Hedge funds have made it back into investors’ good graces.

After finishing 2017 up 8.68 percent – the industry’s best annual return since 2013 – hedge funds have recaptured investor interest, according to Deutsche Bank’s annual alternative investment survey released Thursday. Fifty percent of investors polled by the German bank said they planned to increase their hedge fund allocations this year, while just 11 percent intended to pare them.

The survey included responses from 436 global allocators overseeing $2.1 trillion of hedge fund assets. Institutional investors who planned to increase their hedge fund allocations cited portfolio diversification benefits and improved risk-adjusted returns as the primary reasons.

“Performance has been what investors have wanted and expected,” said Marlin Naidoo, Deutsche Bank’s head of capital introduction and hedge fund consulting. “Alongside that, there’s been more of a partnership discussion on fees, making sure the fees are more aligned with the strategies and with investor needs.”

[II Deep Dive: Surprise! Investors Happier When Hedge Funds Do Well]

Ninety-nine percent of the survey’s respondents said their hedge fund investments performed positively last year, with top quartile funds returning 13.34 percent on average. This year, investors are expecting more of the same, targeting returns of 8.24 percent for their hedge fund portfolios.

For the total hedge fund universe, as measured by the HFRI fund-weighted composite index, respondents forecasted an annual gain of 5.25 percent. By comparison, these same allocators predicted the Standard & Poor’s 500 index would return 5.67 percent this year – far below the 21.83 percent gain in 2017.

According to the survey, hedge fund fees continued to decline, with investors paying an average management fee of 1.56 percent, down from 1.59 percent last year. Average performance fees, meanwhile, fell to 17.43 percent from 17.69 percent in last year's survey.

Of the small portion of institutional investors planning to reduce their hedge fund allocations, only 9 percent said it was because fees were too high.

“When we look at average fees, those have sort of stabilized right now,” Naidoo said. “The bigger trend is the bespoke fee structure – the concept that one size does not fit all.”

He pointed to a range of fee arrangements now desired by investors, including hurdle rates and a sliding management fee that declines as assets under management grow.

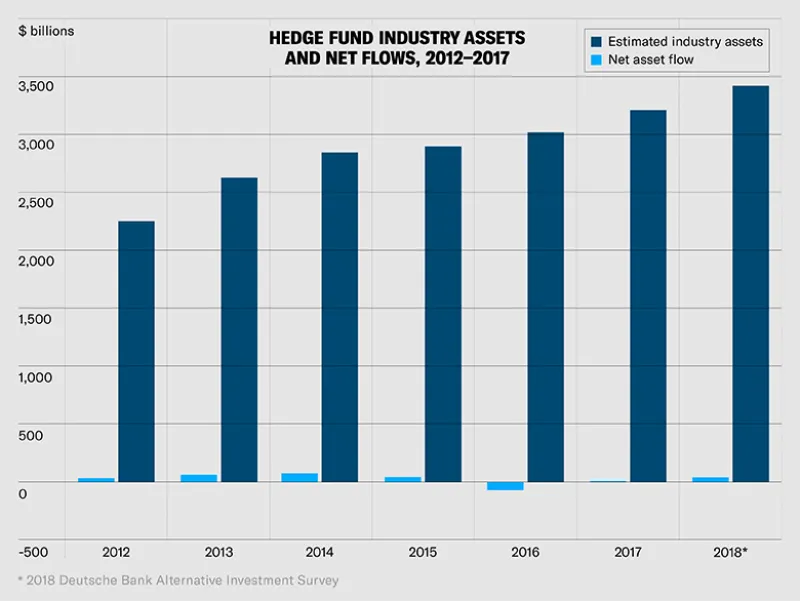

As a result of investors’ renewed belief in hedge funds, Deutsche Bank projected $41 billion in net asset flows to the industry this year, plus an additional $169 billion in performance-based gains. By the end of 2018, the bank estimates the hedge fund industry will manage a total $3.4 trillion of assets.

Preferred strategies for this year include event-driven hedge funds and fundamental equity long-short strategies, according to the survey. Quantitative and systematic strategies also continued to build steam, with 56 percent of investors planning to allocate to at least one quant fund this year.