Working out of a cramped 600-square-foot apartment in Beijing’s Chaoyang central business district, Jack Wang leads a team of ten customer service representatives for Qishi Club Co., an online toy seller. Each month his company racks up more than 150,000 yuan ($24,000) in sales from Alibaba Group Holding’s e-commerce platform, Taobao.com, which is the eBay of China.

In the past Wang would withdraw all of the funds from Alipay, the group’s payment service, and put the money in his bank, where he can earn interest ranging from 35 basis points on demand deposits to a maximum of 3.3 percent on a one-year term deposit. Since early this year, however, he has been transferring the revenue to Yu’e Bao, Alibaba’s new money market fund. The arrangement is simple, requiring just a click on Taobao’s site, and lucrative. In mid-May, Yu’e Bao was paying an interest rate of 5 percent on accounts that offer instant liquidity: Wang can make withdrawals from the fund at any time without penalty.

“Of course, we stop pulling out money and putting them into banks and instead keep all of our cash flow in Yu’e Bao,” Wang tells Institutional Investor. “On average, we keep anywhere from 300,000 yuan to 500,000 yuan on Alibaba’s platform — money that we used to keep in banks.”

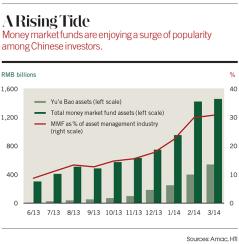

Wang is not alone. At the end of April, Yu’e Bao (pronounced “yu-eh bow”) boasted an astonishing 554 billion yuan, or almost $90 billion, in assets. It also had 81 million investors, more than the combined total of all other Chinese asset managers. Considering that Alibaba launched the money fund only in June 2013, that makes it the fastest-growing mutual fund of all time, anywhere. Yu’e Bao now accounts for just over a third of China’s 1.46 trillion-yuan money market fund business, a burgeoning segment that makes up 31 percent of the country’s asset management industry. Only three U.S. money market funds — Vanguard Prime ($129.8 billion), Fidelity Cash Reserves ($116.1 billion) and JPMorgan Prime ($108.2 billion) — are larger, and they’ve been around for decades.

The fund’s rise underscores Alibaba’s tremendous innovation and potential for growth, which are expected to generate strong demand for the company’s shares. In May, Alibaba filed for an initial public offering on the New York Stock Exchange that analysts estimate could raise as much as $20 billion.

Yu’e Bao, which means “savings balance treasure,” poses a stark challenge to competitors in China’s banking and asset management industries, and to the country’s regulators. Banks have long dominated the country’s financial scene, taking advantage of tight restrictions on interest rates to capture low-cost deposits from hundreds of millions of savers and provide cheap loans to state-owned enterprises. Regulators have begun moving gingerly to free up interest rates, regarding this as crucial to shifting the economy toward greater domestic consumption and away from investment-led growth. Yu’e Bao’s meteoric rise demonstrates the potential for new entrants to break up existing relationships and seize market share in a shifting landscape. Such disruption, however, can pose threats to financial stability, as anyone who experienced U.S. interest rate liberalization in the 1970s and the subsequent savings and loan crisis can attest.

“The explosive rise of Yu’e Bao surprised everyone, including Alibaba, which is proving to be a potential disintermediator for the entire financial industry,” says Peter Alexander, founder and managing director of Z-Ben Advisors, an investment management consulting firm based in Shanghai. Other e-commerce companies, including search engine Baidu.com and Internet service provider Tencent Holdings, have entered the money market fray with similar offerings in recent months, but so far none has gained the kind of traction enjoyed by Yu’e Bao. Traditional asset management companies, whose fortunes have languished because of the five-year bear market for Chinese equities, have ramped up their own money market fund offerings. Nevertheless, Alexander says, “no one more than Alibaba at this point has the ability to disrupt the entire financial industry in China — and in the process help drive financial reforms.”

The banks aren’t taking the challenge lying down. They have lobbied the People’s Bank of China to begin regulating online money market funds. Central bank governor Zhou Xiaochuan has indicated that authorities are considering closer supervision of the money funds, but he has insisted that they don’t want to stifle innovation. “Financial business on the Internet is a new thing,” and regulators need to adapt to it, Zhou told journalists recently. “But in general, financial policy supports the application of technology, so it needs to follow the footsteps of time and technology.”

ALIBABA’S VAST SCALE AND STUNNING GROWTH hint at the potential of e-commerce companies to dramatically change the face of finance in China.

Founded in 1999 by former English teacher and tour guide Jack Ma out of his apartment in Hangzhou, an ancient city about a two-hour drive from Shanghai, Alibaba has grown to become China’s leading Internet company, with revenue topping $7.5 billion in 2013. The group’s Taobao platform plays host to some 7 million online merchants, such as Wang’s Qishi Club, and sold more than 1 trillion yuan worth of products to more than 500 million registered buyers last year. The cash flow generated by that commerce has fueled Yu’e Bao’s rise.

Alibaba executives declined requests for interviews, citing the quiet period before the company’s IPO. But a spokeswoman for Shanghai-based Tianhong Asset Management Co., which manages the fund, says executives are optimistic about the prospects for growth.

“Yu’e Bao is the leading innovation in finance in China,” Tianhong’s Ding Xuemei tells II. “Internet finance is a powerful tool that can break legacy barriers. It isn’t just a financial tool created by e-commerce companies or a digital tool created by financial companies. It is a joint innovation that is the result of champions coming together from e-commerce and finance. Together we win over the customer by serving their needs.”

Ding declines to discuss in detail how the firm manages the money market fund, saying only that it invests primarily in China’s interbank market. According to analysts who know the company well, Tianhong has been able to negotiate annualized interest rates as high as 8 percent from various banks, allowing it to offer returns of 6 percent or more to depositors in Yu’e Bao. In effect, Alibaba is getting the banks to fund their most potent rival.

Chris Powers, an associate at Z-Ben Advisors, estimates that fully 92 percent of Yu’e Bao’s funds are parked in negotiable deposits with smaller Chinese banks. He says most of the Big Five state-owned banks — Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of China and Bank of Communications — have refused to take deposits from Tianhong for competitive reasons.

“When you come in to meet smaller banks with 500 billion yuan, you can negotiate the deposit rates you desire,” Powers says.

Founded by a group of corporate investors in 2004, Tianhong labored in the backwaters of China’s asset management industry for nearly a decade before teaming up with Alibaba last year. It manages 14 other mutual funds, but they collectively have only 13 billion yuan in assets. The firm had moved to bolster its management with an eye to revving up growth before teaming up with Alibaba, though. In May 2011 it hired Guo Shuqiang, head of institutional business at China Asset Management Co., to run Tianhong as general manager.

Sources say Alibaba’s Ma initially approached four leading asset managers about launching a money market fund but was turned down; they apparently didn’t feel it was worth the trouble to cooperate with the e-commerce giant. Ma ultimately chose Tianhong because it was willing to cooperate — and to consider selling a majority stake. In October, Alibaba spent 1.1 billion yuan to acquire 51 percent of the firm.

Formally named the Tianhong Zenglibao Money Management Fund, Yu’e Bao launched in June 2013 and is sold exclusively on Alibaba’s Alipay payments service. The company could hardly have chosen a better time to get into the business.

Chinese banks typically scramble for deposits at the end of a quarter to meet their mandated loan-to-deposit ratios, and the central bank has historically supplied ample liquidity. But last June the PBOC demurred, apparently seeking to send a signal to banks to contain the growth of lending. The one-week Shanghai interbank offered rate, or Shibor, shot up as high as 13 percent. Similar liquidity squeezes drove Shibor up to 8.84 percent in December and to 5.36 percent in February.

Yu’e Bao was able to take advantage of the liquidity shortfall, earning high returns on the interbank market and offering high rates to depositors. In January it advertised rates as high as 6.58 percent. The money fund’s rates have eased recently, but even at 5 percent in mid-May, they’ve been well above the 3.3 percent maximum that banks are allowed to pay on one-year term deposits. Those yields have proved effective: Yu’e Bao had attracted 184 billion yuan of investor funds by the end of December; three months later the total had nearly tripled, to 540 billion.

“High yield with perfect liquidity has made Yu’e Bao an unbeatable product, draining 400 billion yuan from banks in a click,” says Hu Yifan, chief economist and head of research at Haitong International Securities Co., a Hong Kong subsidiary of Shanghai-based Haitong Securities Co., China’s second-largest brokerage house.

Bankers aren’t happy about the newfound competition. “Alibaba takes in 500 billion yuan and puts it into deposit with the banks,” says a senior executive at ICBC — the world’s largest bank, with $3 trillion in assets — speaking on condition of anonymity. “Someone needs to ask this question: If the stuff is so good, is it real? When you put your money into a high-return product, is there no risk? When something goes wrong — say, something happens with the Internet platform — do they have the money to pay?”

To be sure, the banks aren’t in any immediate danger. They dominate China’s economy and will continue to do so for some time. At the end of 2013, the country’s banks held 104 trillion yuan in deposits. That’s nearly 190 times the size of Yu’e Bao, and it dwarfs the 1.46 trillion yuan in assets held by the entire money market fund sector, which includes offerings from other online firms, asset management companies and banks. In the banking sector individual demand deposits account for 17 percent of overall deposits and corporate demand deposits make up 14 percent; the remainder sits in term deposit accounts.

Notwithstanding their overwhelming size advantage, banks are vulnerable to margin compression. They have traditionally enjoyed some of the highest profit margins in corporate China, but those days may be drawing to a close because of increasing competition, says Hua Zhang, an analyst in the Asian financial services group of Celent, a Boston-based financial research firm. In a recent report Zhang estimated that China’s e-commerce industry will rise to $550 billion in sales in 2015 — a 100 percent increase from 2011 and up from $380 billion in 2013. That suggests huge upside potential for Yu’e Bao and other online money market funds, he contends.

Chinese banks have been busy launching online money market funds of their own in recent months, but so far they are finding it difficult to compete with the high rates offered by Yu’e Bao without driving up their own cost of funding, Zhang says. The competition could force banks to rely on their large physical distribution channels as their primary advantage. ICBC, for instance, has 16,648 outlets and branches throughout China, the most of any institution. “If banks do not change with the times, they will be marginalized to merely having deposit accounts, and the very profitable advertising, credit and financial services businesses will gradually move away from them,” warns Zhang.

Other analysts argue that online money market funds pose only a modest risk to bank profits in the near term. Liao Qiang, a Beijing-based director of financial institutions coverage at Standard & Poor’s, says that although Yu’e Bao may be stealing deposits from the big banks, it is actually driving liquidity to smaller banks that traditionally have had a hard time competing with the giants for funding.

“The growing assets invested with Yu’e Bao doesn’t really hurt banks’ liquidity because most of the Yu’e Bao funds are circulated back to the banks as deposits,” Liao says. Yu’e Bao’s high rates will have a very limited impact on the cost of funding for banks, reflecting the small size of the money fund in relation to the banking industry. The analyst estimates that Yu’e Bao will reduce banks’ net interest margin by 6 to 7 basis points at most in 2014. And the impact on banks will diminish, he adds, as money market rates — and hence the rates Yu’e Bao can offer its investors — decline. The overnight interbank lending rate fell back to between 2 and 3 percent in May from 4 to 5 percent at the end of January, just before the Chinese New Year holiday, when demand for cash runs high in China.

Traditional asset managers also are responding to the competition from Alibaba. China Asset Management was the country’s largest fund manager for nearly a decade before Tianhong leapfrogged it earlier this year thanks to the overnight success of Yu’e Bao. The firm is fighting back by teaming up with two of Alibaba’s fiercest rivals, Baidu and Tencent Holdings, to launch new online money funds of its own. The China AMC Cash Interest Money Market Fund is sold on Baidu under the brand name Baifa, while the China AMC Caifubao Money Market Fund sells on WeChat, the Twitter-like mobile messaging service operated by Tencent. The two funds pulled in 118 billion yuan in the first quarter of this year and have a total of 178 billion yuan in assets. The Cash Interest Money Market Fund is China’s second-largest money fund, with 96 billion yuan in assets; it offered an interest rate of 4.7 percent in mid-May. The growth of the two money funds lifted China AMC’s overall assets to 340 billion yuan at the end of March, yet the company finds itself playing catch-up.

“Alibaba is really dominant in this online retail space,” says Z-Ben Advisors’ Powers. “You saw a lot of huge growth from various rival funds, but none of them topped Yu’e Bao.”

Other fund managers are responding by emphasizing their existing strengths. Shanghai-based HSBC Jintrust Fund Management Co., a joint venture between HSBC Holdings and Shanxi Trust Corp., is not only developing its own online fund offerings but strengthening marketing efforts that promote the advantages of investing with an experienced money manager with a proven track record. “We in the asset management industry must focus on our core competence of being strong stock pickers and investment professionals,” says Sun Zhiyong, the firm’s head of sales.

Sun calls Yu’e Bao a one-trick pony that took advantage of a temporary spike in interbank rates. “Yu’e Bao was lucky in that it was able to get contracts that locked in high interbank rates, but the liquidity crisis is coming to an end, and interbank rates are falling again,” he says. “So Yu’e Bao’s advantage will dwindle over time.”

THE SUCCESS OF YU’E BAO doesn’t just reflect the fund’s financial advantages. Its ease of use is also a key attraction, says Yan Xuan, Greater China president for consumer research firm Nielsen Co. Clients can transfer funds immediately from Alipay to their account at Yu’e Bao with the click of a button, either on a personal computer or a smartphone, he notes. They can withdraw funds just as easily at any time without paying a penalty. Most of the online banking or asset management platforms offered by major financial institutions require customers to go through a more complicated, multistep process necessitating multiple approvals along the way, and early withdrawals typically incur a penalty. “The higher rates offered by Yu’e Bao are just one factor of its success,” he says. “The other major factor is user interface. The fact that you can transfer funds in and out with just one click is a powerful and highly attractive proposition for many online users, many of whom tend to be young, well educated and more affluent Chinese.”

That market is vast and still growing. China has 604 million Netizens, 464 million of whom frequently use mobile phone applications, according to Nielsen research. About 70 percent of consumers have purchased smartphones, making mobile e-commerce a strong growth area, Nielsen says. A large portion of Chinese who buy consumer products online earn annual incomes in the range of 100,000 yuan to 150,000 yuan, or three to four times China’s per capita gross domestic product, according to the research firm. Crucially, this segment of the population seems predisposed to turn to e-commerce companies for online finance rather than to traditional financial services companies. A Nielsen study found that 34 percent of all Chinese online users have downloaded Alipay’s app, which includes Yu’e Bao, whereas only 14 percent of ICBC’s customers have downloaded the big bank’s payment app.

“Alipay has a very self-selecting customer base,” says Yan.

“Yu’e Bao’s success proves owning the customer is the key requirement for any business today,” says Chris Harvey, the Hong Kong–based global and Asia-Pacific head of financial services at accounting and consulting firm Deloitte Touche Tohmatsu. “Alibaba has been able to do this because of their enormous customer base and their technological advancement. They are able to serve customers the way a customer wants to be served today. The lesson learned for any asset manager, insurer or even bank is that for you to own the customer, you need to connect to them the way they wish to connect to you.”

In seeking to blunt the threat posed by Alibaba, big banks have been lobbying the People’s Bank of China to regulate the upstart as well as other online money market funds. Regulators have hinted that they will impose new rules, but they have not yet taken any action. In a recent article on Financial News, an online news site connected to the government, Sheng Songcheng, head of statistics at the central bank, called for money market funds to face reserve requirements just like the nation’s banks do.

Analysts say the central bank doesn’t seem inclined to clamp down on the new entrants and wants to see market forces drive change in the financial industry. “The People’s Bank of China and China Banking Regulatory Commission are under pressure to impose regulatory limits on the transfer volumes to Yu’e Bao but so far haven’t,” says Z-Ben Advisors’ Alexander. “The Big Four banks already have imposed certain limits. The smaller banks, however, are telling Alibaba they won’t impose limits in exchange for receiving deposits from Yu’e Bao in return. This is the beginning of a battle between the big banks and the e-commerce giants. It seems the regulators are allowing this to play out by itself.”

The big question is whether the disruption unleashed by Yu’e Bao will spur financial liberalization in China or prompt the authorities to move more slowly. Most analysts are betting on the former.

Central bank governor Zhou is a leading advocate of financial market liberalization, including freer interest rates and a move toward full convertibility of the yuan against foreign currencies, says Haitong International’s Hu. Reformers believe interest rate liberalization will drive efficiency in an economy long dominated by state-owned enterprises and that allowing savers to earn higher yields on their money will hasten the shift to a more consumer-oriented economy.

The central bank lifted all caps on lending rates in July 2013; analysts expect it to lift ceilings on deposit rates in the next few years. The PBOC has laid out a road map to full interest rate liberalization that will require several steps and could last several years, Hu says. Those steps include the establishment of a national deposit insurance program along the lines of the one operated by the U.S. Federal Deposit Insurance Corp. In October the central bank and the FDIC signed a memorandum of understanding to strengthen cooperation between the two banking agencies.

In coming months the PBOC will introduce negotiable certificates of deposit that will allow both corporate and household savers to negotiate higher interest rates based on the amount of their deposits, according to Hu. The instruments will bear rates similar to those on offer in China’s interbank market.

Central bank officials know that full liberalization of interest rates will bring about large fluctuations in the market and pose a major challenge to the banking sector, Hu says. “But leaders also realize they have no choice but to push through with reform,” she contends. “China’s financial markets will never be efficient until market forces are unleashed.”

May Yan, director of China banking coverage at Barclays Capital, also believes that greater liberalization is coming. Although e-commerce companies and banks are increasingly heated rivals, “in the end there will be a compromise,” she says. “There is a need for money market funds. The central bank is not against it. It is supporting it. In fact, it sees the need for interest rate liberalization. But if money market funds grow too fast and become a threat and destablizing to the entire financial sector, they will jump in and impose regulations.”

Liberalization entails risk, of course. In the case of Yu’e Bao, analysts say the big issue is the potential liquidity risk. Yu’e Bao offers customers same-day settlement on fund transfers, whereas other money market funds operate on a next-day basis. “The one-day time difference could raise serious troubles for Yu’e Bao in the case of a bank run,” says Haitong’s Hu.

The money fund also operates with a big maturity mismatch. About 90 percent of Yu’e Bao’s assets are placed in negotiable deposits with maturities ranging from seven days to one month, Hu says. The rest is invested in bonds with longer-term and higher yields. Yu’e Bao currently keeps about 5 percent of its funds on reserve to meet any redemption requests. That’s far less than the banks, which are required to keep 20 percent of their deposits on reserve at the PBOC.

“Daily settlement suggests that a large flow of withdrawals that exceeds provisions could quickly drain the liquidity of Yu’e Bao and cause defaults immediately,” Hu says.

Alibaba and Tianhong got a taste of this vulnerability in February, when Yu’e Bao’s posted yield briefly fell to zero percent, causing a rash of withdrawals. The withdrawals subsided after Alipay, Alibaba’s payments service, announced that the yield drop was a technical error. Tianhong subsequently imposed ceilings on withdrawals of 50,000 yuan a day and 200,000 yuan a month, but those limits would be insufficient if a full-fledged run were to occur, contends Hu.

Executives at Alibaba and Tianhong declined to discuss the incident. Tianhong’s Ding says the firm is well aware of potential liquidity risks and is taking measures to mitigate them, but she declined to provide details.

Yu’e Bao may be just the tip of the iceberg of Alibaba’s financial services ambitions. The e-commerce giant will be the first in line to get a banking license if regulators decide to extend them to online companies, says a China-based executive at IBM Corp., which is advising the company on online financial services.

“The government will likely give Alibaba an online banking license,” says Deloitte’s Harvey. “The government wants to encourage some competition in the sector. If you look at the overall banking sector in China, for a long time it’s been relatively easy to make money. The Chinese banks in general have been pretty profitable and have been protected in a highly regulated environment. The government would be interested in adding some competition, particularly homemade competition. They would rather do that than allow a big foreign bank to come and disrupt.”

The prospect of greater competition is music to the ears of toy merchant Wang, who says he is not concerned about the potential risks associated with Yu’e Bao.

“The Chinese government allowed Alibaba and Yu’e Bao to become so big,” he says. “I doubt that they will allow it to crash. Sure, it means the regulators will begin regulating Yu’e Bao. But that would only be good for China’s consumers. I’d rather have the ease of e-banking and e-investing than what occurred in the past, when I had to stand in line and wait for hours just to make a deposit at a bank.”

Wang is blunt about the challenge to the entrenched financial powers. “Perhaps it is time for the big banks and fund managers to wake up and improve their services,” he says. “Only when services improve will I consider going back to them.” • •