According to the 2021 Pepperdine Private Capital Markets Report, limited partners saw direct investments as the asset that offers the strongest risk-return tradeoff. In fact, 36 percent of LP respondents agreed with that assessment.

“I wouldn’t have guessed that,” said Pepperdine University finance professor Craig Everett, the director of the Private Capital Markets Project, in an interview with Institutional Investor. “Direct investments carry a lot of risk, so if they have the best risk-return profile, that would mean that the return has to be really good. [The LPs] must be really expecting high returns.”

Everett attributed LP trust in direct investments to an overall increase in access to information over the past decade. “Over the last five to ten years, direct investments have gotten more exposure,” he explained. “I think the big institutional investors who are looking for these investments have a much easier time finding them now than they did before.”

In the 2020 report, respondents had also flagged direct investments as offering the strongest risk-return tradeoff, at a rate just slightly lower than the 36 percent recorded this year. But growth private equity was also a strong contender in the latest survey, with 21 percent saying that the asset offered the best tradeoff, compared to just 10 percent in 2020.

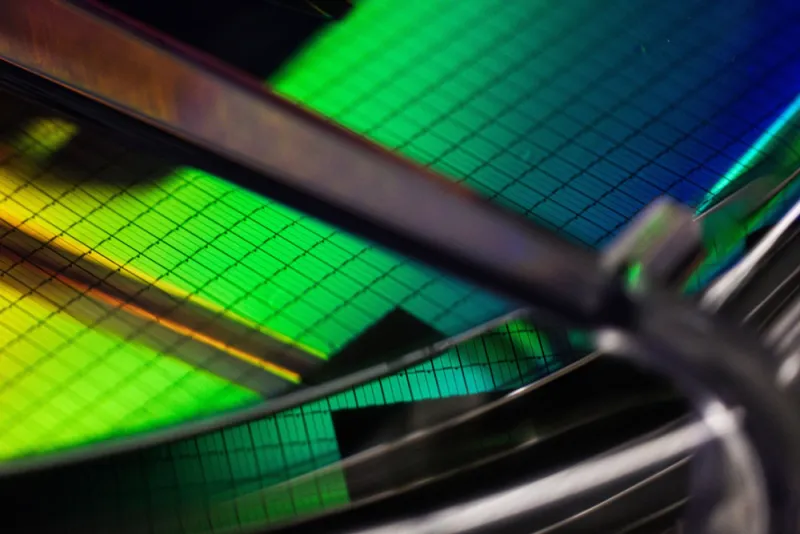

LPs also marked specific industries as their favorites. According to 19 percent of the respondents, the information technology industry currently offers the best risk-return tradeoff. Other top contenders included healthcare and biotechnology (15 percent) and consumer goods and services (15 percent).

The report, which has been produced annually since 2009, was comprised of 12 different surveys of professionals from various subsets of the private capital industry, including, among others, LPs, investment bankers, venture capital professionals, brokers, and private equity professionals.

While there was a marked decrease in allocation to hedge funds, respondents recorded increases in allocations to venture capital, private equity, mezzanine capital, secondary funds, real estate funds, and direct investments. “They’re definitely expecting an increase in allocation to a really broad range,” Everett said. “In anticipation of a crash, I think a lot of investors are moving more of their funds’ higher allocations away from traditional public stocks and [into] alternatives.”

According to the report, 23 percent of respondents aim to allocate their assets to direct investments and 16 percent to VC. In 2020, 38 percent of respondents targeted allocations to direct investments, but only 9 percent to VC. This year, VC surpassed private equity buyouts and real estate funds as the second highest asset in terms of target allocation.

“VC has gotten quite a boost in the past year,” Everett said. “There are a lot more VC funds out there now, and there’s obviously a lot more VC money. This would be consistent with that.”

Everett said private equity buyouts moved down the ranks of LPs’ target allocations because PE buyout deals are usually leveraged, which requires that the target company be profitable. Everett suggested PE leveraged buyouts dropped this year because companies that would otherwise be in the middle markets were hit hard by the Covid-19 pandemic.

“It’s less of a target-rich environment for profitable lower-middle market companies because of [the events of] 2020,” he added.