“One summer day, probably in the 1870s, friends of a major short seller got together on the shores of Newport, Rhode Island, where they admired the enormous yachts of New York’s richest brokers. After gazing long and thoughtfully at the beautiful boats, the short seller asked wryly, ‘Where are the customers’ yachts?’”

— Jason Zweig in his introduction to Fred Schwed Jr.’s 1940 classic, Where Are the Customers’ Yachts? or, A Good Hard Look at Wall Street

If investors complained about Wall Street in Schwed’s day, they’re howling now. You can see the distrust in deeply skeptical regulators, highly critical pop culture (The Big Short book and movie, and Showtime’s Billions series) and voluble protest movements (Occupy Wall Street and Bernie Sanders’ presidential campaign). Since Schwed’s time the definition of Wall Street has broadened to include asset management, an industry that has inspired its fair share of criticism for overcharging and underdelivering. We have to admit that such strong reactions, though often based on misconceptions and exaggerated facts, are not wholly undeserved, leaving the asset management industry vulnerable to disruption.

The need for good money managers has never been greater. Total investable assets are continuously rising. High-net-worth individuals are now influential sources of capital in both established and emerging markets. Baby boomers are living longer in retirement, and as they stop working they’ll need their assets to last longer. Yet for investors too few good options exist.

Many of our colleagues don’t believe that disruption is imminent. After all, asset management is one of the world’s most profitable and exciting businesses. Why should we even worry about disrupters? The challenge, according to innovation expert Clayton Christensen, is that incumbents have a blind spot toward disruption. It is difficult to see because it goes against a set of ingrained assumptions that most likely have led to success so far. As a result, the profitable big players have a hard time seeing threats, especially when these are coming from smaller and more innovative players or outside their traditional set of competitors. Even when incumbents perceive the possibility of disruption, they discount it or cannot change their existing business model fast enough because of vested economic interests or internal bureaucracies — and by then it is too late.

We take the contrarian view. We expect that asset management is about to go through a particularly dynamic period of disruption, for three reasons: high profits, new technologies and a new set of client demands resulting from global social changes. First, the industry is extremely profitable, and excess profit pools attract competition and substitution. According to the Boston Consulting Group (BCG), total 2014 industry profits were $102 billion globally, flowing from remarkably high operating margins of 39 percent. Second, financial technology venture capital is exploding: CB Insights reports that $10.5 billion was invested in fintech start-ups in the first nine months of 2015, compared with less than $5 billion in all of 2014. And third, a number of global trends — including changing demographics, the growing power of women and emerging-markets wealth — are shifting how and when asset managers must serve their clients. Collectively, these irresistible forces are meeting a movable object: the calcified asset management industry structure.

To frame our research we created a picture of the universe of investable assets, which is made up of the global economy’s money supply minus operating capital. It is equivalent to what surplus resources can be saved or invested for future use once the economy has been funded to meet today’s needs. Collectively, the universe of investable assets totals more than $270 trillion, excluding leverage (see “Real World,” below).

We categorize the universe of investable assets into three main overlapping groups: money holders, money managers and intermediaries. The money holders are ultimately the beneficiaries most affected by how the assets perform. They also incur most of the economic risk. Money holders — including sovereign funds, individual households, retirees and corporations — range dramatically in their natures, sets of expectations and investment sophistication.

Money holders delegate to money managers, who make decisions on the holders’ behalf with respect to how investable assets can be allocated to generate optimal return at optimal risk. Some money holders may invest a portion or all of their investable assets directly into the market; they currently hold $47 trillion of bonds and equities through direct purchases. In contrast, alternative assets — including private equity, venture capital and hedge funds — are much harder for individuals to access directly. This sizable asset class, representing $8 trillion in capital, typically charges higher fees for access and is available to only a select few money holders.

Last, intermediaries such as investment consultants and funds of funds have become a critical part of the ecosystem. Intermediaries provide different services to money holders and managers. They offer access to otherwise inaccessible managers and can provide valuable investment perspectives. In today’s period of unprecedented disruption, we see intermediaries in a strategic vise: They need to add increasing value to money holders and money managers while keeping costs low and responding to relentless competitive pressures.

The value of the universe of investable assets has increased over time, fueled by both population growth (which typically expands the value of the underlying corporations and other assets) and economic growth. This type of growth is also referred to as beta return, or the above-cash-market return. To benefit from such organic returns, investors do not require much investment acumen other than smart diversification.

But to beat markets — to create real alpha (returns above the passive benchmark performance) — is much harder and, some would argue, even impossible on a sustainable basis. Delivering alpha consistently on a net-of-fees-and-costs basis has proved an elusive goal. For example, hedge funds have underperformed U.S. equities since 2000 by 1.5 percentage points annually, on average, even though their returns look attractive over longer periods: Hedge funds topped the S&P 500 index by 3 percentage points a year from 1970 through 2015. However, one can argue that hedge funds were a different dish in the 1980s and ’90s, when the industry was much smaller and more nimble.

Even if highly sought-after money managers have successfully outperformed average market returns, it is impossible to guarantee that they will continue to do so in the future. With high management fees and substantial incentive fees relative to low-cost alternatives like index funds and exchange-traded funds (ETFs), hedge funds are under heightened scrutiny, especially in light of recent mediocre performance. As a result, many investors are asking highly skeptical questions, demanding more transparency and expecting better alignment of results and objectives.

The asset management industry is one of the few industries that collectively play a near-zero-sum game. By contrast, most other industries are positive sum: If you eat a great steak dinner, it doesn’t imply that others have to eat hot dogs. In asset management each new money manager that is able to generate alpha in liquid markets normally does so at the expense of other managers or individual investors that underperform the market benchmark. Investors happily pay high fees for top managers but resist paying them for consistent underperformance. The pursuit of hot managers combined with the mathematical difficulty of outperforming markets leads to many of the peculiarities in our industry.

Initially, we based our research on Harvard Business School professor Christensen’s classical view of “disruptive innovation.” In his framework a product or service first gains customers by doing only one or two jobs for a client, typically on the low end of an established market. Eventually, the company moves upmarket and displaces the established competitors.

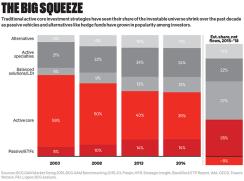

For a tangible example we looked at the unprecedented growth of low-cost ETFs and index funds. As a result of the sector’s success (assets have jumped from $3 trillion to $11 trillion over the past decade), the proportion of money managed in traditional active core strategies has withered from nearly 60 percent of assets in 2003 to less than 40 percent today, a trend likely to continue (see “The Big Squeeze,” below).

Similarly, low-cost retail investment firms like Charles Schwab Corp., Fidelity Investments and Vanguard Group are not immune to pressure from the even-lower-cost, technology-enabled robo-advisers like Betterment. Change is happening so fast that disrupters are now in danger of being disrupted. In a tepid global economy, money holders worry more about minimizing costs, taxes and fees than about generating unpredictable top-line returns. Schwab is looking to take market share from traditional full-service brokerages; Wealthfront works on snaring Bank of America Merrill Lynch clients. Meanwhile, in just a few years, China’s Alibaba Group Holding has amassed more than $100 billion in assets for its money market fund, Yu’e Bao. There are rumors of other Internet giants, such as Facebook or Google, also entering the investing business.

The beauty of the Christensen model is that it articulates why successful, well-managed incumbents often have a hard time both perceiving and reacting to newcomers from the bottom of the market. The model predicts power shifting back to consumers or clients because they get access to lower-cost, higher-value products. At the end of the day, disruptive innovation is generally good for money holders.

Consistent with the disruption concept, some experts we interviewed do not see the current generation of highly automated advisers as worrisome competitors. They believe robo-advisers lack both the investment sophistication of established managers and the human touch of investment advisers, and that may well be true today. We are not saying that any specific robo-adviser or Internet company will overtake the money management establishment. However, we think these players collectively are a meaningful threat to the status quo.

As Christensen’s theory predicts, innovators at the bottom of the market are well positioned to evolve by adding new capabilities. They lack the incumbent’s fear of disrupting existing profit streams and do not have the burden of old technology and the high cost structure of big organizations. The innovators’ solutions eventually will become sufficient to meet the requirements of more-sophisticated clients. Technology often heralds the breakthrough of new business models, particularly when they offer a lower cost. It is not far-fetched to imagine a low-cost robo-adviser to institutional investors. In fact, we’ve come across a number of budding early start-ups with exactly that model.

In addition to our industry’s internal challenges, there are meaningful external forces at play that will likely hasten disruption: demographic shifts, wealth transfer across geographies and generations, technology revolution and the reversal of long-standing economic trends. In our view, the asset management firm of the future will likely be dramatically different in structure and offer tighter alignment with investor needs. Much as BlackRock has led a quiet revolution in the ETF space (which has become a critical component of the firm’s staggering growth to $4.5 trillion in assets today), we expect new business models to arise to reshape the future of asset management far more quickly than could have been envisioned even five years ago.

Historically, the asset management business has been slow to change. The stakes are high, the sector is closely regulated, and there are few early adopters of innovation. Not surprisingly, investors tend to prefer things they understand well: Roughly half of the world’s $270 trillion-plus of investable assets are in real estate and cash, which were also the most popular investment areas in the 1800s. Alternative investments, which have been a separate asset class only since the early 1980s, make up less than 2 percent of investable assets.

Though the asset management industry changes slowly, at pivotal points in its history external forces have quickly altered its dynamics. To learn more about them, we spoke with industry veteran John Casey, co-founder and now senior adviser of Darien, Connecticut–based consulting firm Casey, Quirk & Associates. We wanted to understand what drove the huge expansion in assets in actively managed funds in the ’80s and ’90s. In Casey’s view, investors’ conservatism in the first half of the 20th century was inspired by the Great Depression and two world wars, with savings primarily in cash and bonds. “With regulation preventing access to equity markets, banks became the main option for investors,” he explains. “Following the 1973–’74 stock market debacle, coupled with new ERISA regulations, investors began to look for alternatives to the big banks.” As a result of these changes, the floodgates were opened and pension funds and individual investors could invest in new ways. Thousands of firms registered with the Securities and Exchange Commission as advisers.

“It was like bears fishing when the salmon returned to spawn,” says Casey. Little capital and infrastructure were required to start a money management business — “two white men and a shingle” were now a “money manager,” he adds. This led to the explosion of the mutual fund and hedge fund industries, and created some of today’s biggest investment names. While managers grew large and profitable as assets ballooned, the pension funds and endowments were governed by much more stringent rules, resulting in a talent and incentive imbalance.

In theory, regulations protect money holders and ensure that the retired grandmother does not gamble away or get defrauded out of her hard-earned savings. In reality, the picture may be quite different. Partly as a result of institutional inertia, the incentive systems have gotten way out of whack. Although hedge fund managers can earn millions — and even billions — of dollars, public pension fund CIOs and their teams, entrusted with trillions of dollars to allocate, receive far more modest government employee salaries. Often, highly talented people at pension funds are limited by rigid internal approval processes that make it difficult to invest in new systems and operations. The situation at endowments and foundations can be similar.

The more we try to understand how asset management has evolved, the more we see how highly unusual and somewhat baffling our industry is relative to others. For example, today’s 2 percent management fee, typically charged by hedge funds and other alternative-asset firms, was originally intended to provide operating capital for emerging managers. The model made sense when firms were small, in the 1970s and ’80s. Yet as firms grew because of the unprecedented inflow of capital and gained economies of scale, management fees as a percentage of assets didn’t go down. This created a perverse incentive to raise assets, often without regard to performance. Today alternative-asset managers earn a significant portion of their compensation from management fees, making our industry one of the few in which executives can take home millions of dollars even in years when they lose millions for their clients.

This tendency to want to grow assets under management is in many cases negative for money holders because there is an inevitable tension between size and returns. In 2013, All About Alpha, a website operated by the Chartered Alternative Investment Analyst Association, conducted a study of nearly 3,000 long-short equity hedge funds and found that small managers had outperformed their larger peers by an average of 220 basis points a year during the preceding decade. The study cited a number of factors, including higher marginal incentives for emerging managers and a desire to win that is typically more pronounced for this group. Large hedge funds will often encounter liquidity constraints and affect market pricing when they trade, reducing their ability to exploit arbitrage opportunities. Of course, it is true that size creates certain proprietary advantages, such as the ability to handle the increasing complexity of regulatory requirements and to invest in expensive new technologies that may provide a competitive advantage in beating markets.

The asset management industry is experiencing what can be described as a winner-take-all phenomenon. According to a study by BCG, the world’s ten largest managers as measured by net inflows in the U.S. and Europe over the past 15 years captured nearly two thirds of those assets. This concentration can be partly explained by the principal-agent challenge that institutional investors face.

All companies have some form of the principal-agent problem, in which the principal and its agent have different incentives and motivations. In our industry the problem is exacerbated by the presence of so many conflicted intermediaries. To avoid career risk, an individual allocator is often motivated to assign assets to the most popular fund or type of investment. If an allocator hires a known player, underperformance will rarely prompt questions about that person’s judgment. The resulting herd mentality penalizes new managers, potentially stifles innovation and generates suboptimal returns.

In addition, the effort to find, assess and manage thousands of small external investments may prove unfeasible for many institutional investors. Scalable offerings from a select set of managers tend to concentrate assets into a few well-known firms regardless of returns. In theory, money should follow expected future returns. In reality, the dynamics are far more complex and tend to preserve the status quo.

While money managers are at minimal personal risk, they have disproportionate power to create systemic economic risk. This negative externality is unique to financial services and was particularly visible in the 2008 financial crisis. But the Great Recession that followed was hardly unique in this asymmetrical risk-and-reward dynamic. When highly leveraged hedge fund firm Long-Term Capital Management collapsed in the late 1990s, the resulting bailout, under the supervision of the Federal Reserve Bank of New York, required 16 leading financial institutions to agree on a $3.6 billion recapitalization for a firm led by 11 individuals. By comparison, when oil prices doubled between 2009 and 2011, the spike created stress for consumers but there was no concern that the global economy would collapse.

The asset management industry’s high growth and slow change are driving its next-biggest challenge: a looming talent crisis. Our business is far more homogeneous than the clients it serves, which is hugely ironic for an industry that worships diversification as the one true free lunch. Only 10 percent of mutual fund assets and 3 percent of hedge fund assets are managed by women. A similarly small percentage is managed by traditionally underrepresented minorities. The lack of diversity persists despite some studies showing that funds run by women outperform.

Lack of diversity has two other negative effects. First, it limits investors’ understanding. The U.S. will be a majority minority country by 2040, with inevitable shifts in consumption and behavior patterns. Second, “it is hard to attract top talent if firms are looking at a small slice of the population and their immediate peer group,” says Carol Morley, CEO of Imprint Group, a New York–based strategy consulting firm.

As the incumbents mature, many are facing a painful leadership succession challenge, adding significant operating risk. The money manager owner class is disproportionately near retirement age. According to Imprint Group, one third of global alternative assets are managed by men over 60. While some firms, like D.E. Shaw & Co., are investing in leadership transitions years ahead of time, others are making fatal mistakes. For example, Chris Shumway’s botched transition out of his firm, Shumway Capital Partners, triggered huge simultaneous redemptions, requiring asset liquidations at fire-sale prices and eventually the closure of a highly successful $8 billion hedge fund. In some instances, audit and risk oversight companies and technologies that help limited partners monitor founding partner departure risk can add value. But in many cases they are monitoring stasis without understanding the internal dynamics that will make or break these sensitive leadership transitions.

Asset management shows the typical earmarks of an industry ripe for disruption: unhappy customers and extremely profitable incumbents. The industry looks a bit like the taxi business, which is highly lucrative to medallion owners while providing low service levels to riders — and is squarely in Uber’s sights.

Our research suggests the power base will eventually shift from money managers to money holders. We live in a pivotal time for asset management, when both internal and external forces are creating major tensions. Industry-specific pressures, such as regulatory tightening and succession challenges, are coupled with global economic, demographic and technology shifts that are reshaping asset management.

Fundamentally, the changing nature of the global economy is disruptive to asset management. After decades of prosperity and productivity growth in the developed world and the insatiable boom of emerging markets, the world’s economic machine is running out of steam. On its own, a tectonic shift of this magnitude would rewrite the rules of any industry. In ours, the tremors are just being felt.

The first quake — the illusion of growth — has been prolonged by the infusion of massive leverage into the system. With more than $200 trillion of aggregate debt at the government, corporate and household levels, expanding the global debt burden is no longer a viable option. If the world were an individual, it wouldn’t qualify for a new credit card even in the U.S. The resulting impact is a major realignment of return expectations going forward. Most institutional investors have built 7 to 8 percent net projected returns into their portfolios to be able to meet obligations and liabilities. Historically, such expectations were not unreasonable, as equity markets have delivered average returns of roughly 7 percent per year. Market expectations going forward will likely be much lower because of sluggish economic growth in the developed world, plagued with the risk of deflation, and slowing emerging-markets economies. China — perhaps the biggest driver of these shifting fortunes — is in the process of converting from an export-driven economy to a consumption-led one, which will be characterized by GDP growth falling to low single digits, the nation’s lowest levels in two decades.

For investors the new economic picture means that the hunt for yield continues with fervor. No longer can money managers ride the market and take credit for beta returns (that is, the general expansion of the market). That’s especially true for hedge funds. After a couple of years of lackluster performance, a record number of both new and established managers are closing their doors. BlueCrest Capital Management, JAT Capital Management, Standard Pacific Capital, Tiger Consumer Management and TigerShark Management are just a few of the notable hedge fund firms that have shuttered (and in some cases become family offices) in the past 12 months.

Oddly, this economic environment may be the perfect opportunity to better align the incentives of money managers and money holders. Boston-based Adage Capital Management offers a rare example of a business model with strong alignment. The $23 billion hedge fund firm pioneered the approach of being compensated just for alpha generation. In its model Adage receives performance fees only when it outperforms its benchmark; it returns money to investors when it misses the mark.

We also see increasing collaboration between money holders and money managers as the line between these actors begins to blur. Co-investment options, greater transparency and true thought partnership are among the ways money managers can take investors’ interests closer to heart and generate value in a low-growth economy.

Changing demographics are creating a series of waves in the industry. Retiring baby boomers, Millennials gaining investable assets, theincreasing role of women and the growing sophistication of the newlywealthy in emerging markets all point to a dramatically different investor base today and for the foreseeable future. And when investors change, so do their expectations.

Ultimately, shifting the power back to investors will require a greater focus on what money holders actually want. Disruptive-innovation guru Christensen’s work popularized the idea of analyzing a company by looking at the “jobs to be done” needed by its clients. The most successful companies are able to satisfy the functional, technical and emotional needs of their customers. For example, Starbucks Corp. does more than serve coffee; in fact, one may argue that its coffee is not of the highest quality available. Yet the company has a loyal customer base because it provides a unique third-place experience between home and work. This job to be done is highly valued and paid for through the sale of boatloads of high-gross-margin coffee.

Many money managers think generating outstanding investment returns is sufficient to retain and grow assets, but they are wrong. “Contrary to conventional wisdom, investment performance alone does not drive asset flows,” says Amanda Tepper, CEO of Chestnut Advisory Group, a Westport, Connecticut–based consulting firm. Investment performance accounts for only about 15 percent of the reasons investors place money with managers, according to Chestnut’s research. “We found very low correlations between trailing three-year returns [the primary metric used by most institutional investors] and subsequent one-year net capital inflows,” Tepper explains.

To be successful, money managers need to cover such basics as meeting return expectations at the right risk levels with proper internal controls (the technical jobs to be done). The true opportunity set comes from connecting deeply with investor needs (the emotional jobs to be done).

By far the most significant forces for disruption are these social and demographic waves. As women and Millennials become key allocators, they will create a new group of underserved customers with as-yet-unmet values and expectations. Women’s $14 trillion in investable assets today is projected to reach $22 trillion by 2020, according to the Family Wealth Advisors Council, a network of U.S. fee-only wealth management firms. Meanwhile, Millennials are coming of age in the workforce.

These new decision makers will expect the industry to reflect both better diversity and more-accessible information and insight. Indeed, managers will need to look more like the decision makers themselves in many respects and be available through multiple self-service channels at all times, like the service providers these clients use to order food or pay bills online. These money holders will be less likely to invest only with money managers who look like Warren Buffett and less willing to wait for a branch office to open on a Monday morning.

Women and Millennials tend to invest differently from the past generation of older men. Women are less likely than men to interpret or favor information that confirms their existing beliefs. When selecting investments, Millennials are both more risk-averse and more socially conscious than past generations. Having come of age during the financial crisis, they have a negative brand perception of some of the traditionally dominant financial services companies.

Last, technology innovation provides kinetic energy that makes disruption possible in all industries. Asset management is no exception. The power of technology innovation is difficult to foresee because the outcomes of disruption are not linear. Instead, technology innovation starts slowly and builds up speed at the end. We believe technology is likely to have a far greater impact on our industry in the next five years than it has had in the past ten.

At its most fundamental level, technology is driving a democratization of asset management. Retail investors, small institutions and family offices have more investment choices than ever before in terms of strategic variety, increased access and low cost. Historically, these investor groups have been the most ill served. Few quality investment opportunities have existed for individuals with less than $1 million in net worth, yet these investors represent a $147 trillion market globally. This is partly because of regulatory limitation but also because there have been few scalable, low-cost, high-quality investment options. To this end, we identified numerous disruptive models in asset management. Certain sophisticated hedge funds, like Two Sigma, rely heavily on technology to harness investment opportunities. Other emerging disrupters in this space include Artivest and Franklin Square Capital Partners, which offer retail investors direct access to hedge funds that individuals historically could not access. Crowdfunding sites (AngelList, soon Indiegogo) allow investors to buy directly into early-stage companies in a way that was impossible before.

New technology platforms also enable tremendous scale. BlackRock’s Aladdin is an operational system that better enables institutions to manage their own risks. According to the Economist, Aladdin keeps its eyes on almost 7 percent of the world's $225 trillion of financial assets. A number of younger technology companies, including Novus and Addepar, are aiming to create scale through data aggregation and systematization. Technology will likely further drive greater transparency in a historically opaque industry, catching operational issues earlier and making Bernie Madoff–like fraud much more difficult to execute. Emerging governance and oversight platforms like AcordIQ provide institutional investors with the scalability and reliability to manage thousands of external money managers at lower cost and lower risk.

Technology is neither a panacea nor fault-free, as the August 2015 flash crash and Bank of New York Mellon Corp.’s mutual fund settlement problems readily illustrate. Overall, technology will enable asset aggregation and streamline operations, both of which will likely result in a de facto reduction in fees. But it will not be a competitive differentiator on its own because of its rapid proliferation and ability to be duplicated.

A good mentor once warned us that making predictions about the future is at best futile and at worst perilous. Thus we do not consider our research to be a prediction but rather a wake-up call for ourselves and our colleagues about how our industry is changing. Disruption is imminent whether or not we see exactly how it is happening. The results will likely lead to meaningful, positive change for investors. Both existing and emerging firms can ride the wave of disruption instead of being swept under it. Those that remain blind run the risk of losing their businesses.

So what does the successful asset manager of the future look like? Based on our analysis, the firm will embody several competitive, profoundly differentiated characteristics. First and foremost, the asset manager of the future will need to systematically identify new sources of alpha amid stagnant markets. Purely picking individual securities to gain an edge will be increasingly difficult and ultimately unsustainable, as data is more readily available and markets are far more efficient than in past decades. Instead, the manager will need the acumen to identify specific investment opportunities and allocate capital across multiple asset classes in an agile fashion.

We see the line between liquid and illiquid strategies blurring, allowing more flexibility for investing across public and private assets. A multistrategy platform that allows for both niche investment opportunities and economies of scale can be an effective way to accomplish alpha generation. Simultaneously, we see the hugely disruptive trend of passive, low-cost indexing continuing to gain significant market share among institutional and retail investors. When beta returns are low, investors will focus more on minimizing costs and reducing taxes.

The manager of the future will generate alpha for investors as a thought partner of the client investment team. This closer alignment and better understanding of evolving portfolio-level objectives will likely lead to an increase in co-investment opportunities. These shifts suggest that asset managers and allocators will change their interactions in meaningful ways. Allocators will need to evolve their assessment approach from a siloed, asset-specific model. In the end, we anticipate a more fluid model in which money managers will be more flexible and proactive and allocators will expect more accountability for managers in meeting their investment objectives for given levels of risk.

To address the operational risks that may come with flexibility, allocators will likely demand a more complete governance model. As a result, the asset manager of the future will need to look at risk in an integrated way, not in separate silos. The traditional view segregates risk into market, credit and operational buckets. In the classic organizational chart, the CIO is responsible for market risk, the treasury officer or CFO for counterparty risk and the COO for operational risk. The asset management firm of the future will learn to view risk holistically and pay attention not just to lagging indicators (losses) but to leading indicators (talent retention, investment in infrastructure, succession planning) related to its long-term enterprise health and, ultimately, delivering client results. Risk management will require a deeper understanding of correlation, not only at the strategy level but also at the substrategy level.

Technology is reshaping asset management and will contribute to alpha generation and transparency. The asset manager of the future will use technology to rebalance value from the firm back to investors. Internally, the manager will invest in technology to gain a competitive investment edge: artificial-intelligence and big-data capabilities and more-seamless integration of front- and back-office processes will become the baseline. Externally, technology solutions will pierce the veil of mystery for investors. The black-box hedge fund model is becoming obsolete, with sophisticated investors demanding greater transparency and a deeper understanding of a manager’s investment approach and risk management model. Firms will offer a substantially open book, enabled by sophisticated client-facing technology to communicate, share and interact with investors. Technology is the biggest impetus for disruption among low-net-worth retail investors, who up until now have been continuously underserved. Technology allows for scalability, accessibility and transparency that will likely level the playing field and provide retail investors with access to new opportunities and the ability to compare those opportunities in an intelligent way. Unexpected players with large investor networks and access to technology will likely enter the retail money management sector with creative business models. For example, Long Game, a San Francisco–based start-up, aims to disrupt the $85 billion lottery industry and convert lottery players into first-time savers and investors.

Cultivating and keeping talent will be critical for success. The investment industry today is very immature in its human capital management. As founders age and investor demographics change, established investment firms risk a talent crisis and will have to rethink how to attract, develop and retain people. We foresee that asset management leadership will professionalize to address these concerns, as has happened in other industries in a similar stage of their life cycles. In particular, we see a need for a CEO who’s fully focused on leadership.

“Purpose-led companies are more likely to have employees who exhibit cohesive behavior and act in the best interest of the company and the investors,” says Jeff Hunter, founder of Westport-based Talentism and former head of recruiting at hedge fund firm Bridgewater Associates.

As part of this drive to professionalization, we see more self-regulation and the proactive adoption of corporate governance by private investment firms. Leading firms will establish active, engaged executive boards similar to public companies’, demonstrating that decisions are being made thoughtfully, systematically and with investors’ objectives paramount. Of course, this will create better checks and balances on the historically all-powerful founder or cult CIO. We anticipate that this emphasis on effective governance will in turn reshape the due-diligence process. Today’s largely manual and sporadic processes will evolve to include more timely, systematic and ongoing oversight.

Ultimately, the factors shaping our industry will lead to greater transparency, enhanced governance, better talent management and closer alignment of incentives and objectives. But these powerful forces will place a critical premium on a culture of trust. Egregious examples of negligence and outright fraud are far too common in our industry, and investors are getting fed up. The asset manager of the future, in both the retail and institutional spaces, will create and guard the trust of investors at all costs.

Vanguard became one of the most successful disrupters in asset management not only because of its low-cost model but also because of the high level of transparency the firm provides its investors. Like Vanguard, to continually earn and reinforce its clients’ trust, a leading manager of the future must embrace far higher levels of transparency than has been the norm. As opacity recedes, money holders will see who has been working in their best interests.

Still, none of the mechanisms we’ve outlined will work without an internal culture of high integrity. Trust will be by far the biggest competitive advantage of the asset manager of the future. Only if the culture of trust prevails in our industry can we dispel the anger embedded in the question “Where are the customers’ yachts?” •

Katina Stefanova is CIO and CEO of Marto Capital, a New York–based multistrategy asset manager. David Teten is a partner at a New York–based venture capital firm. Brent Beardsley is the Chicago-based global head of the Boston Consulting Group’s wealth and asset management practice. To read the full results of their disruption study, visit disruptinvesting.com.