, the stocks have been tumbling — which is good news for the bears. “With Russian ADR\GDR stock prices in a freefall, short sellers have had outsized returns in their trades,” Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, wrote in a research report Thursday.

He said that overall Russian ADR\GDR shorts are up $723 million in year-to-date mark-to-market profits on an average short interest of $699 million, which is a return of 103.34 percent.

Sberbank, which is Russia’s biggest lender, is the most profitable Russian ADR short, with short sellers sitting on marked to market gains of more than $165 million, a 173 percent gain, this year.

The bank, which has outposts all over Europe, said Wednesday that it would exit the European market after the European Central Bank ordered the closure of Sberbank Europe, saying the bank could fail due to a run on its deposits.

Other well-known heavily shorted Russian ADRs include Gazprom and Rosneft Oil, whose shares tanked after Western companies pulled out of them. Shorts are up more than 100 percent in those names. Since the invasion of Ukraine, BP said that it would shed its stake in Rosneft, while Royal Dutch Shell said it would cut ties with Gazprom. Then Exxon Mobil announced it would pull out of production facilities it manages with Rosneft and stop all future investments in Russia.

Most of the short seller gains were made after President Biden said the U.S. believed Putin was planning to invade Ukraine, as the Moscow stock market hit its high on February 16, the day before that announcement.

Since then, Russian ADR\GDR shorts are up $698 million in year-to-date mark-to-market profits on an average short interest of $638 million.

Dusaniwsky said short sellers have also been able to profit on shorting ETFs that focus on Russia, like VanEck’s Russia ETF, Blackrock’s iShares MSCI Russia ETF, DWS’s Russian Fund, and Franklin Templeton’s FTSE Russia ETF. All have halted new ETF creations.

Perhaps the best example of their fates is VanEck Vectors Russia ETF, under the ticker RSX.

As of Wednesday, RSX shorts were up $310 million in year-to-date mark-to-market gains, Dusaniwsky told Institutional Investor in an email late Wednesday.

“Over the last thirty days we saw an increase in shares shorted of 2.05 million shares, worth $17.0 million, an increase of 14 percent as its stock price fell 64.7 percent,” Dusaniwsky said. It appears to be getting more expensive and less profitable to open shorts in these securities as the prices have gone so low. Over the past week, he said the amount of the ETF’s shares shorted only jumped 6.8 percent while the stock price fell 60.6 percent.

The marked-to-market gains for RSX shorts represent an increase of 88.7 percent on an average short position of $299 million, he said. The vast majority of these profits –some $258 million worth — are since February 18.

Dusaniwsky notes that the ETF’s short interest is $137.83 million, for about 17.88 percent of the float. And that is despite a hefty 9.32 percent borrow rate that is climbing higher.

“Stock borrow availability in Russian ETFs, ADRs and GDRs is getting very tight — additional short selling may be limited and will definitely get more expensive,” he said. In RSX, for example, he said, “we are seeing rates top the 20 percent level today as demand is far outstripping supply.”

On Thursday, the VanEck Vectors Russia ETF fell another 20 percent. It is now down 78 percent for the year. The ETF’s shares have been falling precipitously since President Biden said he was convinced that Putin was planning to invade Ukraine.

But realizing all these gains may be difficult, S3 Partners warns: “Shorts sellers, as well as long shareholders, may be stuck in their positions until trading re-opens in many of these securities.”