Let’s not mince words. Liquidity is draining out of global corporate bond markets, and we at AllianceBernstein doubt it’s coming back. But that doesn’t mean investors have to take their chips and go home. In fact, with the right approach, markets that are less liquid can offer some attractive opportunities.

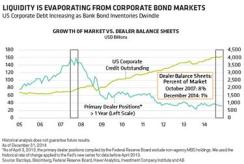

The liquidity drought isn’t a new phenomenon, though it may seem like it sometimes. Strict capital rules that global regulators have imposed on banks to make them safer have been steadily bleeding liquidity from the market for some time. This is because banks responded to the rules by cutting bond inventories at the same time that corporate debt issuance was rising. The result: fewer banks to act as buyers when investors want to sell (see chart 1).

Declining liquidity has been on our radar for years. But for many it came into focus more recently when investors who had chased returns into overcrowded credit sectors found it difficult to exit when sentiment turned and everyone wanted to sell.

Many investors have reacted to these liquidity constraints by moving into passive exchange-traded funds, especially in high-yield. These are priced daily and can be bought and sold more easily than individual bonds. But these vehicles may be less liquid — and more risky — than investors realize. Because of their growing popularity, ETFs must hold an ever-larger share of less-liquid assets. And, as the Federal Reserve pointed out last month, if something should happen to cause the underlying asset prices to fall, it could spark a wave of forced selling.

Markets got a sneak preview of this in May 2013, when the Fed announced plans to taper asset purchases, while signaling that it might raise official interest rates more quickly than expected. Investors reacted by yanking money out of bond ETFs.

Some active managers, on the other hand, viewed the so-called taper tantrum as an opportunity to buy attractive individual high-yield bonds when other investors were blindly hitting the sell button. For providing liquidity at a time of market stress, they were compensated with higher yields. ETFs that passively track the entire high-yield market couldn’t have replicated that strategy.

In our view, this ability to be agile and take the other side of popular trades is the key to staying afloat in less-liquid markets. Managers who were able to profit from the taper tantrum were likely the ones who had begun managing liquidity risk years ago, leaving them in a position to capitalize on liquidity-driven dislocations.

Here are four things that investors should seek out in asset managers if they want to turn illiquid markets to their advantage:

A nimble, multisector strategy. Liquidity can affect different sectors in different ways. So, being able to move into and out of a broad universe of fixed-income assets is critical. If selling spikes and liquidity dries up in high-yield, managers with a multisector approach can quickly and easily move to global investment-grade debt or another sector in which liquidity is more plentiful. Such a flexible approach would even allow strategic allocations to private credit sectors, such as direct loans to medium-size businesses.

Plenty of cold, hard cash — and derivatives. In illiquid markets, managers who keep more cash on hand than usual will be in a better position to swoop in when others are desperate to sell. As we’ve seen, that can mean picking up attractive, high-yielding assets at a discount. Of course, cash yields next to nothing, so to offset the potential performance drag, managers can tap the highly liquid derivatives market to create synthetic securities.

Trading prowess. The best traders can sniff out sources of liquidity and move swiftly to take advantage of them. That’s why it is essential to involve them in the entire investment process. Traders who understand a portfolio’s objectives and an investment manager’s strategies are better equipped to manage liquidity risk and to act when opportunities arise.

Willingness to take the long view. Too much trading, however, can be costly. High trading fees, especially in high-yield, can eat into returns. That’s why each new bond opportunity should be analyzed as if the bond will be held to maturity. What’s more, asset managers can’t rely on liquidity being available when they need it, so they might not be able to sell at a given investment horizon. If holding a particular security to maturity doesn’t look attractive in today’s environment, it might not be worth buying at all. In our view, investment managers who take these guidelines to heart can help increase their potential to both manage liquidity risk — and profit from it.

Gershon Distenfeld is director of high-yield debt at AllianceBernstein in New York.

See AllianceBernstein’s disclaimer.

Get more on fixed income.