Need more proof that the geeks are ruling the world these days?

Look no further than the 2017 Hedge Fund 100, Institutional Investor’s Alpha’s 16th-annual ranking of the world’s 100-largest hedge funds by assets. While the total managed by these firms declined from the previous year, several quantitatively focused firms climbed several notches in the ranking and in some cases grew their assets by double-digit percentages.

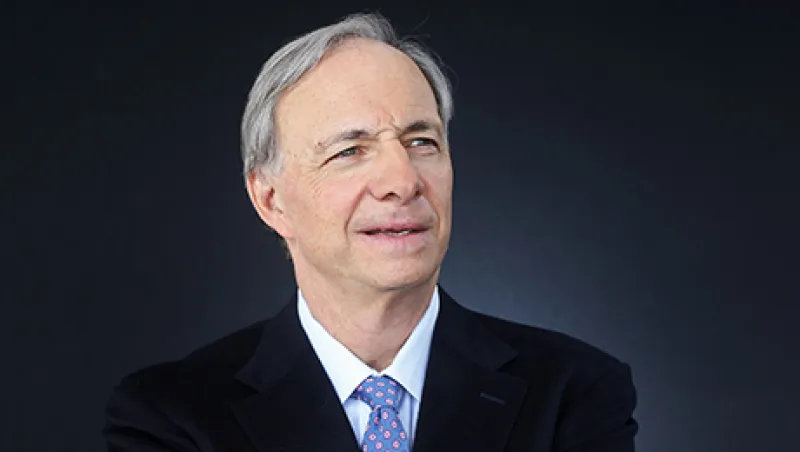

Five of the top six firms on the list rely largely or completely on computers and trading algorithms to make investment decisions — and all of them grew their assets last year. Topping the ranking is Ray Dalio’s Bridgewater Associates, which clocked in at $122.3 billion in total hedge fund assets at the beginning of 2017, a 17 percent increase over the previous year. The firm manages about $160 billion in total.

While that growth is substantial, No. 2-ranked AQR Capital Management outpaced it handily, with the firm’s hedge fund assets swelling a stunning 48 percent year on year, to $69.7 billion. The firm — whose acronym stands for Applied Quantitative Research — managed $187.6 billion firm-wide at the end of March.

Renaissance Technologies, perhaps the best-known and longest-running of the quant-focused hedge fund shops, pole vaulted to the No. 4 spot in the rankings, up from No. 12 the previous year. The firm now manages $42 billion in hedge fund assets, up more than 42 percent from $29.5 billion the previous year, partly due to strong performance in two of its funds that are still open to outside investment: the Renaissance Institutional Equities Fund, which gained 20.6 percent in 2016, and Renaissance Institutional Diversified Alpha Fund, which added 10.6 percent. This performance and asset growth propelled Renaissance founder and chairman Jim Simons to the top of Alpha’s annual Rich List of top-earning hedge fund managers, with $1.6 billion in earnings for 2016.

Another quant firm to climb sharply in the rankings is Two Sigma, founded by John Overdeck and David Siegel, who met at legendary quant hedge fund firm D.E. Shaw. Two Sigma climbed six notches in the ranking to No. 5. Two Sigma now manages $38.97 billion, up nearly 28 percent from what it managed the previous year.

All told, the top 100 hedge fund firms by assets managed a combined $1.65 trillion, down 0.6 percent from the previous year. Although that isn’t a steep decline, it’s the first time that number has fallen year-on-year in recent memory. The move reflects similar troubles in the broader industry in 2016. Hedge funds suffered only their third-ever year of net redemptions last year, according to data tracker HFR, with investors pulling a net $70 billion from hedge funds.