Investment consultants may be as hard to please as they are to avoid.

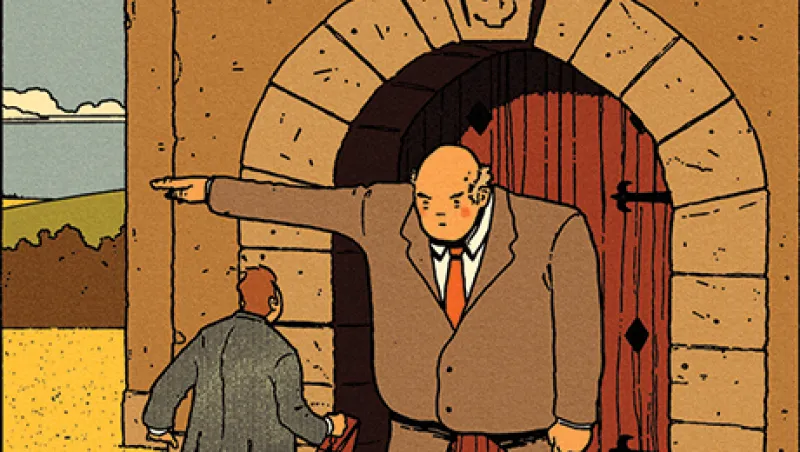

They’re more influential than ever in deciding how assets are allocated across fund managers, according to Spencer Mindlin, an analyst with research firm Aite Group. With thousands of firms vying for consultants’ attention, only a small percentage even make it through the door to meet with these gatekeepers to clients overseeing trillions of dollars.

“We sit in the really enviable position of seeing all the offerings that are out there in the marketplace,” says Steve Foresti, chief investment officer of Wilshire Consulting. “There is so much competition.”

A Greenwich Associates report from last year confirms Foresti’s belief: In the U.S. in 2015, 86 percent of institutional investor relationships were intermediated by investment consultants, the research firm said. At 92 percent, the number was even higher in the U.K. These consultants are “extraordinarily selective,” shortlisting less than 10 percent of the managers tracked in their databases, Greenwich Associates noted in the report on best practices for meetings with consultants. Only 380 — or 16 percent — of the average 2,433 U.S. equity managers followed during searches got a meeting in a consultant’s office, and just 3 percent were shortlisted, the report shows.

The role of the consultant has grown as markets have become more complex and yield harder to find in today’s low-interest-rate environment, says Foresti, adding that as a result, Wilshire’s outsourced CIO business has been growing. The growth comes as the investment management industry is under increasing pressure to produce gains that beat low-cost funds tracking indexes such as the S&P 500. “We’re big fans of low-cost implementation, and that would certainly include a fair amount of passive, large-cap U.S. equity,” says Foresti. Still, he says many investors need help navigating alternative strategies to build out their portfolios.

Aite Group’s Mindlin agrees, saying that consultants filter through the many boutique hedge funds and alternative managers specializing in areas such as private equity, real estate, and emerging markets — work that may be overwhelming for resource-strapped investors to manage.

“Institutional investing has gotten more sophisticated and therefore they need more help in finding asset managers to fit into a more complicated allocation process,” he says. “They’re trying to find asset managers that have niche expertise. It’s impossible for them to do all the searching themselves.”

In its 2017 Alternative Investment Survey, Deutsche Bank found that disappointing hedge fund returns were the single largest constraint for investors considering commitments to the asset class, a view most widely held by investment consultants and advisers.

With Barclays estimating in its February global hedge fund industry outlook that investors will make almost $300 billion of gross hedge fund allocations in 2017, fees are likely to be a focus in discussions.

“Spending time to help change the fee landscape is an incredibly big topic,” says Marlin Naidoo, head of Deutsche’s capital introduction and hedge fund consulting for the Americas.

Beyond scrutinizing performance, Mindlin says, consultants have become a more important part of the selection process because investors need help scrutinizing operational risks revealed during the 2008 financial crisis. Before the collapse of Lehman Brothers, hedge funds typically set up a prime brokerage account with a single Wall Street bank, he says, adding that managers then began spreading their assets among more than one firm to reduce the risk of all their assets being tied up in a failed prime broker.

“Post-crisis, they’re much more concerned with operational due diligence,” says Naidoo.

Despite all their help navigating the complexities of markets, in his 2017 letter to shareholders, billionaire investor and Berkshire Hathaway chairman Warren Buffett questioned the value of consultants. Buffett wrote that with large fees flowing to consultants for recommending small managerial shifts every year or so, repeatedly telling clients to keep adding to an index fund replicating the S&P 500 would be “career suicide.”

But consultants needn’t worry too much.

“The financial ‘elites’ — wealthy individuals, pension funds, college endowments, and the like — have great trouble meekly signing up for a financial product or service that is available as well to people investing only a few thousand dollars,” the Oracle of Omaha said in his letter. “Human behavior won’t change.”