Are technology stocks in a bubble? Opinions differ. But the sector’s start-up baby boom and the rich valuations being showered on so many fledgling firms are worrying. It is important to be more discriminating when investing in disruptive innovation today.

The tech investing scene has never been more youth-obsessed. Publicly traded tech companies that are less than four years old are trading at nearly nine times sales — a 40-year high — while the premium to their older counterparts has exploded (see chart 1).

To study this youth movement more closely, we’ve examined a collection of young tech companies worth $1 billion or more that have either been public for four years or less or are still privately held. (Firms valued in excess of $1 billion account for more than 90 percent of the Nasdaq’s market capitalization.) Think of this as Nasdaq’s nursery. From this brood will emerge the Apples, Amazons and Googles of tomorrow.

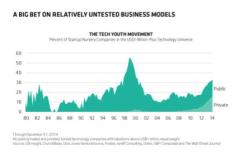

Young companies fitting this description make up one third of all technology firms with valuations above $1 billion — a level surpassed only during the late 1990s. But there’s one glaring difference: The number of privately held start-ups has skyrocketed to 67, or half of our nursery group, versus a prior peak of eight, or 6 percent, in the fourth quarter of 2000 (see chart 2). Many investors may be unaware of the important trends developing in this less transparent part of the technology market.

These tech babies are growing up in relative affluence, thanks to an outpouring of venture capital funding, which had reached a run rate of $26 billion by year-end 2014. This was the largest annual influx in 14 years and even exceeded the 1999 level of $22 billion — though it’s still well below the dot-com-era peak of $52 billion in 2000. These youngsters are taking full advantage of the friendly funding environment. Roughly 82 percent of our private nursery companies have raised capital in the past 12 months, up from 62 percent a year earlier.

This funding pipeline is supported by a growing ecosystem of veteran VC leaders, incubators and angel investors, as well as the dramatic shift among return-hungry investors of all stripes into private equity funds. The major lure is exposure to the next generation of rapid Internet growth. Although Internet companies account for just 13 percent of all publicly traded tech companies more than four years old, they make up a whopping 78 percent of all public companies in our nursery today.

We can understand the attraction to all things Internet in this era of transformative innovation. Internet stocks have historically commanded hefty premiums compared with other areas of the tech sector, especially younger ones with the potential to scale quickly with limited capital on the back of powerful network effects. But we are concerned by the valuations of these nursery companies, particularly in the private market. History shows that the odds of long-term success for such investments are extremely low.

What happens in the VC world matters for public equity markets. These developing companies are the initial public offerings of tomorrow, if not also the M&A targets of today’s public technology firms. A privately funded tech bubble can still be a danger if it encourages undisciplined spending sprees among large public companies. What’s more, only 17 percent of the newly minted tech companies in 2014 were profitable at the time of their IPOs, slightly above the 14 percent last seen at the height of the dot-com bubble in 2000. To many, this scene is uncomfortably familiar.

So how can investors capture disruptive innovation in their portfolios? We believe the key is to cast a wider net and to stay benchmark agnostic. Today the technology indexes and the IPO pipeline suggest that innovation primarily exists in the Internet world. Not true. Although some successful Internet firms will undoubtedly emerge from this pack, innovation is everywhere. It lives in companies such as Hexcel Corp., which creates new materials for planes; in firms such as Mobileye, whose vision-based advanced driver assistance systems are paving the way to self-driving cars; or in Illumina, which is analyzing genetic variation and function.

A comprehensive research approach can make the difference. A top-down perspective alone might lead to an excessive focus on young, fast-growing Internet firms, despite their bubblelike valuations. But a bottom-up discipline introduces a healthy dose of caution and limits or helps diversify exposure to overvalued parts of the innovation ecosystem. In our view at AllianceBernstein, this is the best way to identify companies with real transformational power — and attractive return potential.

Daniel Roarty is CIO of global growth and thematic equities at AllianceBernstein in New York.

See AllianceBernstein’s disclaimer.

Get more on trading and technology.