The recent launch of a smart beta fund priced at only 0.09 percent by Goldman Sachs Asset Management is “credit negative” to active managers that compete with GSAM in factor-based investments, ratings agency Moody’s Investor Service said in a report published on Thursday.

GSAM’s Goldman Sachs Equal Weight U.S. Large Cap Equity exchange-traded fund charges a management fee far below similar funds run by competitors, with the exception of shareholder-owned Vanguard Group. Smart beta funds are based on algorithms designed to find stocks that meet certain criteria, such as low volatility, or to track a custom benchmark.

Moody’s says the low fee threatens asset managers that have assumed a higher pricing structure for smart beta funds, one of the fastest-growing fund categories. Already, managers such as BlackRock, Fidelity Investments, and others have been engaged in a price war when it comes to plain vanilla ETFs. With GSAM’s equal-weight ETF, which will buy equal stock positions in its benchmark index — a common smart beta methodology — the firm’s peers may have to lower fees on similar funds in order to remain competitive.

Moody’s sees a price war in smart beta funds as a “credit negative” for Legg Mason, Franklin Resources, and Janus Capital Group (now Janus Henderson), all of whom are planning to offer competing funds. The credit rating agency also says GSAM’s move will undercut existing smart beta players such as Invesco, BlackRock, and State Street Corp., which owns State Street Global Advisors.

[II Deep Dive: Goldman Sachs Asset Management Bets Big on Smart Beta]

“Traditional active managers including Legg Mason, Franklin Resources and Janus, as participants in an industry faced with a steadily declining market share, have been investing resources in smart-beta products in hopes that it is a product category that will reignite asset growth at a modestly lower price point in between plain vanilla index funds and traditional active mutual funds,” wrote Stephen Tu, senior analyst, in the report. “These managers viewed smart beta as a product category with which they could grow assets without too much sacrifice on revenue.”

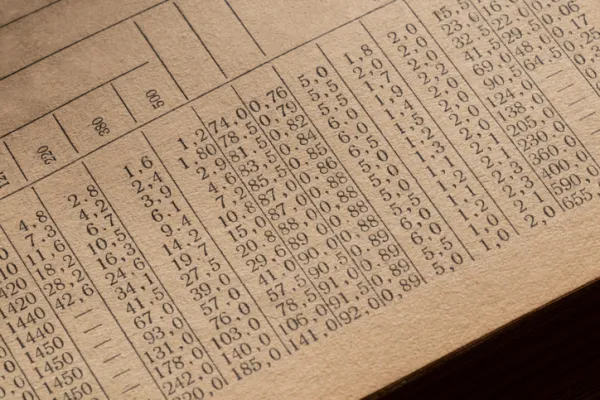

According to Moody’s, most smart-beta products charge fees between 24 and 39 basis points, or 0.24 and 0.39 percent — about half the fee charged by the average actively managed equity mutual fund.

GSAM has long said it wants to price its smart-beta products similar to simple market-capitalization-weighted index funds. Without a price advantage, the asset manager is hoping mainstream and institutional investors will opt for smart-beta funds, which the firm believes offer better performance.