The New York Attorney General’s office has waded into the active-versus-passive debate in investment management, issuing a report critical of actively managed funds.

The office’s Investor Protection Bureau conducted an investigation into mutual fund disclosures and fees, and settled on active share as a key metric for tracking whether managers are, in fact, actively investing client assets, according to an April 5 statement from Attorney General Eric Schneiderman.

Active share measures the percentage of stock holdings in a portfolio that departs from the benchmark index. Managers with very low active share and decidedly active fees are often derided as “closet indexers.”

[II Deep Dive: A Reality Check on Active Share]

The Attorney General said thirteen major asset managers have agreed to begin disclosing their active share measures quarterly for their equity-based mutual funds: AllianceBernstein, BlackRock, Dreyfus Corp., Capital Group Cos., Columbia Management Investment Advisors, Eaton Vance Management, Goldman Sachs Group, JPMorgan Chase & Co., OppenheimerFunds, Nuveen, T. Rowe Price Associates, USAA Asset Management Co., and the Vanguard Group.

“While these major mutual fund firms regularly disclosed this information to well-heeled institutional and professional investors, retail investors were often excluded,” Schneiderman said in the announcement.

Fidelity Management & Research Co., which was also surveyed by the Attorney General, already publishes active share for its mutual funds, according to the announcement.

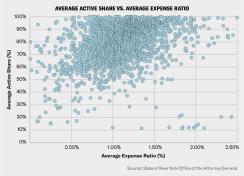

“Significantly, our review shows that investors cannot necessarily assume that a high fee or expense ratio means that a fund will have a high active share,” the Investor Protection Bureau said in the report of its findings. Funds with average expense ratios — ranging from 0.55 percent to 1.75 percent — ranged in average active share from 60 percent to 100 percent.

A few outliers had portfolios with about 90 percent overlap of their benchmarks, and average management expenses of 2 percent or more, the report showed.

“Who are these clowns in the bottom right...” tweeted Cambria Investment Management CIO Meb Faber on April 5, referencing an image of the below chart. “I mean, 2%+ and not even pretending ...”