SEI

In the pre-Covid 19 world, institutional investors’ penchant for alternative investments showed no signs of slackening. While the pandemic hasn’t necessarily affected that fervor, it has seen some investment boards clicking pause on alternative allocations, and the relationships between some GPs and LPs is almost certain to experience some new pain points as the challenge continues. To that end, this special report will focus on how key operational areas can be leveraged to strengthen relationships between alternative investment management firms and their investors.

First let’s take a look at the state of play: In a global survey of asset owners conducted by Institutional Investor1 after the Covid-19 pandemic shuttered much of Europe and the U.S., about 60% said it was too soon to tell what might be the most attractive risk-adjusted buying opportunities in private markets. In interviews for the survey, one investor in alternative funds said that “if valuations [of alternatives] don’t come down as much as they did in public markets,” allocation levels would be maxed out, taking new private markets deals off the table while valuations filter in over the next six months.

Another investor said this had already happened at his fund. “Our soft limits on alternatives have been hit, so the board has pulled the emergency brake on the deal pipeline of structured credit, private equity secondaries, and so on. It’s frustrating.”

Writing in International Investment, Ryan McNelley, a managing director in Duff & Phelps’ portfolio valuation practice, noted that “in private markets, GPs and LPs are grappling with the impact on the value of portfolios. While the dislocation could signal a buying opportunity for private equity, distressed debt, and special situations funds in particular, many GPs will be focused on protecting the value of their portfolio companies.” With the economic impact of the crisis “only just starting to filter through,” writes McNelley, “this leads to potentially difficult discussions between GPs and LPs.” On the LP side, defaults could increase if opportunities arise due to depressed prices and LPs cannot respond to capital calls.

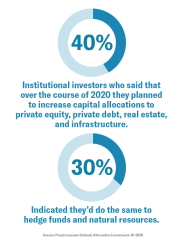

Reasons for investors’ well-documented increased commitment to alternatives range from improved portfolio diversification to less correlation with other asset classes. The appetite for alternatives remained undiminished in the lead up to the current crisis – nearly 40% of institutional investors said that over the course of 2020 they planned to increase capital allocations to private equity, private debt, real estate, and infrastructure, and nearly 30% indicated they’d do the same to hedge funds and natural resources. Similar intentions were expressed for allocations over the long term, as well.2

GPs know the important role they play for their investors. With tough conversations with LPs to come, and many investors likely to reassess manager performance as the crisis lessens, it’s a good time for alternative investment managers to take a look at the inner workings of their shop beyond their core excellence in sourcing deals and portfolio construction and management. By doing so, GPs can create efficiencies that allow them to devote more time to investment decisions, and at the same time, strengthen their relationships with investors – two things they will benefit from in the future.

This was a bold projection when, according to another report9 from roughly the same time, “Data management has also proven to be a vexing challenge for many firms. One out of three LPs now expect GPs to provide for data mapping into their portfolio monitoring systems.”

Effective data management relies heavily on technology, which in itself is ever improving. Keeping up can be costly, and even for larger firms with deep pockets, that can be a challenge. And if LP expectations back in 2015 were “vexing,” a 201910 survey showed how much so by revealing that only 1 in 10 asset owners were willing to pay more for managers that use big data in their investment research and idea generation (as opposed to managers that do not use big data for same). If that doesn’t vex managers, this certainly will: in response to the same question, 10% of investors said they expected to pay less.

GPs up their reporting game – sort of

As noted earlier, institutional investors expect new levels of transparency from traditionally opaque GPs, particularly in performance attribution and operating expenses. Reporting frequency can vary significantly by asset type, and the lack of standardization can make it challenging for firms moving into a new asset class. According to one 2017 study, monthly reporting is standard among hedge funds, although a small number (1 in 10) provide weekly reports. Quarterly reporting is much more common for private equity, private debt, and real estate funds. Infrastructure investments tend to produce the least frequent reports. For them, quarterly is standard, but one out of five infrastructure managers only offer annual reporting.11

Perhaps the necessity to meet investor expectations on reporting is in the eye of the manager. Only 6% of hedge funds in one study12 listed enhanced investor reporting among their top three strategic priorities for the firm. Same study, same question, a much larger 21% of private equity firms said it was a top three strategic priority. As a more “traditional” and liquid alternative product, hedge funds possibly feel they have sufficiently addressed reporting as they’ve been answering questions about it for a longer period of time.

Many firms are moving beyond periodic reports by offering some combination of customization and online access. For example, tailored reports were offered by approximately two out of three alternative managers in 201613 and in a more recent survey the top five types of custom reports were: one-off bespoke reporting upon request; risk and compliance; full position level transparency; open protocol; and, standard reports in tailored formats.

With more resources and a higher percentage of institutional investors, larger and more diversified firms are more likely to offer customizations than their smaller competitors. Online account access is still far from universal, and is more commonly offered by larger firms, particularly those managing multiple asset classes.14

Attuning to customization

Customization is almost surely central to the future of alternatives. More than seven out of every 10 firms plan to offer customized investment vehicles, with many planning to launch co-investment vehicles, separately managed accounts, or other structures.15 The abundance of investment vehicles – customized or standard – is likely to test the personnel, processes, and profitability at many firms. Outsourcing relationships will become more critical and investments in technology internally will need to be judicious.

The sentiment expressed by that investor is indicative of a larger aspect of the state of play in alternative investments – specifically, investors and managers have different priorities and view their relationships through different lenses. Of course, both want their investments to perform like gangbusters, but how they get there matters, too.

Wanted: Improved reporting

In the same EY survey, 40% of investors indicated that improved reporting is among the top three things they’d like their managers to focus on; enhancing middle- and back-office technology is on the top-three wish list of 13% of investors. In other words, they’d like to see their managers invest in the “infrastructure” mentioned by the investor in the EY survey.

Improved reporting has been on the minds of investors for some time now. In a 2017 SEI/Preqin survey of LPs4, only 12% of investors said reporting frequency was unimportant to their firm when evaluating funds and fund managers. At the time of that survey, less than 40% of investors said they’d seen an improvement in reporting frequency during the preceding three years. (It should be noted that the current crisis has brought out the best in GPs as communicators, according to Private Funds CFO, which recently reported that “GP communication has often been a point of dissatisfaction among LPs, who generally want more, specific and easily digestible data from their managers. But in the current downturn, LPs have reported frequent and broad communication from GPs…” The question is, will the new found love of communication extend to reporting post-crisis?)

Customization in demand

Everyone loves customization – institutional investors, included. Alternative investment firms are being challenged by investors to be original and create solutions that aren’t off the shelf boxed offerings.

- Nearly half of institutional asset owners invest in funds with customized fees and liquidity terms.

- More than a third invest in funds with customized portfolio exposures and funds with customized transparency and reporting.5

More recently, a Deutsche Bank survey just prior to the Covid-19 downturn indicated that nearly a third of institutional investors now have customized mandates, which on average account for approximately 9% of their total assets.6

With customization and diversification in demand, managers are taking a second and third look at their product offerings to see where there is room for innovation. Customization of investment strategies, fund structures, and investor communications should all be anticipated. To achieve what investors want in customization, managers will also have to reassess their operational and technological infrastructure to establish if and how they can accommodate the launch of innovative products, entry into new markets, and/or the provisions of further detailed and more timely reports. After all, operations and infrastructure should be viewed as catalysts for growth, not roadblocks.

Lessening the hassle of onboarding

A few years ago, research found 58% of private equity funds said fundraising time had increased compared to their preceding fund – and 16% said it increased significantly.7 No doubt part of that time was spent on LPs filling out non-standard subscription forms, which are typically dense paper documents that leave plenty of room for errors and omissions and require time intensive review.

“In the alternatives industry, there is no standardized subscription documentation for alternative investment funds,” says Joe Henkel, currently Ireland country head and one-time Director of Global Solutions at SEI, one of the world’s leading providers of technology-driven wealth and investment management solutions. “Each private fund has unique qualities, and a law firm will create subscription documents and investor packs that can run to 40 pages or more. They differ between each law firm, fund product and jurisdiction – it is quite a fragmented industry from that perspective. Given that the first impression many LPs get is this inelegant sub doc process, it’s not surprising that investor reporting is equally non-standard and often unsophisticated.”

In short, no investor will ever say they love filling out subscription forms – they want to invest their money! Investors want simplified onboarding processes that take less time. In turn, managers might find easier onboarding shortens the time necessary to raise funds, which can in turn enable them to make speedier portfolio investments.

Transform your organization by learning more about how to improve the investor experience.

Once investors could see behind the curtain, their expectations rose. Investment expertise from GPs was still prized – but the “nice to have” amenities of the investor experience became more of a demand. In short, GPs continue to experience an investor-driven shift in how their value proposition is defined. Here’s a short list of key focus points for alternative managers as they consider the benefits of improved operational excellence.

- Broadly diversified managers and specialist GPs alike must understand that their operational capabilities form a core part of their value proposition.

- Ultimately, asset managers must determine whether they can enhance their investment expertise with a streamlined and technologically supported investor experience.

- Platforms such as SEI Trade enable seamless changes to workflows and processes to accommodate the ever-evolving legal and regulatory environment and operational requirements. They also enhance the investor experience by minimizing manual onboarding tasks associated with private fund investing, significantly improving and streamlining investors’ onboarding experience, while simultaneously reducing errors.

- The ability to embrace big data, robotics, and AI is becoming increasingly important, and in some instances, is a core requirement for managers to differentiate themselves in an increasingly crowded field.

- The talent search at asset managers will evolve to include more diverse skill sets and backgrounds to help firms transition toward priorities being driven by product proliferation, increased data analytics, as well as implementation of new technology throughout organizations.

- Convergence in alternatives is an old trend at this point, but its main knock-on effect remains – firms that make up the alternatives community now compete not only against each other, but also versus traditional (and often very low-fee) long-only products and solutions.

- Alternative managers have not been as quick as their long-only counterparts to outsource various aspects of their businesses, but this is changing as their operations become more complex and investor expectations rise. Fund accounting and administration are two of the most commonly outsourced functions.

- A wide variety of other back- and middle-office functions also are being outsourced by a significant number of firms, including regulatory compliance, data management, trade reconciliation, and so on. Almost one in three firms outsources investor reporting.

- As businesses become more complex, it will become increasingly critical that operations run on flexible, integrated platforms that focus on investor outcomes rather than the underlying technology.

- Systems will need to be capable of handling closed-end and commitment-based fund structures alongside more liquid portfolios. Listed securities and syndicated loans from around the world need to be accommodated alongside traditional assets.

- Full data transparency will increasingly be the norm, with multiple systems being able to talk to one another so managers can provide insights across asset classes, structures and vehicles. More sophisticated infrastructure will also enable multi-strategy funds to customize their risk exposures.

Learn more about SEI’s order processing manager and investor document tracking.

- Institutional Investor Allocator Intel Survey, March 2020

- Preqin Investor Outlook: Alternative Investments H1 2020

- EY 2019 Global Alternative Fund Survey

- 2017 SEI/Preqin LP Survey

- EY 2018 Global Alternative Fund Survey

- Deutsche Bank’s 18th Annual Alternative Investment Survey, 2020

- Going the Distance: The Expanding Lifecycles of Private Equity Funds, Pepper Hamilton LLP, 2017

- Alternative Asset Management 2020: Fast Forward to Centre Stage, PwC, 2015

- 2016 SEI Private Equity Survey

- EY 2019 Global Alternative Fund Survey

- 2017 SEI/Preqin GP Survey

- EY 2019 Global Alternative Fund Survey

- 2017 SEI/Preqin GP Survey

- 2017 SEI/Preqin GP Survey

- 2017 SEI/Preqin GP Survey

In your conversations with alternative investment firms, where do they see themselves as needing the most help?

Investment firms focus most of their effort and spend on the investment process – everything from research to security selection to ongoing due diligence – as they should. Historically, they haven’t really focused as much of their time and effort on the investors themselves – and that is a shortcoming they are increasingly recognizing.

Where do you see the opportunity for them to improve the investor experience?

To improve the investor experience overall, they need to focus on the aggregation of data across multiple vendors and throughout the firm itself, fund administration activities, and any operational outsourcing. Drilling down, there’s a big opportunity in hyper-focusing on investor data management from onboarding, to aggregation, to the racking and stacking of data, and delivering it back to the investor. This is the underserved and underutilized part of the business. That could become particularly important to firms especially now, as they tend to realize how much more important client relationships are when there’s any kind of economic downturn or extreme market volatility.

And, of course, investor expectations change, too – and managers need to keep up.

I agree. Even if you just look back to the global financial crisis of 2007-2008, you can see the evolution of investor expectations. That’s when regulatory processes and institutional investor concerns over transparency really started to drive the requirements around managing data on investors and providing more transparency into investments. More recently, you’ve had firms looking at different ways they can increase assets under management by creating more opportunities across different types of investors – maybe going down from just focusing on large institutional firms and looking a little bit more at family offices and individual investors and how you can distribute to them. That requires a strategy around what your distribution model is going to be. To establish that, you need to look at everything from how you handle research and analytics to the actual underlying investments, vehicle structure, and terms and conditions.

If managers succeed in generating new opportunities outside of their typical universe of clients, would that place greater emphasis on the investor onboarding process?

Absolutely. We’ve invested heavily in creating a digital onboarding process to make the experience of starting a new relationship better for the investor as well as the manager. It decreases the time that it takes to onboard so that assets can be invested sooner. At the same time, a digital process kicks in regarding how investors interact with their funds going forward. There is consistent, timely interaction between the manager and the investor, and that helps forge a stronger relationship.

What makes your onboarding process different?

Traditional hedge fund subscription documents, for example, can be up to 40-60 pages long. It’s a laborious process to fill them out, mail them, and have someone review them only to find you incorrectly populated some data or made simple mistakes answering questions. Back it comes to you to fix, and back you send it, and so on. For the investor, it can be a very slow going before their assets are actually invested, and even then, the information flow about the investments can be agonizingly slow. For the manager, it can take a significant amount of time to onboard just one investor – time that could be used for more valuable, additive activities.

At SEI, we recognized that we could remove the actual paperwork by digitizing the document in a way that allows for flexibility, because every sub doc is different. In what we call SEI Trade, we use rules-based capabilities, where we can take a hedge fund’s sub doc and turn it into an easy online experience, populating only the necessary information and efficiently processing it. The built-in rules and workflow prompt review and approval by all necessary participants, including legal and investor relations at the fund complex. So, we’ve not only improved the experience, but we’ve also put controls in place that streamline and improve the quality of the processing. What used to take months can now be done in weeks, if not days.

You’ve talked about the relationship between managers and investors. How has the dashboard experience changed for both?

About 15 years ago we recognized a need to give our clients online access to their data, rather than just sending them hard copy documents and data stubs. At the time, we built out what we called our Manager Dashboard, which was essentially a report writing capability that took the data we were processing for our clients and delivered it online in an actionable way. Around the same time, we started offering an Investor Dashboard, which initially was simply a secure document portal. For example, the statement an investor normally would have received in the mail could be viewed by logging into the highly secure portal.

Over time, we heard from managers that they wanted to send investors graphs, charts, underlying data, and other information, and it became more of true dashboard. Managers wanted to drill deeper into the data and create reports on the fly, and investors wanted transparency in digital form with visuals in charts and graphs. From our perspective, what managers and investors wanted all pointed to the same data and document sets. That’s really important in creating consistency and control – a consistent set of information is delivered, but then the manager has the ability to control what data they expose to the investors. You could describe what the manager and investor each see on their dashboard as role-based views. For example, if something’s an estimate, a manager might not want to show that to an investor. In the alternatives space in particular, the manager might not provide transparency down to the level of the actual security. They might just tell investors the sectors, industries, asset classes, and countries that they’re invested in – that’s just the nature of that business.

SEI has been a leader in financial technology-driven solutions for a long time. Do you see more managers looking to outsource their technology needs rather than try to keep up with the cost of the latest innovations?

I think it’s more about focus and intent – what technology can we can take off their plates so they can focus on the more value-based portions of their job. On the regulatory side, for example, we can do a lot of the processing so that the manager just has to review the output and weigh in on anything that might affect the firm. Once a manager is comfortable with an outsource partner, they often start to consider what else they can delegate so their firm can focus on its core functions and competencies – and while they may outsource the underlying work to a trusted partner, they are still able to maintain ultimate control and authority. We don’t talk about it like we’re smarter than our clients. We might say, “We do this for 250 clients who run businesses similar to yours. These are activities and processes that we see working effectively and efficiently – why would you want to try to figure out how to do something a different way on your own? Your strength and market advantage is making investment decisions and constructing portfolios. Our strength is based on a vehicle and asset class agnostic platform created to handle all of the things that detract from your focus on your core strength.”

How important is customization to managers?

We could not have grown our business without customizable solutions. “Any color as long as it’s black” doesn’t work well in the alts space. Most of our clients want a customizable look and feel, just like the way they interact with their investors. They feel strongly about the format and look of the reports they have developed internally to manage their day-to-day business, and they want to maintain or improve upon that, not be forced to accept something that’s rigid and one-size-fits-all. We’ve built out our solutions flexibly enough to allow for that. And having been at this for decades, our capabilities have evolved in step with industry tech and business intelligence tools. There are business intelligence tools that allow us to help managers deliver deeper details and information to their clients in customizable way, too. Due to the length of time we’ve been servicing this market and the 500-plus clients we work with, we have a lot of experience when it comes to best practices, and I think our clients appreciate and perceive a strong benefit when we share our perspective. It doesn’t mean we’re going to dictate to them, or not work with them to do what they know helps them stand out in the market, but they do see a value in our broad perspective.

What does a more advanced level of customization look like?

Allow me to use an example. APIs – application programming interfaces – are how our internal systems at SEI talk to each other. We thought there might be some value in our clients being exposed to these integration points if they wished to, say, create their own unique and customized web application or an internally built trading system. They can leverage the same type of connection points that we use internally or that we use for other clients. There is limitless flexibility and customization for clients who leverage this – it’s still relatively new and in the implementation stage across all of our client base, but it has been very well received. We’ve also seen some interesting connections between ourselves and third parties open up as a result.

With all the capabilities we’ve been discussing, how do you think the investment firm of the future will take shape?

Everything we’ve talked about is enabling technology, so I think the investment firm of the future will see people doing increasingly higher value work. If you can reduce the time people spend reconciling information from one system to the next, or one source to the next, and instead just manage exceptions, you’ve changed their workday and the type of work that they can do. That applies to someone in the investor servicing group for an alternative fund manager, too. If they’re spending less time reading and verifying information in a sub doc, or typing it into a system, or creating a report to send to an investor, and more time learning about investors’ proclivities and behavior, you’re really changing their job. You’re empowering them to do higher level analysis and make higher level decisions.

One thing we’ve noticed over time is that our platform grows and expands as investment strategies, capabilities, and market environments do the same. As we come out of the Covid-19 crisis, we will likely see some interesting things that change how investors invest, and what they’re investing in. There will probably be more innovation on both the investment side and the processing side around private equity, private debt, real estate, and other alternatives. Leveraging operational and technological flexibility will be critical, for sure.

Learn more about SEI’s order processing manager and investor document tracking.