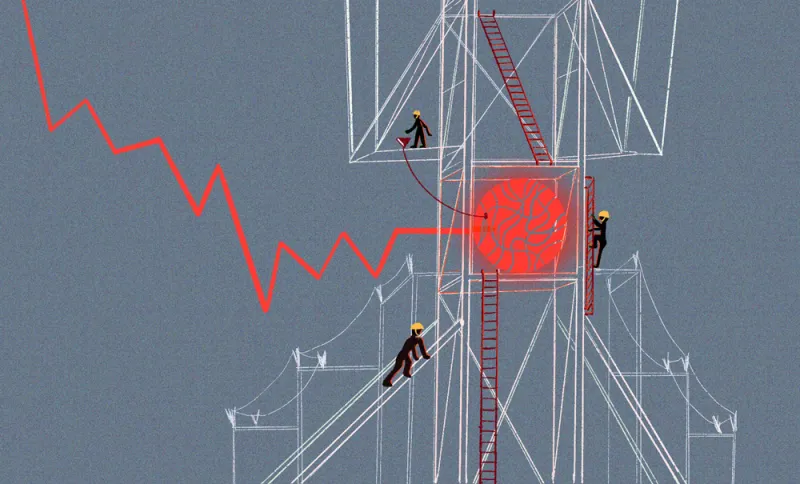

Hedge fund alpha is at its lowest point in almost three decades – but asset owners don’t have to choose between dumping hedge funds or settling for subpar performance, according to a new paper from Willis Towers Watson.

In the paper, the consulting and asset management firm argued that allocators could improve their hedge fund portfolios by taking a different approach to manager selection and portfolio construction. By seeking out specialist managers, asking for customized products, and negotiating on fees, Willis Towers Watson said institutional investors can build hedge fund portfolios that deliver the required returns.

“Simply assuming that the macroeconomic situation will improve and boost returns is a strategy of hope, and we’re urging investors to adopt a new approach to ensure they’re selecting the right manager, mandate, and fee structure for their hedge fund portfolios,” said Sara Rejal, global head of liquid diversifying strategies at Willis Towers Watson, in a statement.

According to Willis Towers Watson, hedge funds are currently floundering in part due to the ongoing bull market and lower volatility in equities. Data shows that hedge funds are taking on less risk than they were previously, setting them up for lower returns.

Combine this with typically high fees and increased competition from alternative beta strategies, and the result is a struggling sector in the asset management industry, according to Willis Towers Watson.

“In recent years, hedge funds have become too focused on issues that are tangential to investment performance,” Rejal said.

[II Deep Dive: Fundraising Has Never Been Tougher for Hedge Funds]

When it comes to building hedge fund portfolios, Willis Towers Watson said investors should select managers that have a “unique competitive advantage” in specific, isolated areas of the market, rather than choosing generalist funds with “lower-conviction ‘risk-management padding’ that can suppress returns.”

Another way to improve hedge fund performance, according to the paper, is to work with managers to customize a portfolio based on the investor’s risk and return needs. Instead of investing in anything off-the-shelf, Willis Towers Watson suggested that allocators collaborate with managers to determine the structure and strategy of the investment.

Finally, Willis Towers Watson said that allocators need to work with hedge funds to create fee structures that make more sense. “Fees should reflect the manager’s cost structure, the underlying strategy, and the risk level,” the paper concluded.