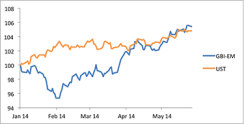

Since the end of January, local-currency-denominated emerging-markets debt has delivered strong returns and served as an effective way to diversify from U.S. Treasuries. As proxied by the J.P. Morgan government bond index–emerging markets (GBI-EM) global diversified index, local currency emerging-markets debt started 2014 badly, slumping nearly 5 percent in January. Since then, it has returned more than 10 percent, significantly outperforming ten-year Treasuries and producing slightly better returns for the year as a whole (see chart 1).

Source: Bloomberg, JPMAM, data through May 26, 2014

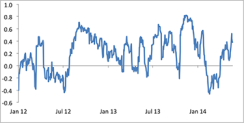

Three factors have contributed to these gains. First, carry has been fairly high by the standards of the past few years, with the GBI-EM yielding 6.91 percent on average since the start of February. Second, yields have dropped significantly over that period, from their peak of 7.2 percent on January 31 to 6.6 percent on May 22. Given the nearly five-year duration of the index, this decline alone produced almost 3 percentage points of return. Third, emerging-markets currencies have staged a recovery after several bouts of weakness in the past couple of years, with the overall emerging-markets foreign exchange index rising more than 4 percent since the end of January (see chart 2), and some exchange rates represented in the index, like the Brazilian real, strengthening considerably more.

Source: Bloomberg, data through May 26, 2014

What forces are pushing these developments? First, emerging-markets foreign exchange appears to have bounced because of several factors: stability in U.S. short-term rates; rising policy emerging-markets interest rates in which rate differentials moved significantly in favor of local markets; and evidence of significant external adjustment in economies whose currencies came under pressure in 2013, such as India and Indonesia. Second, the fall in emerging-markets bond yields likely reflects lower U.S. Treasury yields and the decline in emerging-markets inflation at the start of the year. These two phenomena allowed emerging-markets yield curves to flatten sharply, such that policy rate hikes did not pass through into long-term yields.

Assuming this analysis is broadly correct, risks to the outlook for local currency emerging-markets debt likely fall into two categories: first, the path of global and particularly U.S. interest rates; and second, the mix of growth in emerging markets, inflation and policy rates. Of course, this statement applies under most circumstances. What matters is the particular exposures of the GBI-EM at the moment.

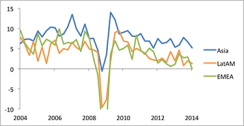

On the U.S. rate front, in common with many fixed-income asset classes, the GBI-EM appears to have benefited from the downdraft in ten-year yields this year. The correlation between Treasuries and emerging-markets yields has strengthened significantly (see chart 3). Whereas emerging-markets local currency debt does not contain a pure Treasury component (in contrast to U.S. corporate credit), some arbitrage exists between the two. The sharp decline in Treasury yields seems to have exerted a downward pull on rates elsewhere, in both developed and emerging economies. A backup in Treasuries thus would likely generate at least some duration losses in emerging markets. At the same time, the GBI-EM has likely benefited from ongoing stability in short-term U.S. rates, which has facilitated carry trades and supported emerging-markets foreign exchange. Should the market begin to question the Fed’s forward guidance, producing volatility in two-year U.S. yields, emerging-markets forex positions would become more difficult to hold.

Source: Bloomberg, JPMAM, data through May 23, 2014

In terms of any given local environment, the GBI-EM has drawn support in recent months from an unusual combination of circumstances: rising emerging-markets policy interest rates but simultaneously improving inflation, with the former boosting currencies and the latter helping to pull down long-term yields. Normally, that kind of yield-curve behavior would occur amid strong emerging-markets economic growth that involves heavy capital inflows. But emerging-markets economies stumbled in early 2014, with overall expansion tracking what looks like its weakest performance of the present cycle (see chart 4).

Source: JPMSL, JPMAM, data and estimates through Q1 2014

Conditions appear to be changing, at least at the margin, in ways that may undermine local currency emerging-markets debt. First, emerging-markets central banks, as a group, may be approaching the end of their rate-hiking cycle. Last week the Turkish central bank cut its policy interest rate by 50 basis points, and the South African Reserve Bank kept rates unchanged, deciding not to add to the tightening implemented back in January. The Reserve Bank of India made a similar decision earlier in May, and the Brazilian central bank also appears to be turning less hawkish. This shift reflects, in part, the significant improvement in external balances observed since mid-2013 in capital-flow-dependent economies. At the same time, it reduces the carry cushion enjoyed by emerging-markets currencies if the Fed turns more hawkish or if the market begins to question the Fed’s forward guidance.

Second, the improvement in emerging-markets inflation has slowed (see chart 5). Whereas persistent economic weakness and currency stability should help on this front, the recent surge in agriculture commodity prices will create upside pressure. Meanwhile, although emerging-markets growth seems to be stabilizing, it remains weak in absolute terms and is forecast to stay that way through the remainder of 2014, making a wave of growth-seeking capital inflows unlikely.

Source: JPMSL, JPMAM, data through April 2014

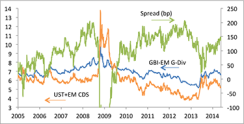

In the medium term the implied premium for currency risk embedded in the GBI-EM, comparing its yield with credit-adjusted U.S. Treasuries (see chart 6), stands at a fairly high level. That being the case, local currency emerging-markets debt remains relatively attractive in a fixed-income environment that offers negative-to-meager positive return prospects for the rest of this year. The forces that produced outsize returns for the GBI-EM between February and May, however, seem unlikely to persist, and some may reverse. Treasury yields are likely to rise from here, with short rates becoming somewhat more volatile — presenting potential problems for all fixed income, not just the GBI-EM. The carry for emerging-markets foreign exchange may drop if the recent tendency toward increased dovishness by emerging-markets monetary policymakers becomes more pronounced and an upward drift in emerging-markets inflation generates added pressure on yields. A strong acceleration in emerging-markets growth, although in itself a negative for yields, could help counter those factors by supporting currencies and generating inflows into emerging markets as a whole — but that does not look like a base case expectation for now.

Source: JPMSL, JPMAM, data through May 22, 2014

Michael Hood is a market strategist for J.P. Morgan Asset Management. For additional global Market Insights, please visit jpmorgan.com/institutional.

Read more about emerging markets.