A recent environmental report by Refinitiv examines the impact that industries, countries, and companies are having on the planet. Using its ESG data, Refinitiv identified trends in corporate emissions, and progress on recycling, supply chain risk, and water efficiency.

Companies are a leading source of pollution, from energy production to solvent use. Refinitiv’s report analyzes what industries, countries, and companies are doing to reduce their negative impact on the environment. The data shows that more companies have committed to take their impact on the environment seriously, although that commitment is not backed up by specific targets. A notable rise in companies setting specific water efficiency targets suggests this is the next area of focus in efforts to ensure that companies are acting sustainably.

Here are some of the key findings from Refinitiv’s “A Deep Dive Into Environmental Metrics.”

Transition to low carbon economies

The report found that 63 percent of companies within Refinitiv’s ESG database, which covers 70 percent of the world’s market cap, have a policy to reduce emissions.

This is up 56 percent from five years previously, showing a solid trend of companies committing to take their impact on the environment more seriously.

However, only 35 percent of companies have specific reduction targets around their emissions, meaning many are setting up policies without backing up their intentions.

Recycling to protect the planet

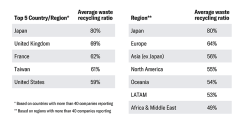

When looking at the average recycling ratio of companies by country, the top performers are spread across the globe, with Asian and European countries leading the way.

To counter the amount of waste they produce and to improve recycling, companies are increasingly committing to and publishing their resource reduction policies.

In a similar vein to emissions, many companies have strict resource reduction policies (78 percent). However, far fewer are putting tangible targets in place (30 percent), and only 26 percent have both in place.

Risks in the supply chain

Refinitiv’s data shows that over the past five years, the number of companies with a focus on the environmental impact of their supply chain has increased by 44 percent.

Now, more than 50 percent of companies report on environmental policies for their suppliers, based on the Refinitiv ESG database.

The rise of environmentally friendly products

In 2017, 46 percent of companies reported having products or services that are environmentally friendly — that’s an increase from 39 percent of companies in 2013.

Importance of water efficiency

Over the last five years, there has been a 25 percent increase in companies with water efficiency policies, with 34 percent more companies setting specific water efficiency targets.

Interestingly, the number of companies reporting on water policies and targets is far less than those reporting on emissions, but the percentage increase in the last five years is larger.

Could water efficiency be the next area of focus in efforts to ensure companies are acting sustainably?

Reducing energy use

The research found that the average energy output (gigajoules) per million US dollars in revenue for a company is 4914.563.

Regarding the highest energy use by revenue, the results are not surprising. It is interesting to note that of the highest energy consumers, the majority have not improved in the last five years.

For further details, download the full report.

Refinitiv ESG Data

At Refinitiv, we strive to be the trusted and preferred partner for Environmental, Social and Governance data and solutions, and are committed to bringing to the market an array of best-in-class data, analytics and fully integrated workflow solutions.

We have deep domain expertise and have been providing ESG solutions to the financial industry since the early 2000s.

Discover how to make sound, sustainable investment decisions with Refinitiv’s ESG Data.