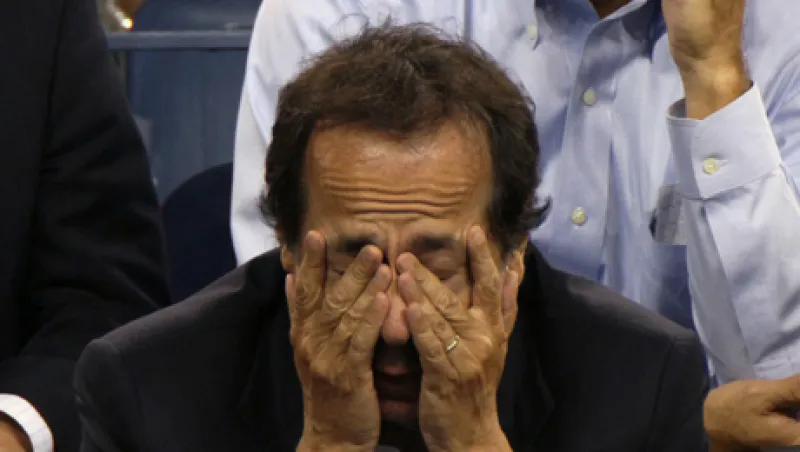

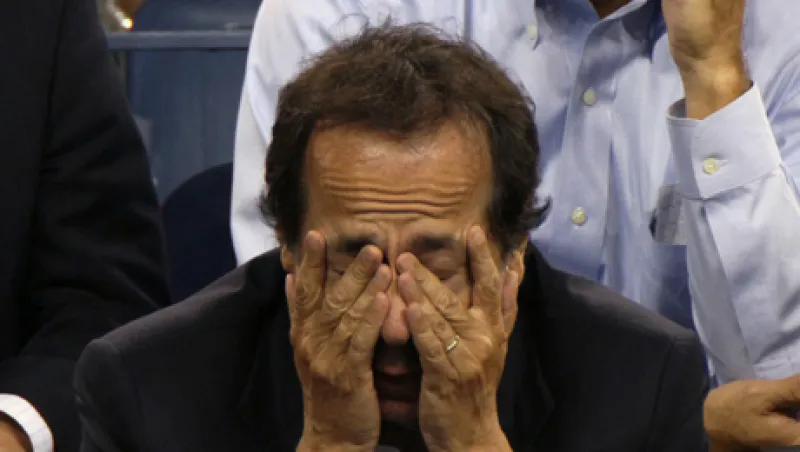

Big Name Hedge Funds Struggle While Markets Surge

Plenty of the biggest names in hedge funds have failed to take advantage of the markets lately.

Stephen Taub

September 7, 2012